INP-WealthPk

Shams ul Nisa

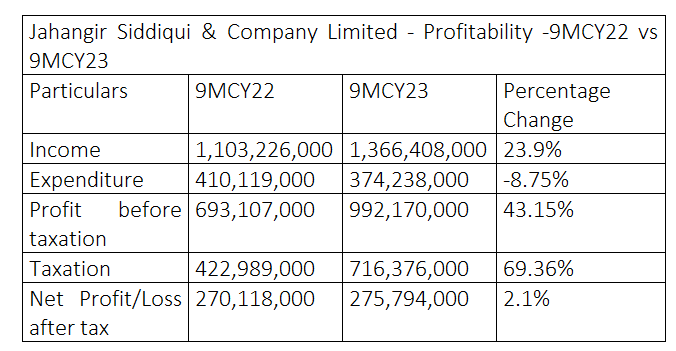

Jahangir Siddiqui & Company Limited posted an income of Rs1.36 billion in the first nine months of the last calendar year 2023 compared to Rs1.1 billion over the same period the previous year, showcasing a growth of 23.9%, reports WealthPK. The company attributed this rise in income to greater dividend income and the realised capital gains on equity securities. The company manages strategic investments, trading securities and consultancy services. Going by the results, the company’s expenditure dipped by 8.75% year-to-year to Rs374.2 million from Rs410.1 million in 9MCY22. During the period, profit-before-tax clocked in at Rs992.17 million compared to Rs693.1 million in 9MCY22, indicating a significant surge of 43.15%.

On the tax front, the company paid a higher tax worth Rs716.37 million against Rs422.98 million in the corresponding period of CY22, depicting a substantial increase of 69.36%. This included the super tax and capital gains tax levied on selling Bank Islami Pakistan Limited shares. As a result of higher tax during the period under review, the company’s net profit grew only by 2.1% to Rs275.79 million in 9MCY23 from Rs270.1 million over the same period in CY22.

Quarterly analysis

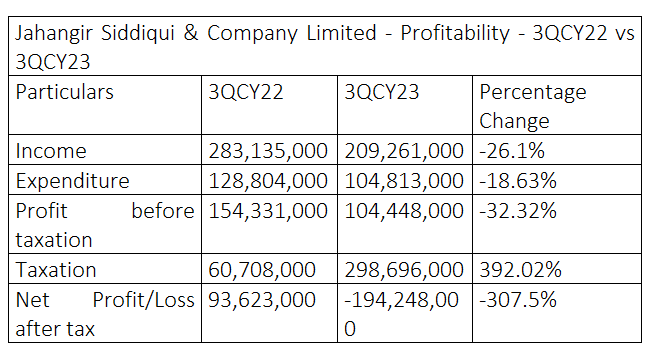

During the three months ended September 30, 2023, the company registered a 26.1% decline in income. Similarly, the expenditure dipped to Rs104.8 million from Rs128.8 million in 3QCY22. In 3QCY23, profit-before-tax clocked in at Rs104.4 million, 32.32% lower than Rs154.3 million in the same period of CY22.

The company paid a tax of Rs298.69 million in 3QCY23 against Rs60.7 million in the same period the previous year, reflecting a massive surge of 392.02%. Thus, it suffered a net loss of Rs194.2 million during the period under review compared to a net profit of Rs93.6 million in 3QCY22.

Assets analysis

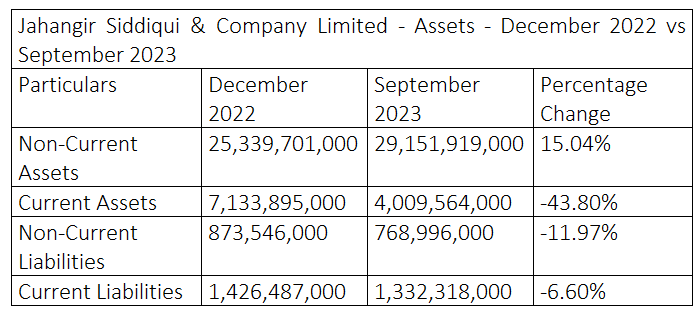

During September 2023, the non-current assets of Jahangir Siddiqui & Company Limited stood at Rs29.15 billion against Rs25.3 billion in December 2022, showing a growth of 15.04%. Whereas, current assets dipped 43.80% to Rs4 billion in September 2023 from Rs7.13 billion in December 2022. The company’s non-current and current liabilities decreased by 11.97% and 6.60%, respectively. This indicates the company paid off its long-term financing, lease liabilities, trade and other payables, and unclaimed dividends during the period. In September 2023, the non-current and current liabilities stood at Rs768.9 million and Rs1.33 billion, respectively.

Cash flow analysis

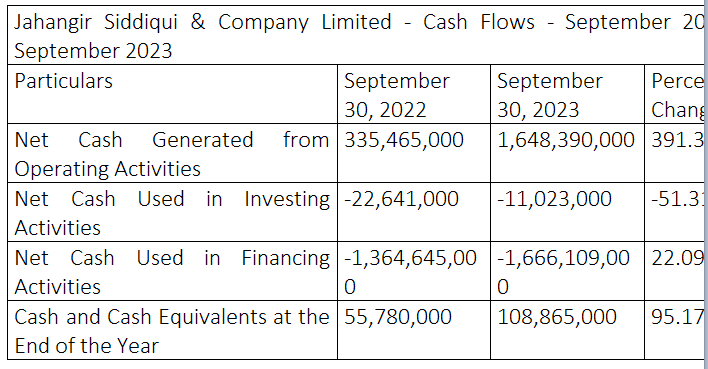

Jahangir Siddiqui & Company’s net cash generated from operating activities inflated by a huge margin of 391.37% to Rs1.6 billion in September 2023 from Rs335.4 million in September 2022. However, the company used cash of Rs11.02 million in investing activities in September 2023, which was 51.31% lower than Rs22.64 million in September 2022.

Similarly, Rs1.66 billion was used in financing activities such as paying dividends, long-term loans repaid to banks, and payments against lease liabilities. This indicates an expansion of 22.09% from the Rs1.36 billion utilised in financing activities in September 2022. The cash and cash equivalents at the end of the year climbed to Rs108.8 million in September 2023 from Rs55.78 million in September 2022, reflecting a hike of 95.17%.

Credit: INP-WealthPk