INP-WealthPk

Jawad Ahmed

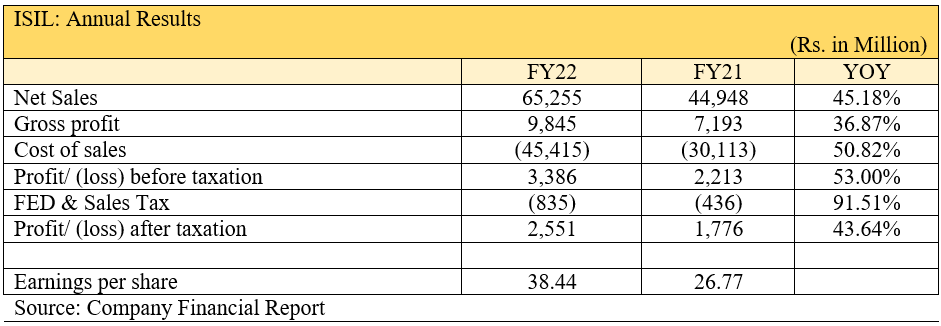

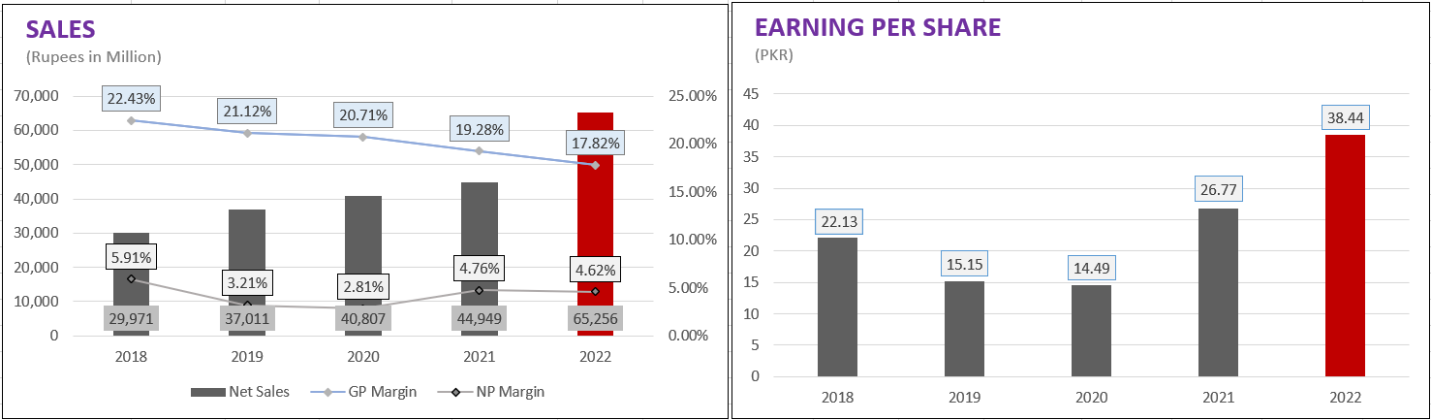

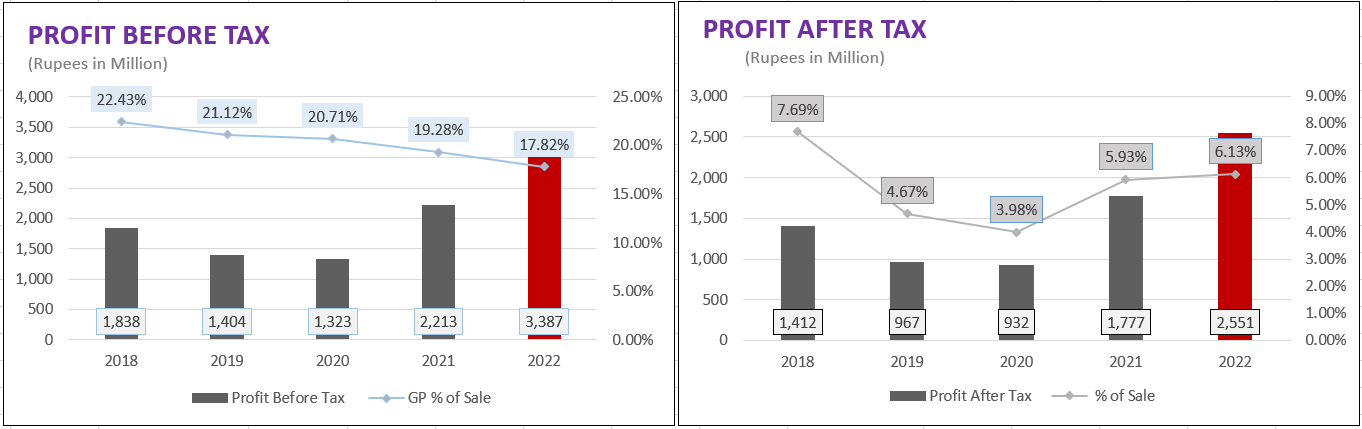

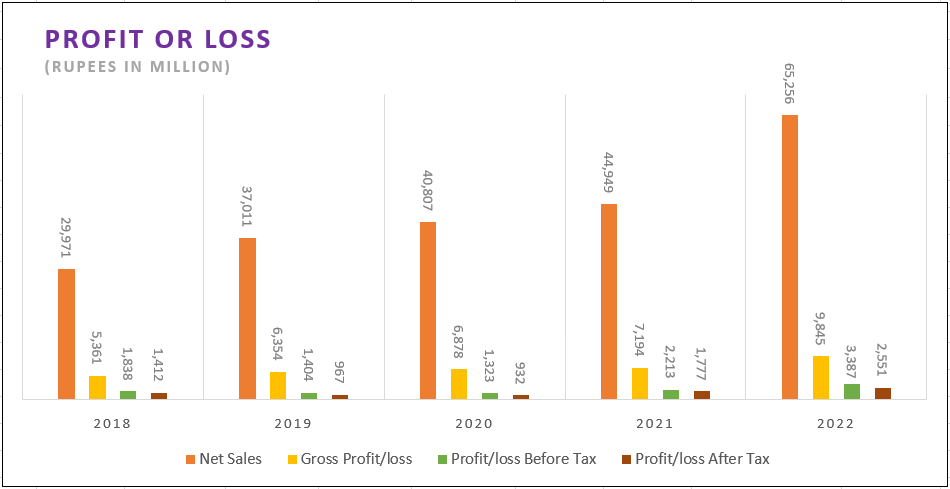

Revenues of Ismail Industries Limited climbed 45% to Rs65.25 billion in the fiscal year that ended on June 30, 2022, from Rs44.94 billion the previous year. Sales income climbed both numerically and financially during the fiscal year 2021-22, WealthPK reports quoting the company's financial statistics.

The company was incorporated in Pakistan as a private limited firm on June 21, 1988. On November 1, 1989, it was converted into a public limited company. The principal activities of the company are manufacturing and trading of sugar confectionery items, biscuits, potato chips, cast polypropylene and biaxially-oriented polyethylene terephthalate film under the brands of CandyLand, Bisconni, Snackcity and Astro Films, respectively.

Due to an increase in revenue, the gross profit of the company increased 36.8% to Rs9.84 billion in FY22 from Rs7.19 billion in the prior year. The profit-before-tax for the year increased by 53% to Rs3.38 billion compared to Rs2.21 billion in FY21.

Net profitability increased by 43.6% from Rs1.77 billion in FY21 to Rs2.55 billion in FY22. Earnings per share (EPS) rose exponentially due to the considerable top-line growth, jumping from Rs26.77 in FY21 to Rs38.44 in FY22.

Company’s performance over the years

In 2019, the company's sales revenue climbed to Rs37 billion from Rs29.97 billion in 2018. The company's gross profit increased by 18.5% year-over-year, from Rs5.36 billion the previous year to Rs6.35 billion this year. However, the profit-after-tax decreased by 31.5%, from Rs1.41 billion the year before to Rs967 million this year. As a result, the EPS went down from Rs22.13 in 2018 to Rs15.15 in 2019.

