INP-WealthPk

Fakiha Tariq

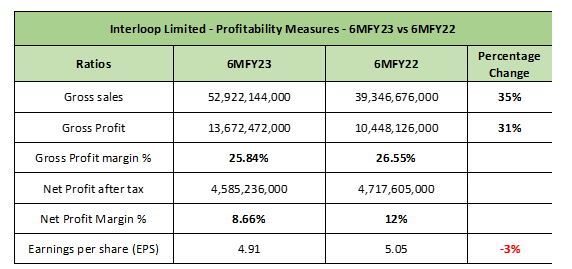

Interloop Limited (ILP) posted a gross revenue of Rs52 billion in the first six months (July-Dec) of the ongoing fiscal year 2022-23 compared to Rs39 billion recorded over the same period of last fiscal, registering a 35% growth year-on-year, reports WealthPK. Interloop Limited is listed on the Pakistan Stock Exchange with the symbol of ILP in the textile composite sector. ILP is the largest firm in the textile composite sector and has a market capitalisation of Rs46.7 billion.

ILP commenced its operations in 1992 with just 10 knitting machines, but now it is a leading manufacturer of a full family of clothing domestically and internationally. ILP was listed on PSX in 2019. In 1HFY23, ILP reported a 31% increase in gross profit compared to the same period in Y22. The company posted a gross profit of Rs13 billion in 1HFY23 whereas the gross profit in 1HFY22 stood at Rs10 billion. However, ILP’s net profit declined from Rs4.7 billion reported in 1HFY22 to Rs4.5 billion in 1HFY23.

ILP’s gross profit and net profit ratios declined from 26.55% and 12% to 25.84% and 8.66%, respectively, in the two comparable periods. ILP’s earnings per share value dropped by 3% from Rs5.05 in 1HFY22 to Rs4.91 in 1HFY23.

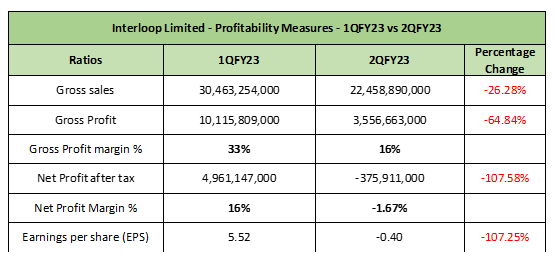

Interloop Limited – Quarterly Review – 1HFY23

A quarterly analysis reveals that ILP’s profitability in the first quarter (July-Sept) of FY23 remained high, whereas the company sustained net loss in the second quarter (Oct-Dec) of this fiscal.In the first quarter of FY23, ILP posted gross and net profits of Rs10 billion and Rs4.9 billion on the sales of Rs30 billion. Thus, the gross profit and net profit ratios came out to be 33% and 16%, respectively. ILP posted an EPS value of Rs5.52 in the first quarter of FY23.

ILP posted 26% less sales value of Rs22 billion in the second quarter compared to 1QFY23. The gross profit and net loss declared by ILP were Rs3.5 billion and Rs375 million in 2QFY23. The company’s loss per share was Rs0.40 in 2QFY23.

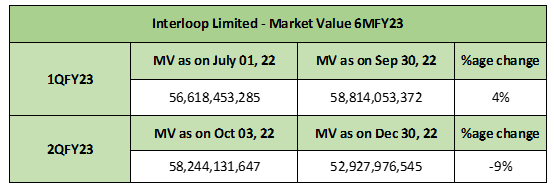

Interloop Limited – Market Value Review – 1HFY23

In the first six months of FY23, ILP lost 7% of its market value on PSX. The company gained market value in 1QFY23, whereas in the 2QFY23, it lost market value. In the first quarter of FY23, ILP gained 4% of market value, pushing its cap to Rs58 billion from Rs56 billion.

However, the second quarter of FY23 saw IPL lose 9% of its market value, pushing it down to Rs52 billion.

Credit: Independent News Pakistan-WealthPk