INP-WealthPk

Shams ul Nisa

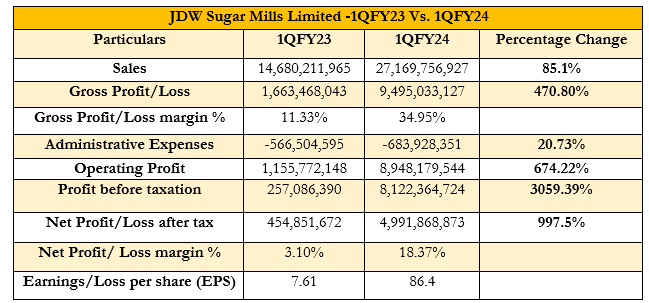

The JDW Sugar Mills Limited's profitability increased by 997.5% for the first quarter of FY24, clocking in at Rs27.16 billion, compared to Rs 14.68 billion in the corresponding period of the last year. The company's fiscal year ends in September every year. The company attributed this rise in profitability to the growth in sugar, corporate sugarcane farms, and power division. The company ended the first quarter with sales of Rs27.16 billion, against Rs14.68 billion in 1QFY23, representing an 85.1% year-over-year growth.

Gross profit observed a hefty hike of 470.80% on a YoY basis to reach Rs9.49 billion in 1QFY24 from Rs1.66 billion in the same period last year. Going by the results, the company's gross margin expanded to 34.95% in 1QFY24, from 11.33% in 1QFY23. During the review period, administrative expenses rose by 20.73% to stand at Rs683.9 million. Operating profit increased to Rs8.94 billion in 1QFY24 as compared to Rs1.15 billion in the same period last year, a jump of over 674.22%. According to the results, profit before tax spiked by 3059.39% and profit after tax by 997.5% during the period under review. The company registered a profit before tax and profit after tax of Rs8.12 billion and Rs4.99 billion in 1QFY24, respectively. The net profit margin increased to 18.37% in 1QFY24 against 3.10% in 1QFY23. Earnings per share of the company soared to Rs86.4 in 1QFY24 from Rs7.61 in 1QFY23.

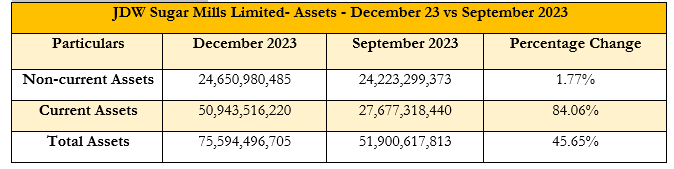

Assets Analysis

At the end of December 2023, JDW Sugar Mills Limited's non-current assets increased by 1.77% to stand at Rs24.6 billion compared to September 2023. In December 2023, the current assets totaled Rs50.94 billion, 84.06% higher than Rs27.677 billion in September 2023. This rise in current and non-current assets suggests improved operational efficiency, stronger liquidity position, and higher investment to expand the company's resources during the period under review. Consequently, the total assets increased substantially by 45.65% from Rs51.9 billion in September 2023 to Rs75.59 billion at the end of December 2023.

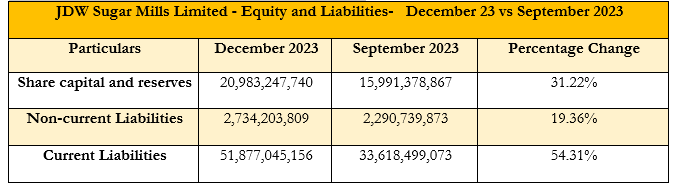

Equity and Liabilities Analysis

The JDW Sugar Mills Limited reported an increase in share capital and reserves to Rs20.98 billion in December 2023, a 31.22% increase from Rs15.99 billion in June 2023. This suggests that the company has ample reserves to foster growth through increased operations and better profitability during the review period. The company's non-current liabilities grew by 19.36%, from Rs2.29 billion in September 2023 to Rs2.73 billion in December 2023. This rise demonstrates that the company has added to long-term debt by borrowing long-term finances, lease liabilities, and deferred taxation. Similarly, current liabilities expanded significantly from Rs33.6 billion in September 2023 to Rs51.87 billion in December 2023, indicating a growth of 54.31% increase.

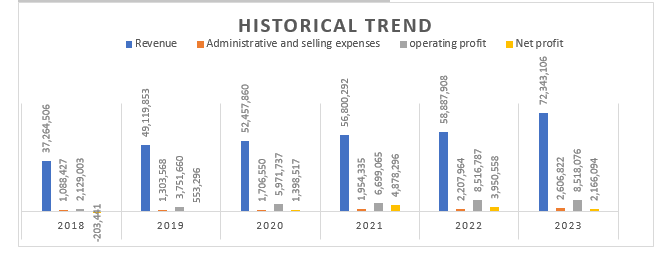

Historical Trend

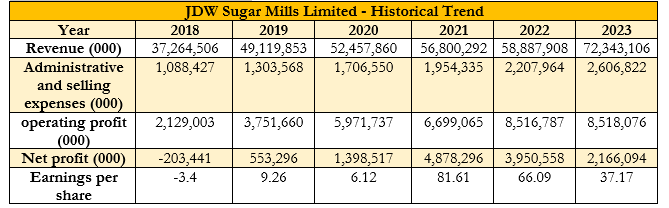

Over the past six years, the company's revenue has grown significantly from Rs37.2 billion in 2018 to Rs72.34 billion in 2023. This reflects that the company witnessed increased demand for sugar and higher prices leading to higher revenue generation each year. Administrative and selling expenses have grown over the years, ranging from the lowest of Rs1.08 billion in 2018 to the highest of Rs2.6 billion in 2023. The expenses have increased relatively slower than the revenue over the past six years, suggesting efficient cost management.

Similarly, JDW Sugar Mills Limited's operating profit followed an upward trend, moving from Rs2.1 billion in 2018 to Rs8.5 billion in 2023. This suggests that over the past year, the company aimed to widen its core operations to improve its financial position.

Starting from a net loss of Rs203.44 million in 2018, the company reported net profit in the later years. From Rs553.29 million in 2019, net profit kept on increasing, reaching the highest of Rs4.87 billion in 2021, followed by a decline to Rs2.16 billion in 2023.

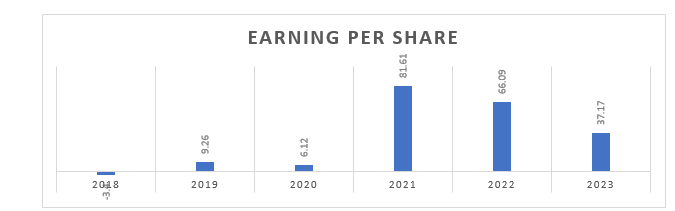

During the period, the earnings per share (EPS), which measures the profit generation of each stock of the company remained volatile. The company registered a loss per share of Rs3.4 in 2018 but grew from Rs9.26 in 2019 to the highest of Rs81.61 in 2021. However, it declined to Rs37.17 in 2023 from Rs66.09 in 2022 but remained positive.

Company's profile

The JDW Sugar Mills Limited was incorporated in 1990. The core activities of the company include production and sales of sugar, power generation, and operation of corporate farms. The company works to enhance the social and economic development of rural areas through social mobilization, women's business development, support for technical and primary education, microcredit for the underprivileged, infrastructure development, livestock development, etc.

inpCredit: INP-WealthPk