INP-WealthPk

Shams ul Nisa

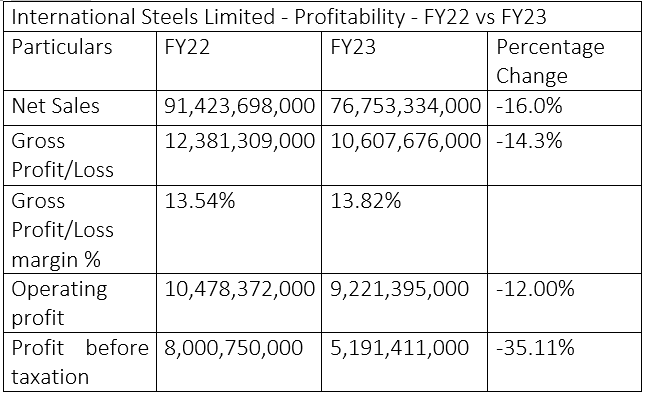

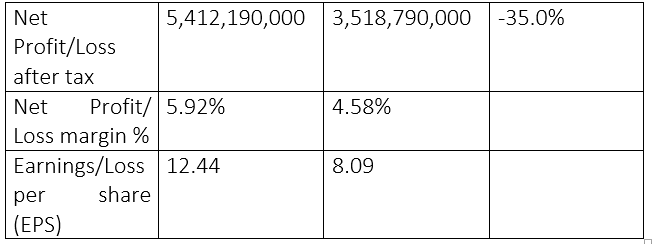

International Steels Limited (ISL) recently released its financial report for the fiscal year ending June 2023, posting a decline in both revenue and profitability because of the changes in market demand caused by depressed economic conditions. The company reported total revenue of Rs76.7 billion in FY23 compared to Rs91.4 billion in FY22, registering an overall decrease of 16%. This decrease in revenue is attributed to the prevailing economic distress in the country mainly because of the high inflation rate and currency depreciation against the US dollar.

As a result of the decrease in revenue, the company’s gross profit fell by 14.3% from Rs12.38 billion in FY22 to Rs10.60 billion in FY23. This can be attributed to the rise in cost of goods sold by the company. However, the gross profit margin witnessed a slight increase from 13.54% in FY22 to 13.82% in FY23. This shows that the company saved higher percentage of revenue out of the costs of goods sold. The operating profit of ISL decreased by 12% to Rs9.22 billion in FY23 from Rs10.47 billion in FY22. This shows that the company wasn’t able to manage its operational expenses effectively during the period under consideration.

The profit-before-tax decreased by 35.11% to Rs5.19 billion in FY23 from Rs8 billion in FY22. Similarly, ISL’s net profitability declined by 35% in FY23 to Rs3.51 billion from Rs5.41 billion in FY22. The company’s net profit margin also dwindled from 5.92% in FY22 to 4.58% in FY23. This downfall is because of high interest rate and domestic currency devaluation. The earnings per share (EPS) fell to Rs8.09 in FY23 from Rs12.44 in FY22. This decline reflects the fall in profitability per share that caused the stock less attractive.

Total assets analysis

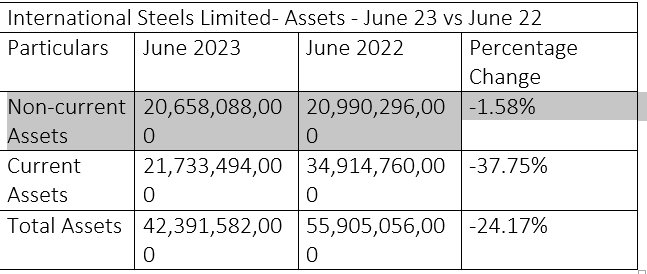

The company’s non-current assets decreased by 1.58% to Rs20.65 billion in June 2023 from Rs20.99 billion in June 2022. This suggests that the company disposed of certain non-current assets during the period such as property, equipment and intangible assets.

Similarly, the company’s current assets plunged by 37.75% from Rs34.9 billion in June 2022 to Rs21.7 billion In June 2023. This shows the company had lower liquidity and working capital such as cash, account receivables and inventory. As a result of the fall in current and non-current assets, the company’s total assets declined 24.17% to Rs42.39 billion in June 2023 from Rs55.90 billion in June 2022.

