INP-WealthPk

Hifsa Raja

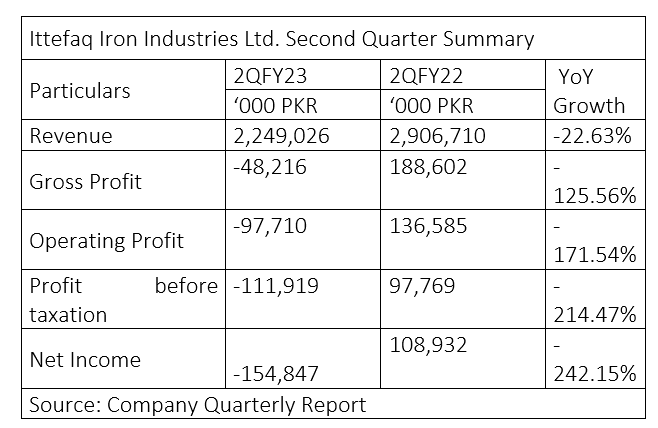

Ittefaq Iron Industries Limited – maker of iron bars and girders – generated a revenue of Rs2.24 billion during the second quarter (Oct-Dec) of the ongoing financial year 2022-23 (2QFY23), registering a drop of 22.63% from sales revenue of Rs2.90 billion over the same period of the previous fiscal, reports WealthPK.

The company incurred a gross loss of Rs48.2 million in 2QFY23 compared to a gross profit of Rs188.6 million in 2QFY22, marking a significant decrease of 125.56% year-on-year. Ittefaq Iron Industries also incurred an operating loss of Rs97.7 million in 2QFY23 compared to an operating profit of Rs136.5 million in 2QFY22, indicating a significant decrease of 171.54% in operating profit.

The company also sustained a loss-before-tax of Rs111.9 million in 2QFY23 compared to a before-tax profit of Rs97.7 million, posting negative growth of 214.47% year-on-year. The firm also suffered a net loss of Rs154.8 million during the second quarter of FY23 as opposed to a net income of Rs108.9 million over the same period of FY22, registering a significant decrease of 242.15% year-over-year. Overall, the data indicates that Ittefaq Iron Industries had a poor second quarter of FY23 compared to the corresponding quarter of the previous year as far as revenues and profits are concerned.

Industry comparison

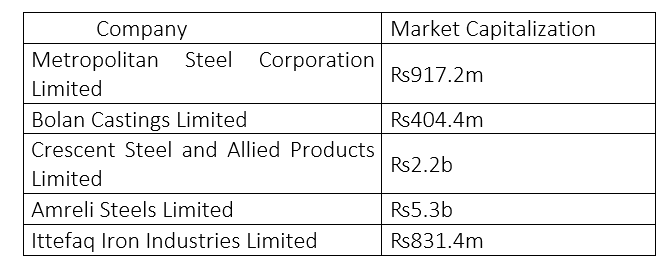

Ittefaq Iron Industries Limited’s competitors are Metropolitan Steel Corporation Limited, Bolan Castings Limited, Crescent Steel and Allied Products Limited, and Amreli Steels Limited.

Amreli Steels Limited is the largest of its peers in terms of market capitalisation, while Bolan Castings Limited is the smallest. Market capitalisation is just one metric for comparing companies and does not necessarily indicate which company is the most profitable or successful. Other factors such as revenue, profitability and market share may also be important considerations when comparing competitors.

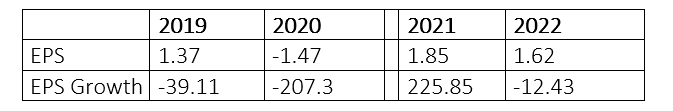

Earnings per share and EPS growth

The company posted earnings per share in 2019, 2021 and 2022. However, in 2020, it recorded loss per share. The EPS growth stood negative in 2019, 2020 and 2022, reflecting the company either sustained losses or its per share values decreased. However, the EPS growth was very high in 2021, suggesting the company experienced significant growth in earnings per share that year.

Ratio analysis

Gross profit margin stood at 9.39% in 2019, but decreased to just 0.52% in 2020. However, it increased to 10.42% in 2021 and then decreased again to 4.53% in 2022. The fluctuations in the gross profit margin indicate changes in the cost of goods sold or the pricing strategy of the company.

The net profit margin was 2.91% in 2019, but turned negative in 2020 at -6.29%. However, it bounced back to 4.3% in 2021 and then declined again to 2.09% in 2022. A negative net profit margin indicates the company is operating at a loss. Overall, the net and gross profit margins suggest the profitability of Ittefaq Iron Industries Limited has fluctuated over the years. While the company was profitable in 2019 and 2021, it suffered losses in 2020 and 2022.

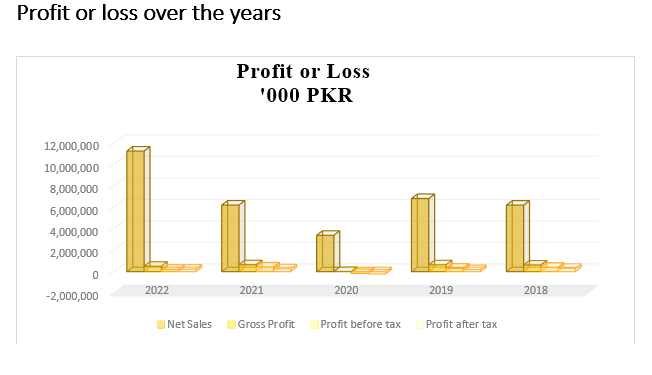

Profit or loss over the years

In 2018, the company made a profit of Rs313 million. In 2019, it posted a profit of Rs198 million, but in 2020, the company suffered a loss of Rs212.8 million. In 2021, the company made a profit of Rs266.7 million compared to a profit of R234 million in 2022.

Credit: Independent News Pakistan-WealthPk