INP-WealthPk

Shams ul Nisa

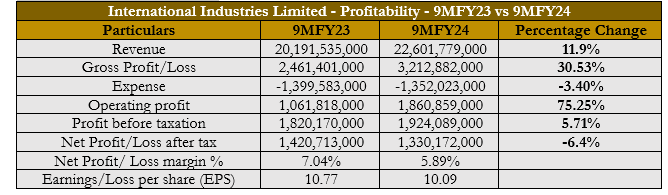

International Industries Limited announced its financial results for the quarter that ended on March 2024, wherein the company's revenue grew by 11.9% but net profit contracted by 6.4% over the same period in the last year, reports WealthPK. During the period, the company's domestic sales in quantity and value declined by 5% and 16% compared to last year. However, export sales in terms of amount saw a hike of 2% but a 6% contraction in value.

Thus, at the end of the period, the company's revenue stood at Rs22.6 billion. Whereas the market for pipe and tubing decreased by 25% compared to last year, the company maintained its market share with minimal sales volume erosion. High inflation, monetary tightening, and muted demand remain challenges, with declines in construction and building, infrastructure, and automotive industries. Hence, the company registered a net profit of Rs1.33 billion in 9MFY34, lower than Rs1.42 billion in 9MFY23.

Gross profit showed a 30.53% surge from Rs2.46 billion in 9MFY23 to Rs3.21 billion in 9MFY24. Meanwhile, the company managed to trim down selling and distribution expenses significantly by focusing on efficiency improvements and cost controls. This resulted in a decline of 3.40% in overall expenses during the review period. Operating profit in 9MFY24 went up by 75.25% YOY to Rs1.86 billion. At the end of the period, profit before tax multiplied by 5.71% to stand at Rs1.92 billion compared to Rs1.82 billion in 9MFY23. Net profit margin and earnings per share slipped to 5.89% and Rs10.09 in 9MFY24.

Engineering Sector

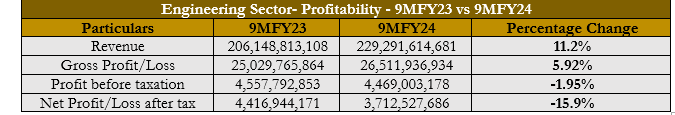

The Engineering Sector registered a moderate 11.2% rise in revenue during the nine months of the current fiscal year, clocking in at Rs229.29 billion compared to Rs206.14 billion in the same period last year. The sector's largest contributor was Mughal Iron & Steel Industries Limited with a total revenue of Rs67.133 billion in 9MFY24. This is followed by International Steels Limited, with a revenue of Rs56.01 billion, mainly due to growth in export sales across key markets like North America, Europe, and Asia against the same period last year. Gross profit spiked by 5.92% in the sector, with the highest Rs7.22 billion contributions by International Steels Limited. However, the Engineering Sector's profit before and after tax decreased by 1.95% and 15.9% during the 9MFY24, due to economic instability, high inflation, and the increase in energy prices. During the review period, Agha Steel Ind.Ltd and Amreli Steels Limited suffered losses before and after taxes.

Historical Trend

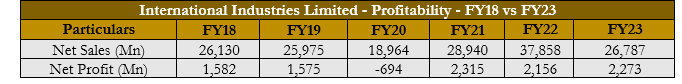

Net sales for International Industries Limited varied from FY18 to FY23, with a little drop in FY19 due to the COVID-19 pandemic. Sales increased to Rs28.9 billion in FY21, indicating recovery. Net sales climbed in FY22 and reached a record high of Rs37.85 billion, mainly driven by rising consumer demand. Net sales dropped significantly in FY23 to Rs26.78 billion, mostly due to the nation's economic hardship, customer choices, and market conditions.

From FY18 to FY23, INIL's net profit fluctuated significantly, declining somewhat to Rs1.575 billion in FY19 and significantly to Rs694 million in FY20 due to the COVID-19 economic slowdown. But in FY21, the profit increased to Rs2.31 billion. The net profit for FY22 was Rs2.15 billion, and it increased by a small amount to Rs2.27 billion in FY23, showing that cost control and revenue generation were successful.

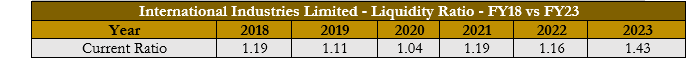

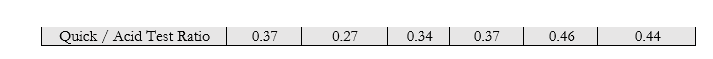

Liquidity Ratio Analysis

The current ratio evaluates a company's ability to meet its immediate financial obligations. A ratio below 1.2 raises the risk, whereas one above 1.2 is regarded as safe. With fluctuations in between, the company's current ratio improved overall from 1.19 in 2018 to 1.43 in 2023. The quick ratio, which has stayed below 1 for the last six years, illustrates the growing risk involved in fulfilling its responsibilities. The quick ratio of the company did not change from 0.27 in 2019 to 0.46 in 2022.

Company Profile

International Industries Limited was established in 1948. The company manufactures and sells polymer pipes and fittings, precision steel tubes, API line pipes, galvanized steel pipes, and precision steel tubes.

Credit: INP-WealthPk