INP-WealthPk

Qudsia Bano

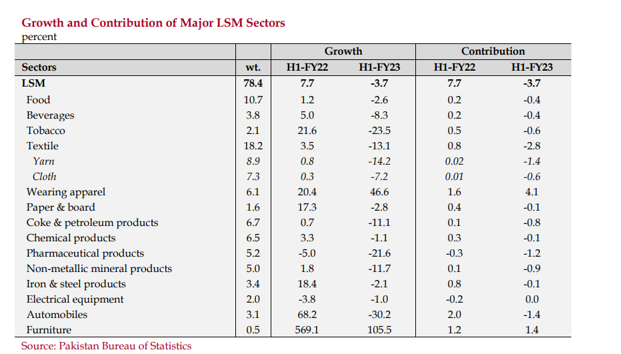

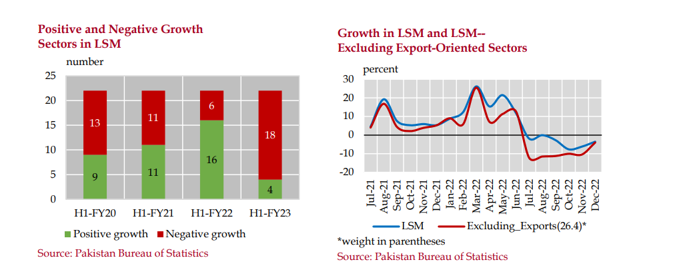

In a significant economic development, Pakistan's Large-Scale Manufacturing (LSM) sector contracted by 3.7% during the first half of fiscal year 2022-23 (1HFY23), marking a stark contrast from the previous year's robust expansion of 7.7% over the same period. This contraction underscores the multifaceted challenges faced by the sector, including tight monetary conditions, reduced Public Sector Development Programme spending, import compression measures, escalating power tariffs and fuel prices, and decreased demand in both domestic and global markets. The downturn in LSM during 1HFY23 affected a broad spectrum of industries, with 18 out of 22 sectors witnessing contractions.

This is in stark contrast to the same period last year when only six sectors were in contraction, and an average of 12 sectors experienced contractions during the corresponding period over the previous three years. Despite the overall decline in exports, the export-oriented sectors tracked by the LSM index played a stabilising role in the manufacturing industry during 1HFY23. However, when segregating these sectors, the magnitude of contraction worsened to 9.9% compared to an expansion of 6.1% during the same period the previous year.

The cumulative contraction in LSM was primarily attributed to the textile industry, followed by the automobile, pharmaceutical, non-metallic mineral products, and coke and petroleum products sectors. Textiles and automobiles, which are among the largest contributors to the LSM sector, contracted by 13.1% and 30.2%, respectively, during 1HFY23, as opposed to expansion rates of 3.5% and 68.2% over the same period the previous year.

The decline in pharmaceuticals, non-metallic minerals, and petroleum output also played a significant role in the overall contraction. In contrast, the wearing apparel and furniture industries continued to experience growth, which mitigated the extent of the LSM decline. These sectors expanded by 46.6% and 105.5%, respectively, in 1HFY23.

The increase in tariffs and fuel prices administered by the government led to a substantial rise in input costs, as reflected in the Wholesale Price Index (WPI), which surged from 21.5% in the same period the previous year to 34.1% in the period under review. Additionally, the tight monetary conditions resulted in a decline in demand for bank borrowing by the manufacturing sector, dropping from Rs674 billion in 1HFY22 to Rs502.5 billion in 1HFY23. External factors also weighed heavily on Pakistan's LSM sector during 1HFY23. Insufficient foreign exchange inflows, escalating pressure on foreign exchange reserves, and exchange rate challenges led to temporary restrictions on importing raw materials, which impeded manufacturing activities.

Talking to WealthPK, Kashif Anwar, President of the Lahore Chamber of Commerce and Industry (LCCI), expressed deep concern over the significant increase in production costs in recent months, noting that this trend was causing distress across the nation. The factors contributing to this competitive disadvantage, he said, included high-interest rates, a vulnerable exchange rate, and the continuous rise in prices. He anticipated a continued decline in exports due to the substantial challenges that manufacturers are grappling with in managing the escalating production costs.

According to him, it's the business and industrial sectors that are particularly burdened by the high cost of doing business. He stressed the importance of the government engaging with stakeholders and developing effective strategies to mitigate these costs. He also emphasised the need for collaboration to find solutions in this challenging economic environment.

Credit: INP-WealthPk