INP-WealthPk

Shams ul Nisa

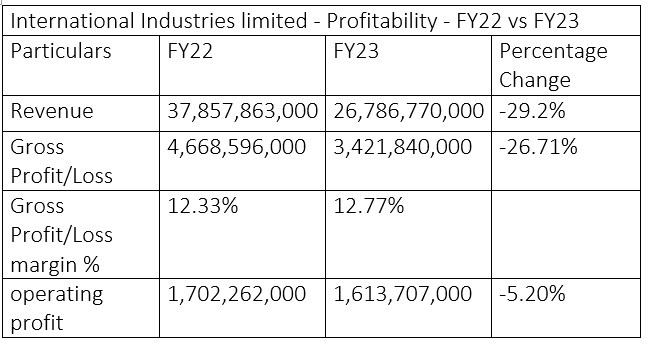

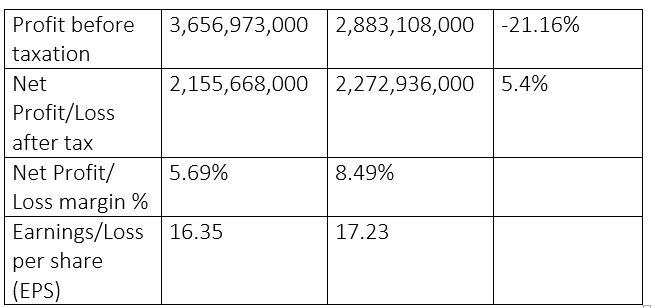

International Industries Limited (INIL) revenue fell substantially to Rs26.78 billion in the financial year 2022-23 from Rs37.8 billion in FY22, registering a decline of 29.2%. This decrease suggests that the company faced challenges in generating revenue because of changes in demand of consumers, market conditions and economic distress in the country. Similarly, the gross profit declined 26.71% to Rs3.42 billion in FY23 from Rs4.66 billion in FY22. However, the company’s gross profit ratio rose marginally to 12.77% in FY23 from 12.33% in FY22. The company’s operating profit also declined by 5.20% to Rs1.61 billion in FY23 from Rs1.70 billion in FY22.

The profit-before-taxation also dropped to Rs2.88 billion in FY23 from Rs3.6 billion in FY22, reflecting a substantial decline of 21.16%. This is because the company faced challenges in both gross profit and operational level during the period under consideration. On the other hand, the company’s profitability marginally increased 5.4% from Rs2.15 billion in FY22 to Rs2.27 billion in FY23. Thus, the net profit margin increased from 5.69% to 8.49%. The company’s earnings per share (EPS) slightly increased from Rs16.35 in FY22 to Rs17.23 in FY23.

Total assets analysis

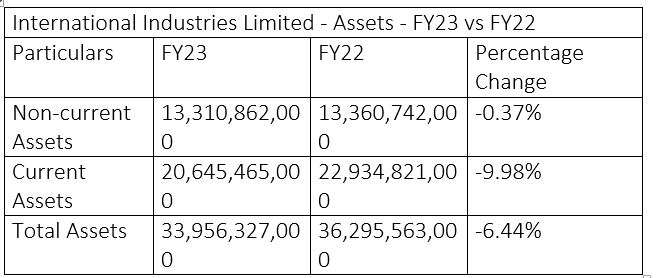

The company’s non-current assets dropped slightly by 0.37% to Rs13.31 billion in FY23 from Rs13.33 billion in FY22. This suggests the company liquidated certain long-term assets, such as property, equipment and intangible assets.

The current assets decreased by 9.98% from Rs22.9 billion in FY22 to Rs20.64 billion in FY23. This shows the company lowered its current assets such as cash, accounts receivables and inventory, suggesting lower liquidity and working capital of the company during FY23 compared to the previous year. The decline in current and non-current assets resulted in a fall of 6.44% in total assets as the company’s total assets dropped to Rs33.95 billion in FY23 from Rs36.29 billion in FY22.

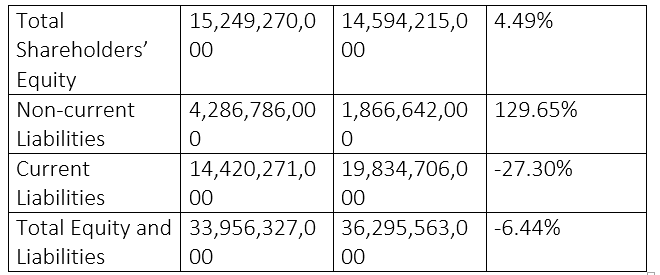

Analysis of total equity and liabilities

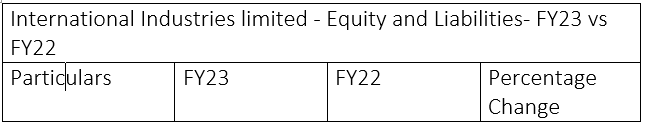

During FY23, the company’s total shareholders’ equity increased 4.49% to Rs15.24 billion from Rs14.59 billion in FY22. This rise reflects the company’s ability to expand its equity base during the period.

