INP-WealthPk

Qudsia Bano

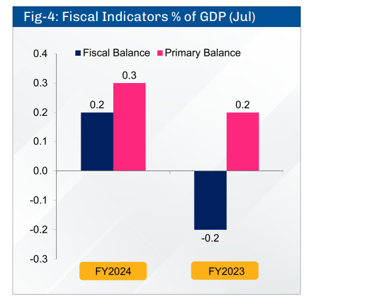

In a reassuring start to the Fiscal Year 2024, Pakistan’s fiscal performance in July demonstrates the nation’s commitment to financial prudence and revenue enhancement, reports WealthPK. Data for the period in question reveals a noteworthy surplus in the primary balance, accompanied by a fiscal deficit at the same level as the previous year. These developments reflect a sound economic strategy and responsible financial management. One of the key highlights of the fiscal report is the success of new tax measures in boosting direct tax collection. This uptick in direct taxes contributes significantly to government revenues, thus further stabilizing the fiscal position.

Additionally, the other components of tax collection, such as the Federal Excise Duty (FED), have recorded substantial growth, primarily driven by increased collections at the import stage. The import-related taxes are expected to rise further, as import restrictions are eased, making it evident that the government is making strategic decisions to stimulate economic activities and revenue generation. Moreover, the increase in sales tax, particularly the 25.6 percent growth in domestic collections, underscores a revival of economic activities and consumer spending. These positive trends collectively position Pakistan favorably to achieve its tax collection target for the first quarter of the current fiscal year.

Behind these promising numbers is a proactive government strategy aimed at ensuring fiscal sustainability. The government is taking deliberate steps to enhance revenue and manage expenditures prudently. A key focus of this strategy is the containment of non-markup expenses through the implementation of austerity measures and targeted subsidies. This approach aligns with the government’s main objectives of limiting the fiscal deficit to 6.5 percent of the GDP and maintaining a primary balance surplus of 0.4 percent throughout FY2024. The fiscal performance in July FY2024 provides optimism for the nation’s economic outlook. It showcases the government’s dedication to achieving a balanced budget and, more importantly, a primary surplus, which is essential for debt reduction and overall financial stability. The positive revenue trends and prudent fiscal management are clear indicators of Pakistan’s commitment to a responsible financial governance.

Muhammad Arqam, Head of Investments at Bank Alfalah, told WealthPK that the growth in the FED collections, primarily due to the increased import-related taxes, reflects the government’s adaptability to changing economic conditions. The decision to ease import restrictions is likely to further boost revenue from import-related taxes, showcasing a dynamic approach to revenue generation. “The surge in sales tax, especially from domestic collection, is a strong indicator of the revival of economic activities and consumer spending. This is essential for stimulating economic growth and employment opportunities, which, in turn, contribute to fiscal health,” he said. “The government’s proactive approach to fiscal sustainability, as evidenced by its focus on containing non-markup expenses through austerity measures and targeted subsidies, is commendable. These measures are in line with the government’s stated objectives of limiting the fiscal deficit and maintaining a primary balance surplus, both of which are essential for fiscal stability and long-term debt reduction,” he added.

Credit: INP-WealthPk