Analysis of total equity and liabilities

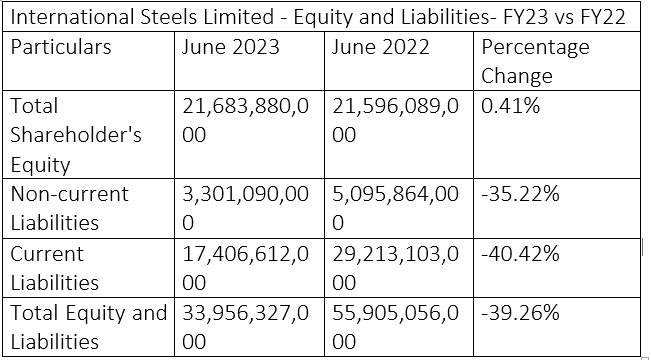

The company’s total shareholders’ equity grew marginally by 0.41% to Rs21.68 billion in June 2023 compared to Rs21.59 billion in June 2022. This slight increase suggests that the company either conserved earnings or invested in additional capital during this period. As of June 2023, the company’s non-current liabilities stood at Rs3.3 billion compared to Rs5.09 billion in June 2022, resulting in a decline of 35.22%. This signifies that the company reduced its long-term obligations.

Likewise, the company’s current liabilities dropped significantly by 40.42% to Rs17.4 billion in June 2023 from Rs29.21 billion in June 2022. This shows that the company efficiently managed its accounts payables and reduced short-term borrowings such as loans. International Steels Limited’s total equity and liabilities diminished by 39.26% to Rs33.95 billion in June 2023 from Rs55.90 billion in June 2022.

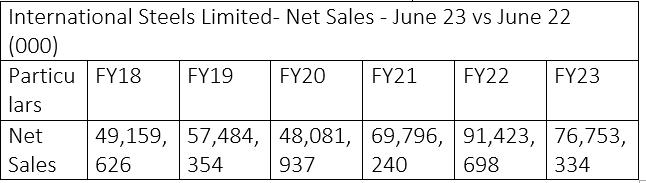

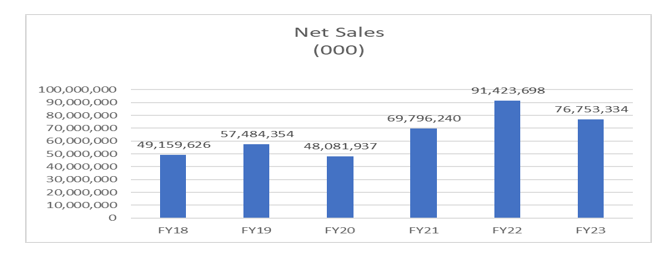

Analysis of net sales

International Steels Limited's net sales from FY18 to FY23 exhibited a fluctuating trend. The net sales experienced incremental growth from Rs49.15 billion in FY18 to Rs57.48 billion in FY19, reflecting a positive trend.

This upward trend, however, reversed in FY20 as the company observed a slight decline in its net sales to Rs48.08 billion. The net sales regained the momentum and rebounded to Rs69.79 billion in FY21 and to Rs91.4 billion in FY22, showcasing a substantial growth. During FY23, the net sales notably declined to Rs76.75 billion.

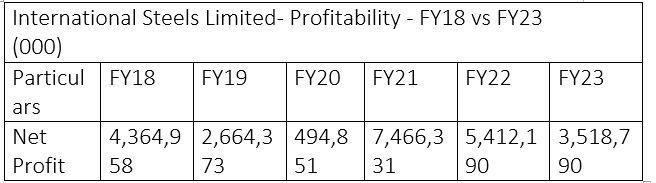

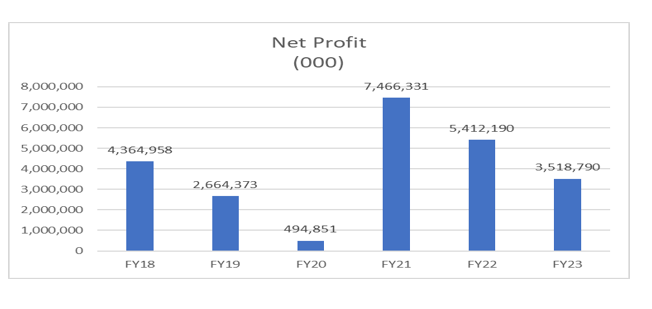

Analysis of net profit

The highest net profit of Rs7.46 billion was observed in FY21 followed by Rs5.4 billion in FY22 and Rs4.36 billion in FY18.

The lowest net profit of Rs494.8 million was recorded in FY20 followed by Rs2.66 billion in FY19 and Rs3.51 billion in FY23.

Credit: INP-WealthPk