The non-current liabilities stood at Rs4.28 billion in FY23 compared to Rs1.86 billion in FY22, reflecting a growth of 129.65%. This signifies that the company has taken more long-term obligations to finance either its long-term projects or core operational expenses. The company’s current liabilities notably decreased by 27.30% to Rs14.42 billion in FY23 from Rs19.83 billion in FY22. This indicates the company had lower short-term obligations such as loans, accounts payables and other current liabilities. The firm’s total equity and liabilities dropped by 6.44% to Rs33.95 billion in FY23 from Rs36.29 billion in FY22.

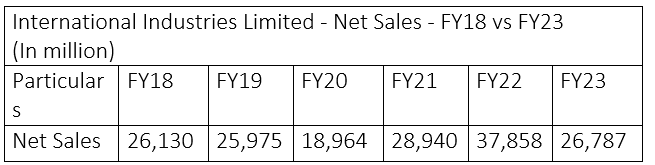

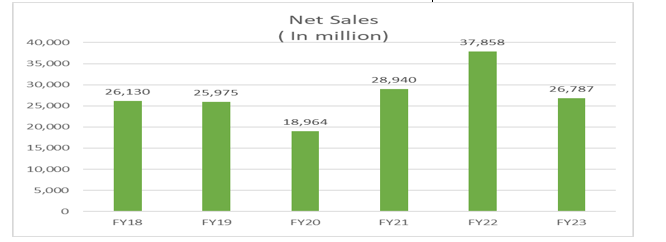

Analysis of net sales

International Industries Limited's net sales fluctuated over the years from FY18 to FY23. Form FY18 to FY19, the net sales declined slightly. However, a substantial dip was witnessed in FY20 as the Covid-19 pandemic affected market demand and economic conditions.

In FY21, there was a notable rebound in sales, which increased to Rs28.9 billion from Rs18.9 billion in FY20. This reflects the company was able to recover by capturing new opportunities. The company’s net sales continued to grow and peaked in FY22 at Rs37.85 billion. This can be attributed to improved market conditions and increased demand of goods.

However, FY23 witnessed a notable fall in net sales to Rs26.78 billion because of changes in market conditions, consumer preferences and economic distress.

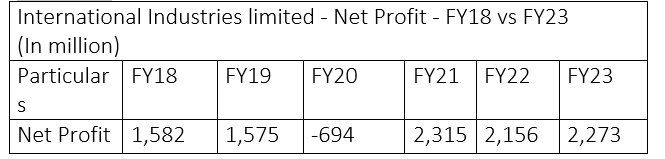

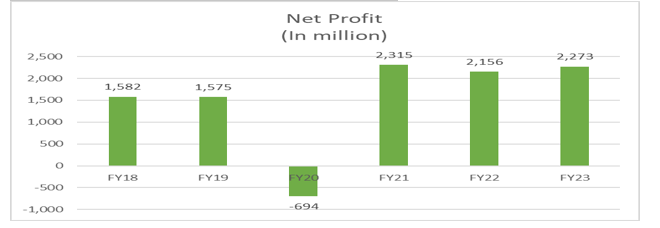

Analysis of net profit

The company’s net profit witnessed swings from FY18 to FY23. The net profit declined slightly to Rs1.57 billion in FY19 form Rs1.58 billion FY18. However, a significant decline occurred from FY19 to FY20 as the company suffered a net loss of Rs694 million in FY20.

This can be attributed to economic downturn because of the Covid-19 pandemic. However, the company managed to shed losses and posted a substantial profit of Rs2.31 billion in FY21 because of improved market conditions.

This profit remained robust in FY22 at Rs2.15 billion and rose modestly to Rs2.27 billion in FY23. This reflects the company successfully managed its costs and generated ample revenue over the time.

Company profile

International Industries Limited was established in Pakistan in 1948. The company manufactures and sells polymer pipes and fittings, precision steel tubes, API line pipes, galvanised steel pipes and precision steel tubes.

Credit: INP-WealthPk