INP-WealthPk

Shams ul Nisa

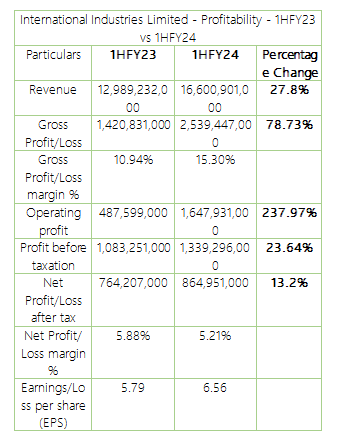

International Industries Limited (INIL) posted handsome revenue and net profit in the first half (July-Dec) of the ongoing Fiscal Year 2023-24, reports WealthPK. During 1HFY24, the company's revenue increased by 27.8 percent to Rs16.6 billion as against Rs12.98 billion in 1HFY23 mainly because of slight expansion in the domestic sales. Similarly, the net profit grew by 13.2% to Rs864.95 million in 1HFY24. The company's gross profit soared by 78.73% to Rs2.5 billion in 1HFY24 compared to Rs1.4 billion in the same period last year. Thus, the company achieved a gross profit margin of 15.30% against 10.94% in 1HFY23. This is a result of better management of expenses and working capital.

Additionally, an excellent jump in the operating profit to Rs1.6 billion from Rs487.59 million in 1HFY23, resulting in a growth of 237.97%, added to the better performance of the company during the period. In 1HFY24, the profit before tax expanded by 23.64% to 1.33 billion. However, the net profit margin slipped to 5.21% in 1HFY24 compared to 5.88% in 1HFY23. The earnings per share grew to Rs6.56 in 1HFY24 against Rs5.79 in 1HFY23.

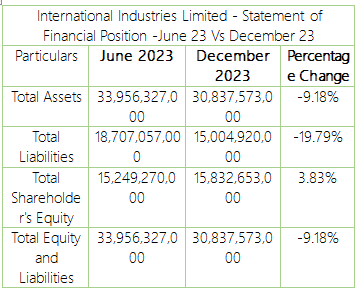

Statement of Financial Position

The company's financial position at the end of 1HFY24 showed a decline of 9.18% in total assets from Rs33.9 billion in June 2023 to Rs30.8 billion in December 2023. This reduction is associated with a decrease in current assets such as stores and spares, stock in trade and advances, trade deposits, and prepayments.

Furthermore, the company’s total assets fell by 19.79% to Rs15.004 billion at the end of December 2023 compared to Rs18.7 billion in June 2023. This reflects that during this period, the company paid its non-current and current liabilities. However, the total shareholder's equity grew to Rs15.8 billion in December 2023 from Rs15.24 billion in June 2023, posting an expansion of 3.83%. At the end of this period, the total equity and liabilities stood at Rs30.8 billion, 9.18% less than Rs33.95 billion in June 2023.

Historical Trend

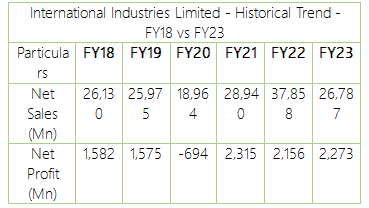

International Industries Limited experienced fluctuating net sales from FY18 to FY23, with a slight decline in FY19 due to the COVID-19 pandemic. However, in FY21, the sales rebounded to Rs28.9 billion. In FY22, the net sales continued to grow, reaching the highest at Rs37.85 billion, attributed to increased demand for goods. FY23 saw a significant decrease in the net sales to Rs26.78 billion, largely due to the market conditions, consumer preferences, and economic distress in the country.

The company's net profit remained volatile from FY18 to FY23, with a slight decline to Rs1.575 billion in FY19 and a significant loss of Rs694 million in FY20 due to the COVID-19 economic downturn. However, the profit recovered to Rs2.31 billion in FY21. In FY22, the net profit was Rs2.15 billion, with a modest rise of Rs2.27 billion in FY23, indicating successful cost management and revenue generation.

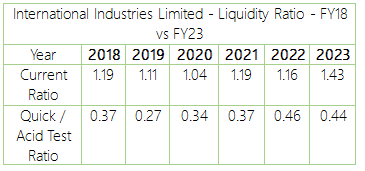

Liquidity Ratio Analysis

The current ratio measures the capacity of a company to pay its short-term obligations. A ratio greater than 1.2 is considered safe and below 1.2 increases the danger. The company overall improved its current ratio from 1.19 in 2018 to 1.43 in 2023, with variations in between. The quick ratio, which remained below 1 over the past six years, reflects the increasing risk associated with meeting its obligations. The company’s quick ratio stayed between 0.27 in 2019 and 0.46 in 2022.

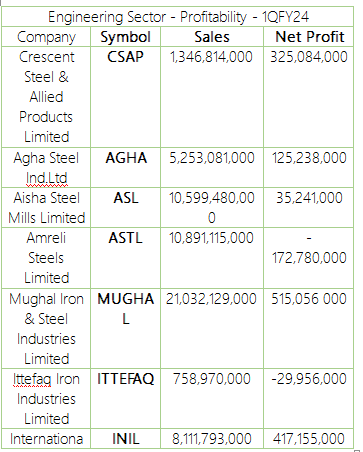

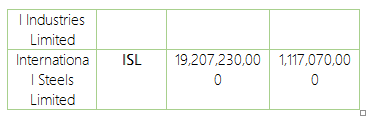

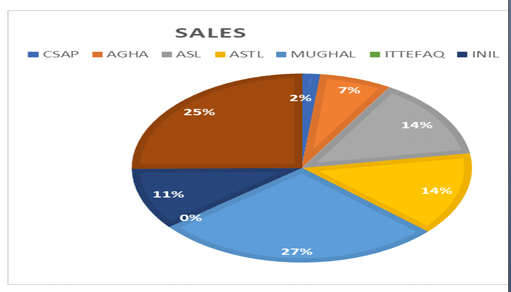

Sector Analysis

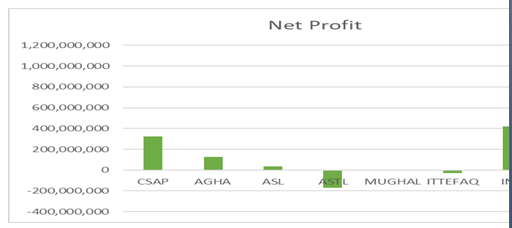

Comparing the companies in the engineering sector based on sales and net profit for the first quarter of Fiscal Year 2024 provides a detailed insight into the highest-performing company during the period. As per the sales, 27% of the total sales were made by Mughal Iron and Steel Industries Limited, followed by 25% of total sales by International Steels Limited.

In contrast, net profit provides different results for the 1QFY24, led by International Steel Limited with a total net profit of Rs1.17 billion. International Industries Limited smashed a net profit of Rs417.15 million, standing at the second line in the sector. During 1QFY24, Amreli Steels Limited and Ittefaq Iron Industries Limited faced a net loss of Rs172.7 million and Rs29.9 million respectively.

Company profile

International Industries Limited was established in 1948. The company manufactures and sells polymer pipes and fittings, precision steel tubes, API line pipes, galvanized steel pipes, and precision steel tubes

Credit: INP-WealthPk