INP-WealthPk

Fakiha Tariq

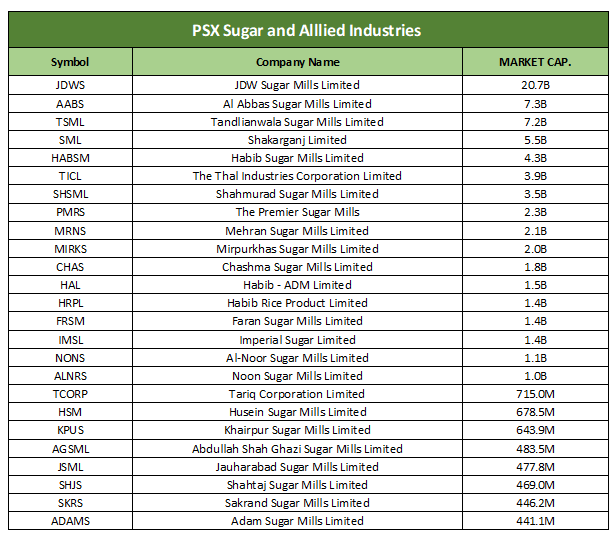

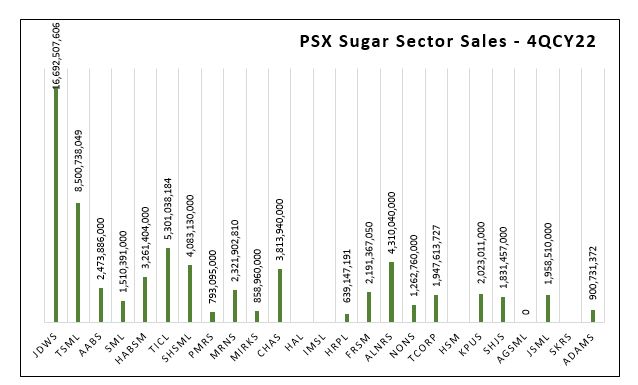

JDW Sugar Mills Limited (JDWS) posted gross revenue of Rs16 billion in the last quarter (Oct-Dec) of calendar year 2022, beating its 25 peer companies in the sugar sector. Overall, the sector earned a cumulative gross revenue of Rs66 billion during the period, reports WealthPK. The majority of sugar sector firms observe their fiscal year from October to September. JDWS is the largest sugar firm with a market capitalisation of Rs20.7 billion in sugar and allied industry sector listed on the Pakistan Stock Exchange. Currently, the market cap of sugar and allied industries is Rs32 billion.

Tandlianwala Sugar Mills Limited (TSML), the third largest firm in the sector, reported the second highest revenue of Rs8.5 billion in 4QCY22. Thal Industries Corporation Limited (TICL) and Al-Noor Sugar Mills Limited (ALNRS) with the sales values of Rs5.3 billion and Rs4.3 billion, respectively, marked third and fourth position in the sugar sector in 4QCY22. Chashma Sugar Mills Limited (CHAS) declared gross revenue of Rs3.8 billion and ranked as the fifth highest revenue collector in the sugar sector.

Abdullah Shah Ghazi Sugar Mills Limited (AGSML) made no sales as it bore the cost of sales, whereas Habib Rice Product Limited (HRPL) declared the lowest revenue of Rs639 million in 4QCY22.

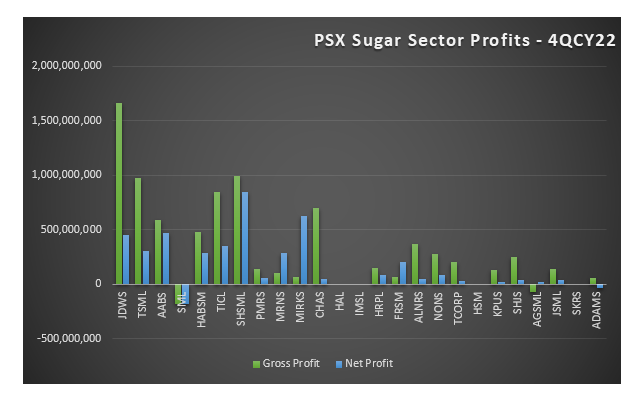

PSX sugar sector gross and net profits – 4QCY22

Overall, the sugar sector remained in profits in 4QCY22. Six out of 25 firms declared their gross profits above Rs500 million. JDWS scored the highest gross profit followed by Shahmurad Sugar Mills Limited (SHSML) and TSML. TICL, CHAS and Al-Abbas Sugar Mills Limited (AABS) grabbed the fourth, fifth and sixth highest gross profits in 4QCY22, respectively.

