INP-WealthPk

Qudsia Bano

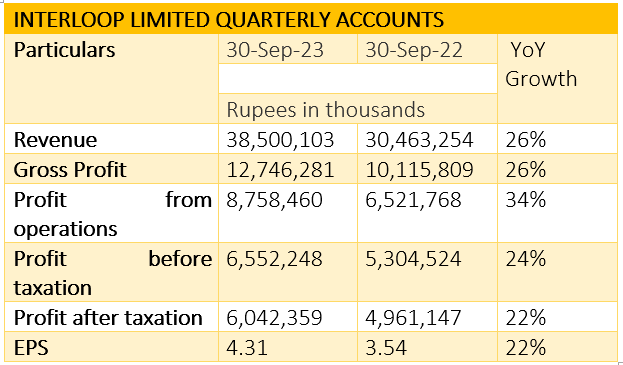

Interloop Limited reported a robust financial performance for the quarter ending on September 30, 2023. The textile giant showcased a substantial 26% year-on-year (YoY) growth in revenue, reaching an impressive Rs38.5 billion, compared to Rs30.46 billion in the same quarter of the previous year. This notable revenue surge indicates Interloop's effective market positioning and demand for its products. The gross profit of Interloop also mirrored this growth, standing at Rs12.75 billion, reflecting a significant 26% YoY increase from Rs10.12 billion in 3QCY22. This increase in gross profit underscores the company's efficiency in managing production costs, ensuring a healthy bottom line amid challenging market conditions. Profit from operations witnessed a commendable growth of 34%, reaching Rs8.76 billion in 3QCY23 from Rs6.52 billion in the same period last year.

This indicates Interloop's adeptness in optimising its operational processes and maximising profitability, contributing to the overall positive trajectory of the company. Interloop Limited reported a profit-before-taxation of Rs6.55 billion, showcasing a 24% YoY growth from Rs5.30 billion in the corresponding quarter of 2022. After taxation, Interloop recorded a profit of Rs6.04 billion, marking a 22% YoY increase from Rs4.96 billion in 3QCY22. Earnings per share (EPS) for the quarter stood at Rs4.31, indicating a 22% YoY growth from Rs3.54 in the same period last year. This metric is crucial for investors as it reflects the company's ability to generate value for its shareholders.

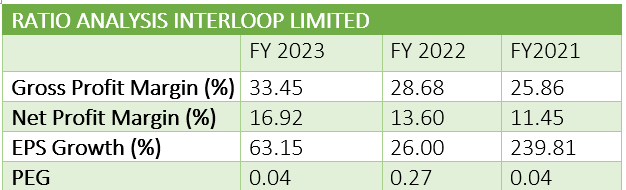

Interloop Limited has showcased a consistent improvement in its gross profit margin, reaching 33.45% in FY23, up from 28.68% in FY22 and 25.86% in FY21. This steady upward trend reflects the company's effective cost management and pricing strategies, contributing to a healthier bottom line. The net profit margin for Interloop also experienced positive growth, rising to 16.92% in FY23 compared to 13.60% in FY22 and 11.45% in FY21. The upward trajectory in net profit margin is a positive signal for investors, demonstrating Interloop's success in managing expenses and maximising profits. Interloop Limited reported a significant growth in earnings per share (EPS), with a notable 63.15% increase in FY23.

This follows a 26% growth in FY22 and an outstanding 239.81% surge in FY21. The consistent rise in EPS highlights the company's capacity to generate value for its shareholders, reflecting a strong financial performance. The price/earnings to growth (PEG) ratio for Interloop Limited was notably low at 0.04 in FY23. This suggests that the stock may be undervalued relative to its earnings growth. A PEG ratio below 1.0 is generally considered favourable, indicating that investors may pay less for future earnings growth.

About the company

Interloop Limited was incorporated in Pakistan on 25th April 1992 and publicly listed on the Pakistan Stock Exchange on 5th April 2019. Interloop is a vertically integrated multi-category full-family clothing company, manufacturing hosiery, denim, knitted apparel, and seamless activewear, for top international brands and retailers, besides producing yarns for a range of textile customers. Interloop's commitment to environmental, social responsibility and governance (ESG) is deeply rooted in its mission and has gained it global recognition as a pioneer in responsible manufacturing. Interloop's diverse and engaged workforce and operational excellence have established it as a partner of choice for its customers.

Credit: INP-WealthPk