INP-WealthPk

Shams ul Nisa

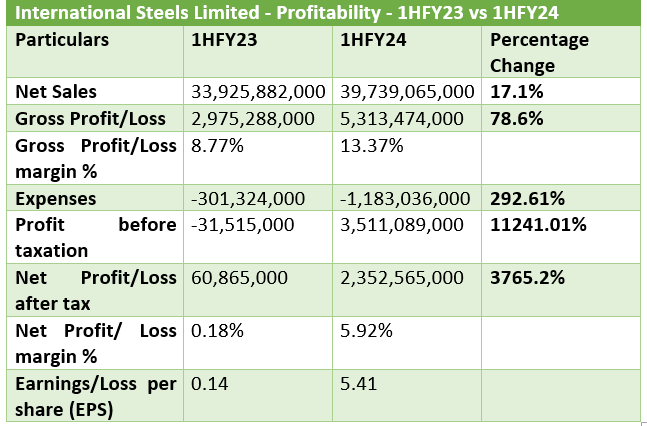

The net profit of International Steels Limited (ISL) witnessed an astonishing spike of 3,765% to reach Rs2.35 billion in the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of last year. The driving factor behind this mammoth profit growth was the improved exports caused by the stable economic conditions. In 1HFY24, prices stabilised as a result of moderation in global demand. The company reported total sales of Rs39.7 billion in 1HFY24 compared to Rs33.9 billion over the same period of the previous year, posting a 17.1% expansion.

The company's gross profit expanded by 78.6% to Rs5.31 billion. Thus, the gross profit margin climbed to 13.37% in 1HFY24 from 8.77% in 1HFY23. ISL's selling, distribution and administrative expenses grew a substantial 292.61% to Rs1.18 billion in 1HFY24 from Rs301.3 million in 1HFY23. The profit-before-tax widened an exponential 11,241% to Rs3.51 billion against a loss-before-tax of Rs31.5 million in 1HFY23. ISL's net profit margin also rose to 5.92% in 1HFY24 from 0.18% in 1HFY23. Earnings per share climbed to Rs5.41 in 1HFY24 from Rs0.14 in the same period last year.

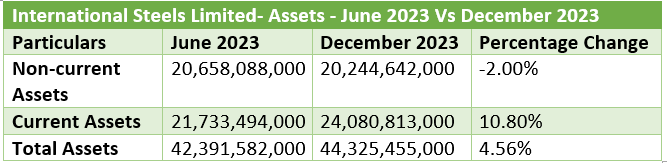

Assets analysis

The non-current assets fell by 2% from Rs20.65 billion in June 2023 to Rs20.24 billion in December 2023. This may indicate the business sold off certain non-current assets, like real estate, machinery and intangible assets, during the period. However, the current assets jumped by 10.80% to Rs24.08 billion in December 2023. This demonstrates the increase in working capital and liquidity position of the organisation, including cash, inventory and account receivables. Total assets of the company increased from Rs42.39 billion in June 2023 to Rs44.3 billion in December 2023, showing a growth of 4.56%.

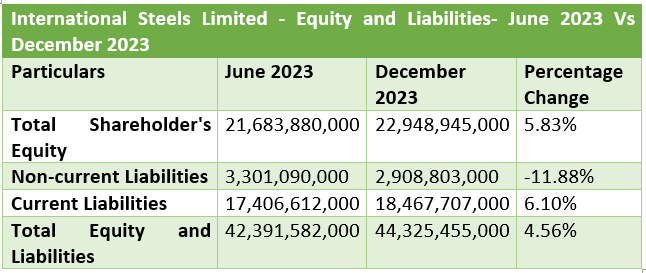

Equity and liabilities analysis

The company's total shareholder equity increased 5.83% to Rs22.94 billion in December 2023 from Rs21.68 billion in June 2023. However, the non-current liabilities went down by 11.88% to Rs2.9 billion in December 2023. This means fewer long-term commitments were made by the company during the period under review.

The company's current liabilities grew 6.10% to Rs18.46 billion in December 2023. This demonstrates the company added to its accounts payable and increased short-term borrowing, including loans. Total equity and liabilities surged by 4.56% to Rs44.32 billion in December 2023 from Rs42.39 billion in June 2023.

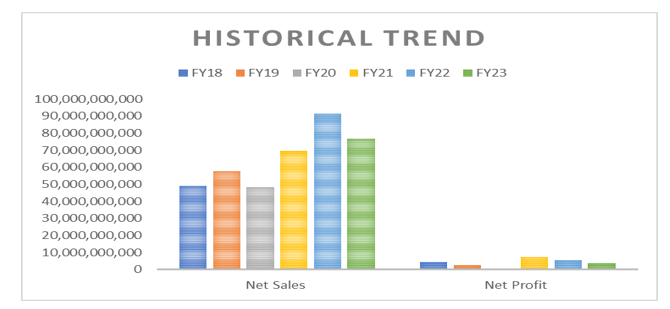

Historical trends

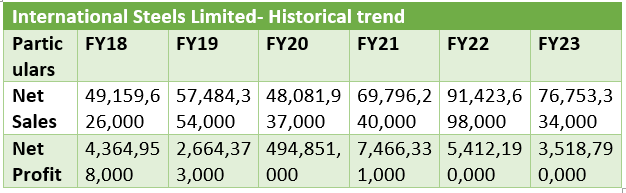

Net sales of International Steels fluctuated from FY18 to FY23. Sales increased from Rs49.15 billion in FY18 to Rs57.48 billion in FY19, indicating a healthy trend. But in FY20, the company's sales fell to Rs48.08 billion, reversing the growth trend. Sales demonstrated a notable increase, rising to Rs69.79 billion in FY21 and Rs91.4 billion in FY22, before decreasing significantly to Rs76.75 billion in FY23.

The company's net profit decreased from Rs4.36 billion in FY18 to Rs3.51 billion in FY23. Over this period, the highest net profit of Rs7.46 billion was recorded in FY21, and the lowest of Rs494.8 million in FY20.

Company profile

Founded in 2007, International Steels is Pakistan's biggest producer of flat steel. The company is a subsidiary of International Industries Limited. Its core activities are manufacturing cold-rolled, galvanised and colour-coated steel coils and sheets.

Credit: INP-WealthPk