In 2020, sales climbed 10.3% to Rs40.8 billion from Rs37 billion the year before. The gross profit increased to Rs6.87 billion from Rs6.35 billion in 2019. The net profit, however, decreased slightly in 2020 to Rs932 million from Rs967 million previously. Thus, the earnings per share dropped from Rs15.15 to Rs14.49.

In 2021, due to an increase in product demand, the company's top line increased to Rs44.94 billion from Rs40.80 billion in 2020. With the lifting of the Covid-19-induced restrictions, the economy recovered, posting an increase in gross profit, which inched up to Rs7.19 billion from Rs6.87 billion in 2020. The net profit rose from Rs932 million in 2020 to Rs1.77 billion in 2021.

Thus, the EPS grew from Rs14.49 last year to Rs26.77 this year.

Future outlook

Pakistan's business environment has become very difficult as a result of the unstable political and economic environment and depreciation of the rupee, soaring inflation and high interest rates. Margin protection is still a significant problem for the company. The general public's disposable income has been impacted by rising inflation, and it is anticipated that their spending will stay restrained.

However, the company has made every effort to offer customers the best products at the most affordable costs without sacrificing quality. The company has high hopes for steady growth in the long term.

It is determined to significantly increase sales and profitability in the future thanks to strong market position in the production of food and plastic films through well-known brands and timely capacity expansions.

Credit : Independent News Pakistan-WealthPk