INP-WealthPk

Ittehad Chemicals market value declines in 6MFY23

January 09, 2023

Fakiha Tariq

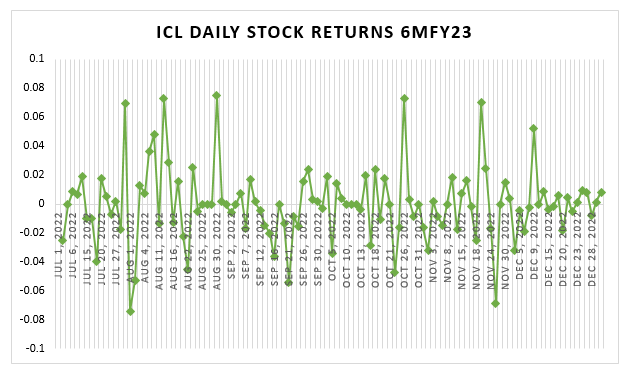

On average, Ittehad Chemicals Limited (ICL) generated negative stock returns for its shareholders in the first six months (July-Dec) of the ongoing fiscal year 2022-23, reports WealthPK. ICL’s loss margin in its shareholders’ wealth stood at 0.02%, almost the same compared to average loss of 0.03% experienced by the market as a whole in 6MFY23.

Whereas, ICL stock returns showed a moderately positive correlation with the market returns in 6MFY23. During the 6MFY23, the correlation coefficient between ICL and market returns was reported to be 0.3. During the first quarter (July-Sept) of FY23, the ICL stocks suffered a market value loss of 0.01%, whereas it had gone up to 0.04% in the second quarter of FY23.

During 6MFY23, ICL stock opened at the price of Rs28.40 on July 1, 2022, and ended in a dropped value of Rs27.50 on Dec 30, 2022. Ittehad Chemical Limited has been trading under the symbol of ICL on the Pakistan Stock Exchange as the 12th largest company with a market cap of Rs2.8 billion in the chemical sector.

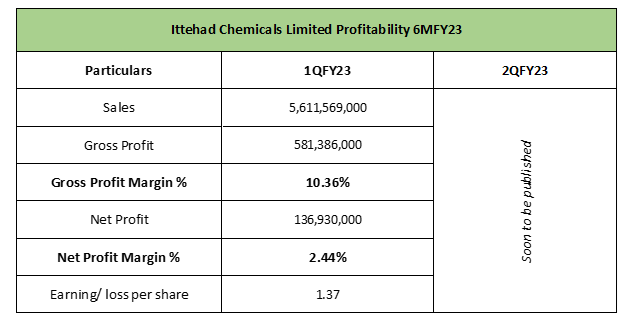

Incorporated in 1991, ICL is now a leading manufacturer and seller of industrial chemicals in Pakistan. In the first quarter of FY23, ICL remained profitable and earned a gross profit of 10.36% or Rs581 million from the sales of Rs5.6 billion. ICL net profit margin for 1QFY23 was reported to be 2.44%, whereas it produced earnings of Rs1.37 per share for its shareholders.

ICL also earned a gross profit of 12.20% in the first six months of FY22. With a net profit margin of 2.70%, ICL reported an EPS value of Rs1.83 apiece in 6MFY22.

Credit : Independent News Pakistan-WealthPk