In terms of net profits, only two companies crossed the Rs500 million bar. SHSML posted the highest and Mirpurkhas Sugar Mills Limited (MIRKS) the second highest values of net profits in 4QCY22. Shakarganj Limited (SML) suffered gross and net losses in 4QCY22. AGSML sustained gross loss, but reverted back to earning net profit. Adam Sugar Mills Limited (ADAMS), the smallest company of the sector, reported net loss in the last quarter of CY22.

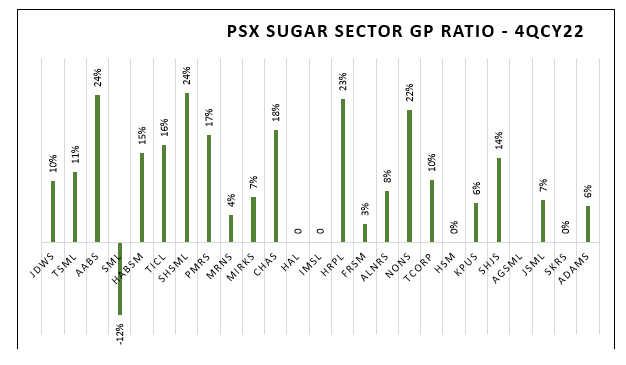

PSX sugar sector gross profit (GP) ratio – 4QCY22

In the last quarter of CY22, AABS and SHSML managed the cost of sales most effectively and came up with the gross profit ratio of 24% each. HRPL posted second highest GP ratio of 23% and Noons Sugar Mills Limited (NONS) scored third highest of 22%.

CHAS reported a GP ratio of 18% and Premier Sugar Mills (PMRS) 17%, which is the fifth highest in 4QCY22. The lowest GP ratio of 3% has been declared by Faran Sugar Mills Limited (FRSM), whereas SML reported a gross loss ratio of 12% in the period under review.

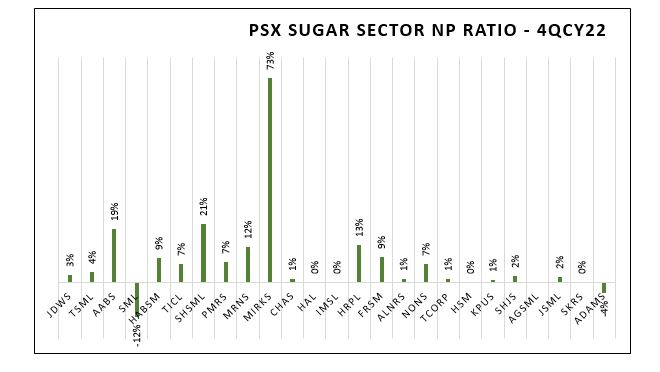

PSX sugar sector net profit (NP) ratio – 4QCY22

MIRKS reported the highest net profit ratio of 73% in the last quarter of CY22 due to the addition made by income from other sources. The second highest NP ratio of 21% was attained by SHSML. AABS and HRPL posted NP ratios of 19% and 13%, respectively, which was the third and fourth highest in the sector in 4QCY22. Mehran Sugar Mills Limited (MRNS) with a net profit ratio of 12% ranked the fifth highest in the last quarter of CY22.

The lowest NP ratio was declared by CHAS, ALNRS, Tariq Corporation Limited (TCORP) and Khairpur Sugar Mills Limited (KPUS) at 1% each in 4QCY22. However, SML and ADAMS reported net loss ratios of 12% and 4%, respectively, in 4QCY22.

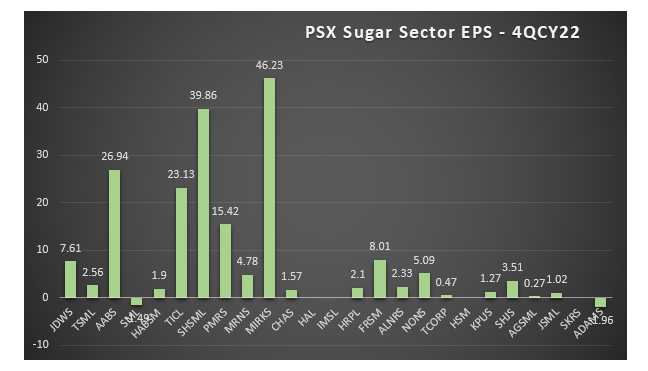

PSX sugar sector EPS value – 4QCY22

Five out of the total 25 listed companies posted double-digit earnings per share value in the sugar sector in 4QCY22. MIRKS and SHSML reported the first and second highest EPS values of Rs46.23 and Rs39.86. AABS and TICL ranked third and fourth as they reported EPS value of Rs26.94 and Rs23.13, respectively.

PMRS reported the fifth highest EPS value of Rs15.42 in sugar sector in 4QCY22. The lowest EPS value of Rs0.27 was reported by AGSML. SML and ADAMS reported loss per share of Rs1.49 and Rs1.96 in the last quarter of the calendar year 2022.

Credit: Independent News Pakistan-WealthPk