INP-WealthPk

Hifsa Raja

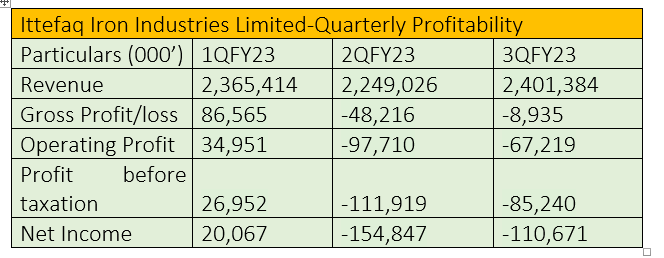

Ittefaq Iron Industries Limited, a prominent player in the iron industry, recently released its quarterly profitability analysis, depicting a challenging period for the company.

The first quarter of FY23 proved to be the best period for the company as its revenues, gross and net profits increased. The company posted revenues of Rs2.36 billion, a gross profit of Rs86 million and a net profit of Rs20 million in 1QFY23.

The company revenue fell slightly to Rs2.24 billion in the second quarter, with a gross loss of Rs48 million and a net loss of Rs154 million.

The third quarter of FY23 saw an increase in revenue, which inched up to Rs2.40 billion. The firm managed to bring down its gross loss to just Rs8.9 million and net loss to Rs110 million compared to the second quarter.

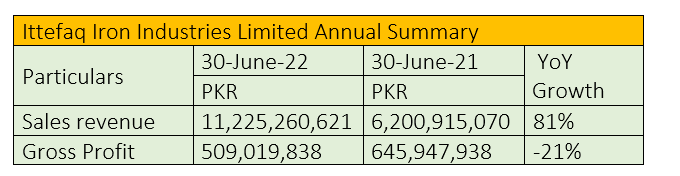

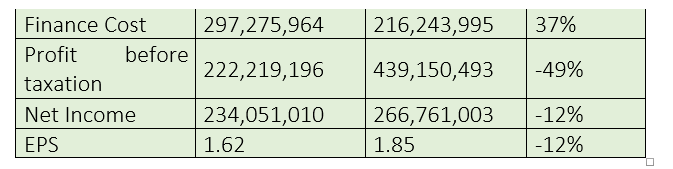

FY22 compared with FY21

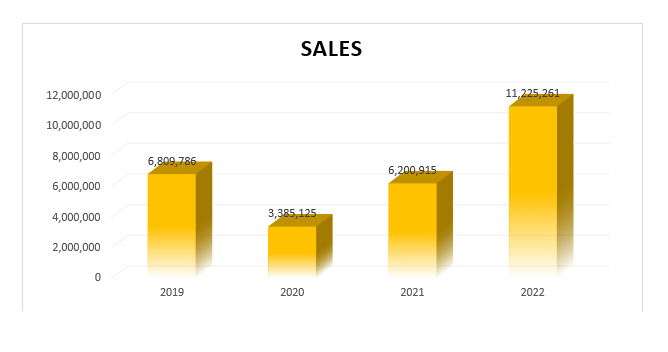

In the fiscal year 2021-22, the company reported a substantial increase in sales revenue, which jumped to Rs11 billion from Rs6 billion the previous year, indicating a growth of 81%.

However, the gross profit decreased to Rs509 million in FY22 from Rs645 million in FY21, posting a negative growth of 21%.

The company’s finance cost increased by 37% to Rs297 million in FY22 from the previous year's cost of Rs216 million.

Further, the company’s profit-before-tax fell by 49% to Rs222 million in FY22 from Rs439 million the year prior.

The profit-after-tax for FY22 also decreased 12% to Rs234 million from Rs266 million in FY21.

The earnings per share (EPS) also declined by the same percentage.

These trends suggest the need for the company to take strategic measures to navigate the changing market conditions and enhance its overall performance.

