INP-WealthPk

Ayesha Mudassar

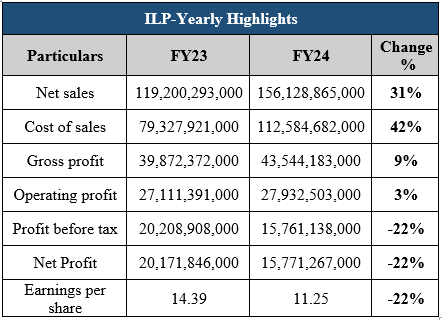

The Interloop Limited (ILP), one of Pakistan’s leading textile exporters, recorded a net profit of Rs 15.7 billion for the fiscal year 2024, marking a 22% decrease compared to the last year’s, according to WealthPK.

This decline in profitability was primarily attributed to higher sales costs, foreign exchange loss, and increased working capital requirements.

The company’s sales grew 31% to Rs 156.1 billion in FY24 from Rs 119.2 billion in FY23. This rise in sales highlights the effectiveness of the management’s strategic initiatives, including timely investments and capitalizing on opportunities in both export and domestic markets. The cost of sales increased by 42%, primarily due to rising material costs, higher energy expenses, and an upward adjustment in minimum wages.

Pattern of Shareholding

As of June 30, 2024, Interloop Limited had 1.4 billion shares distributed among 7,268 shareholders. The company’s directors held a majority stake of 71.9 %, followed by the local general public who possessed 18.9% of the company's ownership. Approximately 2.9% of the shares were owned by modarabas & mutual funds while foreign companies held a 2.2% stake. Banks, Development Financial Institutions (DFIs), and Non-Banking Financial Institutions (NBFIs) accounted for 1.5% of ILP's shares. The remaining ownership was held by other categories of shareholders including insurance companies and the foreign general public.

Performance over the four years (2020-23)

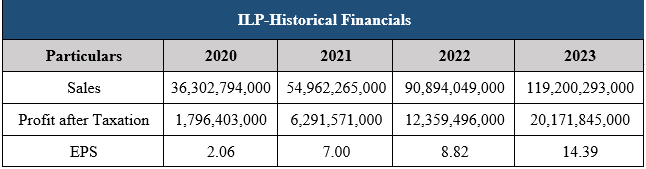

Historical Financials

ILP’s sales and net profit have shown significant growth over the years. In fiscal year 2023, the company delivered exceptional results, achieving a record-high sales revenue of Rs 119.2 billion, up from Rs 90.8 billion in FY22. Additionally, ILP reported a profit-after-tax of Rs 20.1 billion for FY23, a 63% increase from Rs 12.3 billion the previous year. This substantial improvement in profitability was largely driven by cost-saving measures and enhanced pricing strategies, leading to earnings per share (EPS) of Rs 14.39 in FY23, compared to Rs 8.82 in FY22.

An analysis of the company's EPS indicates a consistent upward trend, with 2023 marking the highest EPS of Rs 14.39.

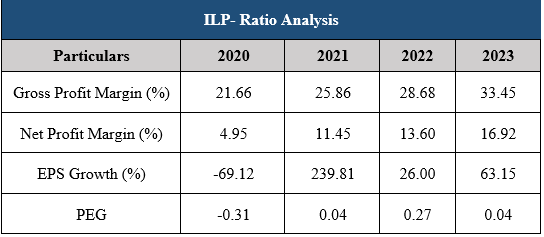

Historical Ratios

Interloop Limited's historical ratios offer valuable insights into the company's financial performance and growth trajectory. The company has consistently improved its gross profit margin, which reached 33.45% in FY23, up from 28.68% in FY22, 25.86% in FY21, and 21.66% in FY20. This steady increase reflects effective cost management and pricing strategies, strengthening the bottom line. Similarly, Interloop’s net profit margin has shown positive growth, rising to 16.92% in FY23 from 13.60% in FY22, 11.45% in FY21, and 4.95% in FY20. This upward trend in net profit margin signals effective expense management and profit maximization, offering encouraging prospects for investors.

Interloop Limited reported a notable 63.15% growth in the EPS for FY23, following a 26% increase in FY22 and an exceptional 239.81% surge in FY21. This sustained EPS growth demonstrates the company's ability to create value for shareholders, underscoring its strong financial performance. In the years analyzed, the company’s price/earnings to growth (PEG) ratio was remarkably low at 0.04 in FY23. The PEG ratio, which assesses the relationship between a company's price/ earnings (P/E) ratio and its earnings growth rate, suggests that a value below 1 may indicate the stock is undervalued relative to its growth potential.

About the Company

Established in 1992, Interloop was listed on Pakistan's stock exchange in 2019. The company is a vertically integrated, multi-category manufacturer of hosiery, denim, knitted apparel, and activewear. It also produces yarn for textile customers.

Textile Sector

The textile sector in Pakistan has exhibited a weak performance during the fiscal year 2024, primarily due to reduced demand in key markets such as the USA and Europe. Additionally, the industry is grappling with several challenges, including elevated raw material costs, expensive energy, high bank financing rates, and delays in sales tax refunds. These factors have collectively eroded profitability and adversely affected sectoral performance.

Credit: INP-WealthPk