INP-WealthPk

Shams ul Nisa

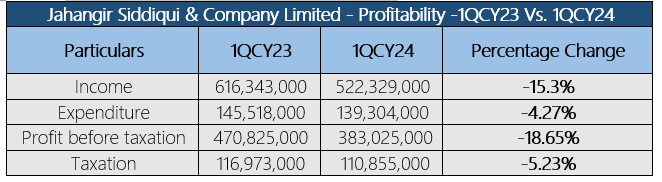

Jahangir Siddiqui & Company Limited (JSCL) reported an income of Rs522.3 million in the first quarter (1QCY24) of 2024 compared to Rs616.3 million in the same period the previous year, indicating a decline of 15.3%, primarily because of less dividend income and unrealized and realized losses on equity securities, reports WealthPK.

According to the financial report for the first quarter of 2024, despite a notable rise in the operating and administrative expenses, the company's expenditure decreased by 4.27% to Rs139.3 million from Rs145.5 million in 1QCY23. This was mainly due to the lower finance costs and the decline of provision for the Sindh Workers' Welfare Fund during the period.

![]()

Likewise, the review period saw a notable decrease of 18.65% in profit before tax and a decline of 5.23% in taxation. The company's net profit contracted by 23.1% to Rs272.1 million in 1QCY24 from Rs353.8 million in the same period the previous year due to lower income and higher taxes.

Financials analysis

The company's financial performance from CY19 to CY23 shows a fluctuating yet resilient trajectory in income and profitability. The total income increased from Rs1.22 billion in CY19 to Rs1.57 billion in CY23. However, this upward trend was interrupted in CY20 and CY22, with total income slightly decreasing to Rs956.5 million and Rs1.38 billion.

Profit after taxation also displayed significant fluctuations, with a peak of Rs1.2 billion in CY20 and a decline in subsequent years, reaching Rs290.8 million in CY23. The downturn in profit after this peak suggests challenges in maintaining high profitability levels, possibly due to increased costs, and market volatility.The earnings per share followed a similar trend as net profit, with an ESP of Rs0.39 in CY19 and peaking at Rs1.32 in CY20. The ESP gradually collapsed to the

![]()

![]()

lowest of Rs0.32 in CY23. This implies challenges in sustaining earnings growth and a potential decrease in shareholder value.

Ratios analysis

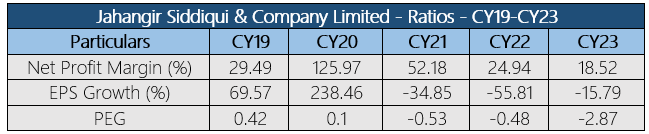

The net profit margin and EPS growth of JSCL from CY19 to CY23 show significant volatility and challenges. Despite CY20 being an exceptional year for profitability and EPS growth, with the highest net margin of 125.97% and EPS growth of 238.46%, the subsequent years

turned out to be concerning.

The company witnessed a consistent drop in net profit margin to 18.52% and a negative EPS growth of 15.79% in CY23. The PEG ratio, which provides a valuation measure considering the company's earnings growth rate, shows a downward trend, reaching negative Rs2.87 in CY23, suggesting a declining future earnings potential.

Investment banks/securities sector

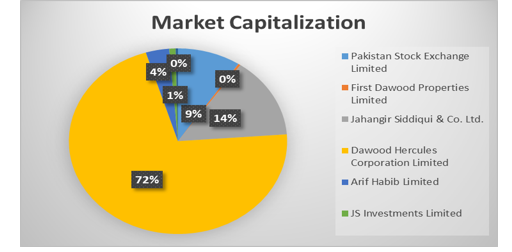

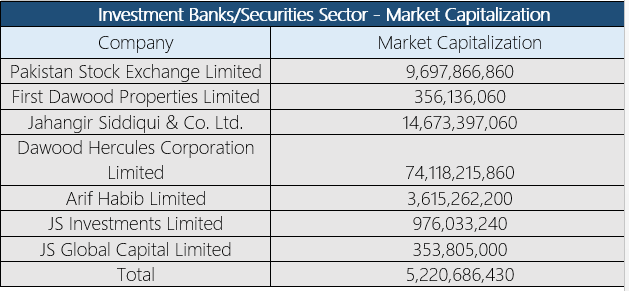

Dawood Hercules Corporation Limited has the largest market size with Rs74.12 billion market capitalization, covering a total of 72% of the total market in the sector. Followed by 14% of the share, Jahangir Siddiqui & Co. Ltd stood second in the list with Rs14.67 billion.

Pakistan Stock Exchange Limited contributed 9% to the total market capitalization in the sector with Rs9.70 billion. The total sector market capitalization is Rs5.22 billion.

Future outlook

Inflationary pressure is expected to trigger monetary easing in 2HCY2024, influenced by stable exchange rates and external factors like food, energy, and commodity prices. Global conflicts may be a short-term decision. Inflationary concerns may resurface due to the IMF program and the FY24-25 Federal Budget, limiting indigenous real economic growth. However, the company's investments in banking, insurance, technology, textiles, and chemicals are resilient enough to withstand adjustment periods, contributing positively to the economy and shareholders' value.

Company's profile

Jahangir Siddiqui & Co. Ltd. was established in 1991. The core activities include managing strategic investments in financial services, trading securities, and consultancy services. Additionally, long-term investments in transport and communications and financial services include investment in commercial banking, Islamic banking, asset management, securities brokerage, consumer credit rating agencies, and micro-finance.

Credit: INP-WealthPk