INP-WealthPk

Shams ul Nisa

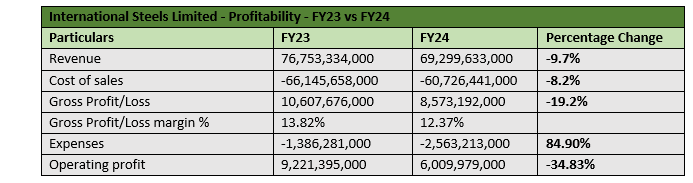

The revenue of International Steels Limited (ISL) dipped 9.7% to Rs69.30 billion in the fiscal year 2023-24 from Rs76.7 billion in FY23, reports WealthPK.

The cost of sales also decreased by 8.2% and the gross profit by 19.2%, which pushed the gross profit margin down to 12.37% in FY24 from 13.82% in FY23. The reduction in gross margin was because of increased energy costs during the period. Likewise, total expenses surged by 84.90%, impacting operating profit, which decreased by 34.83%. This indicates that the company struggled to convert sales into operational earnings effectively in FY24.

![]()

The company’s profit-before-taxation saw a smaller decline of 9.5% in FY24. However, the net profit increased by 3.87% due to effective working capital management, which led to a robust cash flow of Rs4.9 billion from operating activities. Thus, earnings per share increased slightly from Rs8.09 in FY23 to Rs8.40 in FY24, reflecting improved profitability available to shareholders despite declining revenues and operating profits.

Engineering sector performance

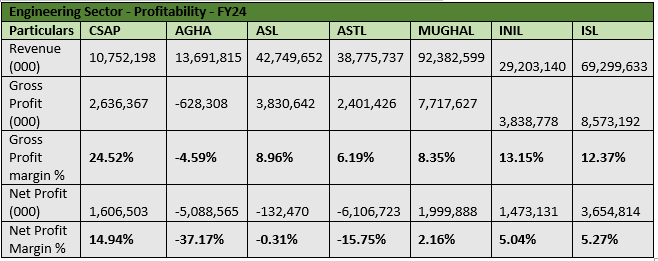

The revenue and profitability figures across companies in the engineering sector show significant variations in FY24. The sector is comprised of Crescent Steel & Allied Products Limited (CSAP), Agha Steel Ind.Ltd (AGHA), Aisha Steel Mills Limited (ASL), Amreli Steels Limited (ASTL), Mughal Iron & Steel Industries Limited (MUGHAL), International Industries Limited (INIL), and International Steels Limited (ISL).

MUGHAL led the sector with a revenue of Rs92.38 billion, followed by ASL with Rs42.75 billion and ASTL Rs38.78 billion. AGHA reported the lowest revenue of Rs13.69 billion, suggesting market challenges for some companies. In terms of gross profit, ISL led with a gross profit of Rs8.57 billion. Again, AGHA posted a gross loss of Rs628.3 million, highlighting difficulties in managing production costs. Gross profit margins reveal CSAP's strength at 24.52%, while AGHA'S gross loss margin of 4.59% suggests severe cost inefficiencies. CSAP and MUGHAL recorded net profits of Rs1.61 billion and Rs1.99 billion, respectively, while AGHA and ASTL posted substantial losses of Rs5.09 billion and Rs6.11 billion. CSAP led with a net profit margin of 14.94%, while AGHA reported a net loss margin of 37.17% during FY24.

Historical trends

Net sales of ISL saw fluctuations over the years from FY18 to FY24. Starting at Rs49.16 billion in FY18, sales increased to Rs57.48 billion in FY19 before declining to Rs48.08 billion in FY20, likely due to market challenges. A strong rebound in FY21 saw sales rise to Rs69.80 billion, continuing to peak at Rs91.42 billion in FY22. However, sales declined again in FY23 and further to Rs69.30 billion in FY24, signalling potential challenges like competition and pricing pressures.

![]()

![]()

The net profit trend presents more concerning picture over the years. From Rs4.36 billion in FY18, profit fell to Rs2.66 billion in FY19 and then dropped sharply to Rs494.85 million in FY20. A strong recovery in FY21 put the net profit at Rs7.47 billion, but it declined again to Rs5.41 billion in FY22. FY23 saw its profit fall to Rs3.52 billion, followed by a slight recovery to Rs3.65 billion in FY24.

Future outlook

ISL anticipates a challenging operating environment due to ongoing economic uncertainties, but remains confident in its strong financial position, operational efficiency, and market focus. Key factors impacting its outlook include economic recovery, government policies, global steel trends, and technological advancements. The company is prioritising cost management, operational excellence, and market diversification for sustainable growth. To reduce costs and its carbon footprint, ISL is installing a 6.4MW solar power plant, which is expected to be operational within a year.

Additionally, it has invested in supply chain management software to enhance inventory management and customer satisfaction. The firm has also approved a Rs48.45 million investment in Chinoy Engineering & Construction (Private) Limited. A focus on research and development will be key to staying competitive while delivering value to stakeholders and supporting the community and environment.

Company profile

ISL, a subsidiary of International Industries Limited, was established in Pakistan on Sept 3, 2007, under the Companies Act, 2017. The firm primarily manufactures cold-rolled, galvanised and colour-coated steel coils and sheets.

Credit: INP-WealthPk