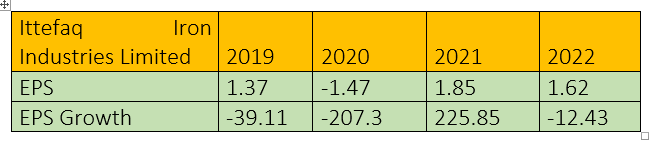

Earnings Per Share

In 2019, 2021 and 2022, the EPS was positive, demonstrating that the business was profitable. However, the EPS for 2020 was negative, indicating the business lost money that year.

In 2019 and 2020, the company’s EPS growth was negative, showing a considerable decline in the earnings per share. However, the EPS growth in 2021 was quite high, indicating the business had a large increase in profits per share. The EPS growth in 2022 was negative once more, suggesting a drop in earnings per share from the year before.

The firm must demonstrate how it can continue to operate well, strategise, and build on its advantages while correcting problems that have affected its performance in the past.

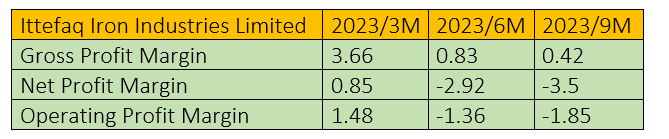

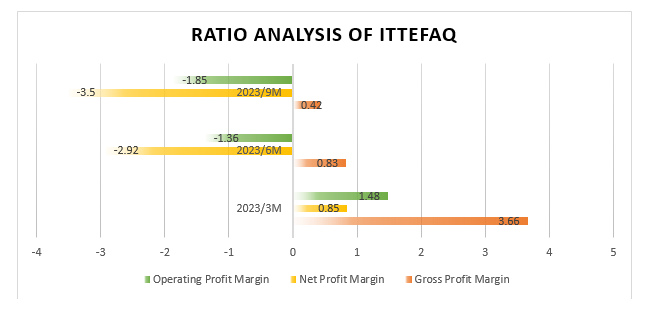

Ratio analysis

In the first quarter of FY23, the gross profit margin stood at 3.66% and the net profit margin at 0.85%. The operating profit margin was 1.48% in 1QFY23.

In the second quarter, operating, net, and gross profit margin numbers decreased considerably. The gross profit margin dropped to 0.83%. The net profit margin stood at negative 2.92% and the operating profit margin at negative 1.36%.

In the third quarter, the gross profit margin further decreased to 0.42%. The net and operating profit margins further declined to -3.5% and to -1.85%.

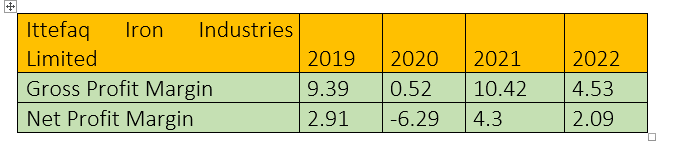

In 2019, Ittefaq Iron Industries’ gross profit margin was 9.39%, which plunged in 2020 to only 0.52%. However, it rose back to 10.42% in 2021 before falling again to 4.53% in 2022.

Changes in the cost of products sold or the company's pricing strategy is reflected in variations in the gross profit margin.

In 2019, the net profit margin was 2.91%, but in 2020, it fell to -6.29%. Nevertheless, it recovered to 4.3% in 2021 before falling again to 2.09% in 2022. A low net profit margin suggests that the business is losing money.

Overall, the net and gross profit margins indicate that Ittefaq Iron Industries Limited's profitability has changed overtime. While the company was profitable in 2019 and 2021, it suffered losses in 2020 and 2022.

The relatively low net profit margin suggests the company may need to assess and address factors such as cost management, revenue growth strategies, and operational efficiencies to improve its financial performance. It is important for the company to carefully analyse these margins and identify areas for improvement in order to enhance profitability and ensure long-term sustainability.

Company profile

Ittefaq Iron Industries Limited (formerly Ittefaq Sons Private Limited) was incorporated on February 20, 2004 and converted into public unquoted company on January 5, 2017. The company also changed its name from Ittefaq Sons Private Limited to Ittefaq Iron Industries Limited on February 9, 2017. The principal activity of the firm is manufacturing of iron bars and girders.

Credit : Independent News Pakistan-WealthPk