INP-WealthPk

Ayesha Mudassar

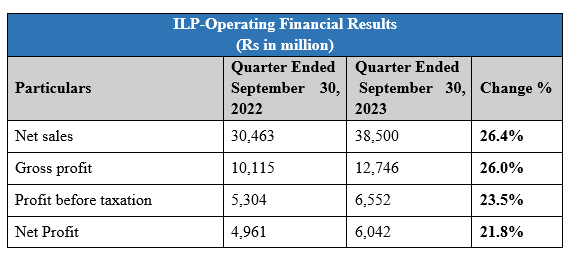

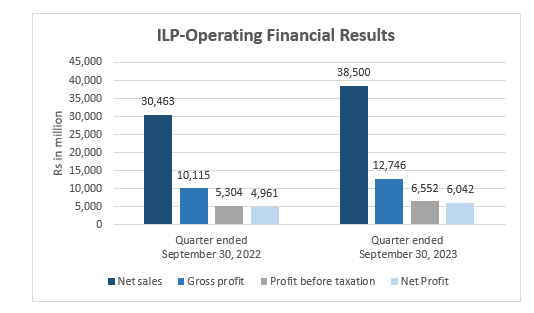

The revenue of Interloop Limited (ILP) grew by 26.4%, gross profit by 26%, and net profit by 21.8% in the first three months (July- September) of the ongoing fiscal year 2024 (3MFY24), compared to the corresponding period of the previous year, WealthPK reports. As per the Condensed Interim Statement, the textile giant posted revenue of Rs 38.5 billion and a gross profit of Rs 12.7 billion in 3MFY23. The net profit stood at Rs 6.04 billion compared to Rs 4.9 billion in the corresponding period last year, resulting in an earnings per share (EPS) of Rs 4.31 against Rs 3.54 in the same period last year.

The improved performance reflects the company's commitment to innovation, customer satisfaction, and operational effectiveness. On the other hand, the company's administrative cost inched up by 28.6% year-on-year, to Rs 2.02 billion in 1QFY24. The finance cost jumped by 81.2% to Rs 509 million on account of a significant increase in interest rates.

Performance over last four years (2020-2023)

Historical Financials

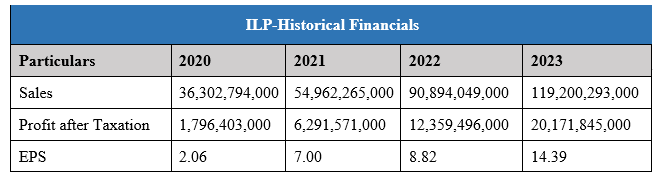

The sales and net profit of ILP have grown at a staggering rate over the years under review. Nonetheless, the company performed remarkably well during the fiscal year 2023 and delivered exceptional results by achieving the highest-ever sales revenue of Rs 119.2 billion, compared to Rs 90.8 billion during FY22. Cost-saving initiatives and better pricing management contributed to the notable improvement in profitability. The company, resultantly, achieved a profit-after-tax of Rs 20.1 billion for the current fiscal year, reflecting an increase of 63% compared to Rs 12.3 billion last year. This translated into earnings per share of Rs 14.39 in fiscal year 2023, compared to Rs 8.82 in fiscal year 2022.

Analysis of ILP EPS shows that in the last four years, its earnings per share kept increasing. The company posted its highest four-year EPS in 2023 at Rs 14.39.

Historical Ratios

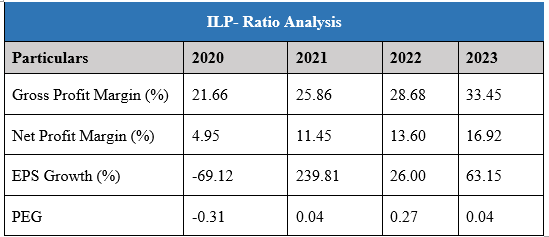

The historical ratios of Interloop Limited provide valuable insights regarding the company's financial performance and growth patterns over the years. The company has showcased a consistent improvement in its gross profit margin, reaching 33.45% in FY23, up from 28.68% in FY22, 25.86% in FY21, and 21.66% in FY22. This steady upward trend reflects the company's effective cost management and pricing strategies, contributing to a healthier bottom line. The net profit margin for Interloop also experienced positive growth, rising to 16.92% in FY23 compared to 13.60% in FY22, 11.45% in FY21, and 4.95% in FY20. The upward trajectory in net profit margin is a positive signal for investors, demonstrating Interloop's success in managing expenses and maximizing profits.

As far as earnings per share (EPS) are concerned, the Interloop Limited reported a significant growth of 63.15% in FY23. This follows a 26% growth in FY22 and an outstanding 239.81% surge in FY21. The consistent rise in EPS highlights the company's capacity to generate value for its shareholders, reflecting a strong financial performance. During the years under consideration, the price/earnings to growth (PEG) ratio for the company was notably low at 0.04 in FY23. The PEG ratio assesses the relationship between a company's price/ earnings (P/E) ratio and its earnings growth rate. A PEG ratio below 1 suggests that the stock may be undervalued relative to its earnings growth potential.

About Company

Established in 1992, the Interloop was listed on Pakistan's stock exchange in 2019. The company is a vertically integrated, multi-category company that manufactures hosiery, denim, knitted apparel, and activewear. In addition, it produces yarn for textile customers.

Future Outlook

Interloop has collaborated with Suzette Denim to digitally transform the fiber sampling process from farm to final product, through Loomshake and their innovative banana plant waste yarn. This cooperation incorporates LoopTrace technology, which ensures the traceability of banana fibers back to the farm, benefitting both farmers and the environment. In addition to the long-term initiatives, Interloop management is actively monitoring the global macro-outlook and taking proactive measures to ensure the effectiveness of the company's operations. Interloop remains committed to its key stakeholders and will continue to provide environment-friendly products.

Sector Review

The textile sector in Pakistan has exhibited a weak performance in the first quarter of fiscal year 2023-24. The reason is primarily attributed to a subdued demand for textile products in the USA and European markets. Additionally, frequent energy shortages and power outages in the country have hindered the textile industry's ability to maintain consistent production schedules, affecting delivery timelines and eroding customer trust. Total textile exports during the quarter were $4.12 billion as compared to $4.59 billion during the same period last year, which demonstrates that the textile sector continued to maintain a downward trajectory.

inpCredit: INP-WealthPk