INP-WealthPk

Jawad Ahmed

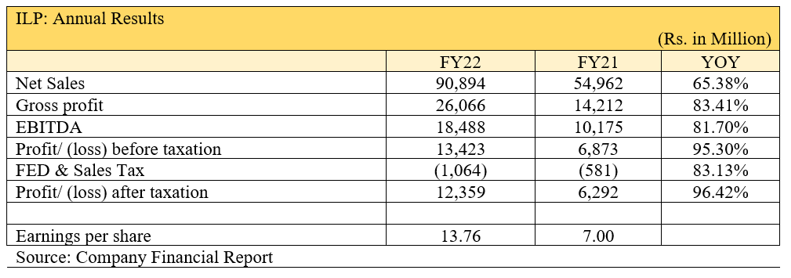

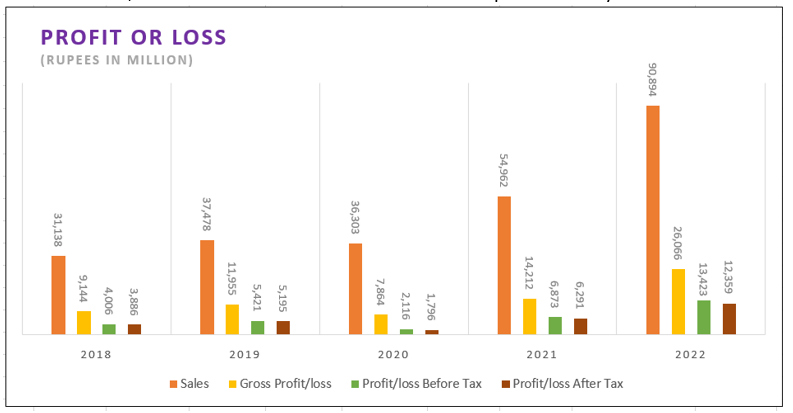

Interloop Limited’s net sales increased 65.38% to Rs90.9 billion in the financial year that ended on June 30, 2022 compared with Rs55 billion in fiscal 2020-21.

During the year, the company delivered exceptional results by achieving the highest-ever sale revenues, volumes and profitability, reports WealthPK quoting the company’s financial stats.

Interloop Limited was incorporated in Pakistan on 25th April, 1992, and publicly listed on the Pakistan Stock Exchange on 5th April, 2019.

The company is a vertically integrated multi-category full family clothing company, manufacturing hosiery, denim, knitted apparel and seamless active wear, for top international brands and retailers, besides producing yarns for a range of textile customers.

The company also achieved the highest-ever gross profit of Rs26 billion during the FY22, up 83.4% from the previous year’s Rs14 billion.

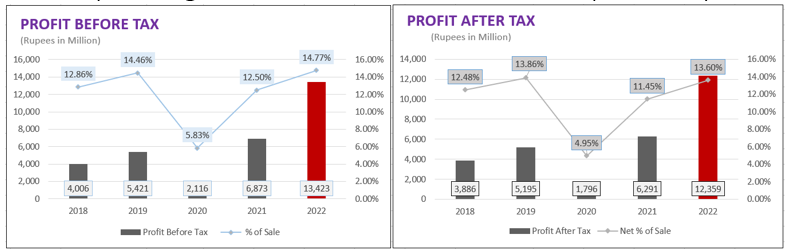

The profit-before-tax for the year was Rs13.5 billion compared to Rs6.8 billion during FY21.

The company’s net profitability rose 96.4% from Rs6.3 billion in FY21 to Rs12.4 billion in FY22 as a result of significant topline growth. This increase caused the earnings per share (EPS) to soar to Rs13.76 from Rs7 the previous year.

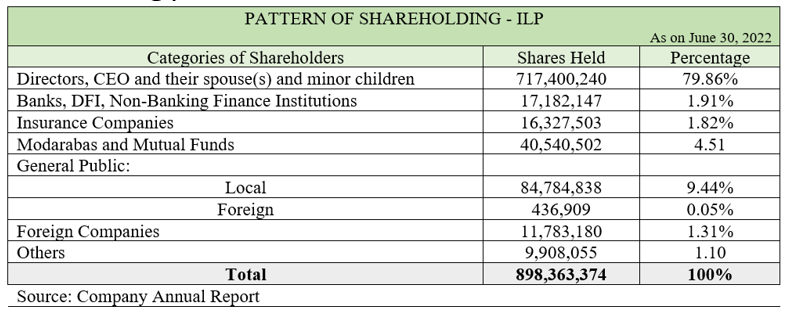

Shareholding pattern

As of June 30, 2022, the company’s directors, the CEO, their spouses and minor children owned 79.86% of the shares. Banks, DFIs and NBFIs held 1.91% of the shares, insurance companies 1.82%, and modarabas and mutual funds 4.51%. Local investors owned 9.44% of the shares and foreign companies possessed roughly 1.31%. Others represented 1.1% of the total shares.

Company’s performance over the years

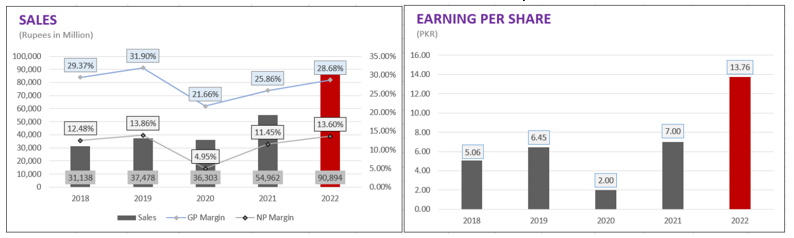

In 2019, the company’s sales revenue increased to Rs37.5 billion from Rs31 billion in 2018. The company’s gross profit surged to Rs11.9 billion from Rs9.1 billion in the previous year, registering a 30.74% increase year-over-year. The profit-after-tax for the year jumped to Rs5.2 billion, 31.7% higher than the previous year’s Rs3.9 billion. Resultantly, the EPS increased to Rs6.45 in 2019 from Rs5.06 a year before.

In 2020, the Covid-19 pandemic and difficult economic climate caused the company’s sales to decline 3.12% to Rs36.3 billion from Rs37.5 billion the year before. As a result, the business’s gross profit decreased from Rs11.9 billion the previous year to Rs7.9 billion this year.

During the year, the company reported a net profit of Rs1.8 billion after tax deductions against Rs5.2 billion in 2019. The EPS for the year edged down to Rs2 from Rs6.45 the previous year.

In 2021, due to increase in demand for products, the company’s topline increased to Rs55 billion from Rs36.3 billion in 2020.

The gross profit almost doubled to Rs14.3 billion from Rs7.9 billion in the previous year, principally because of rising demand and the economy’s rebound after the Covid-19-induced restrictions were lifted.

The net profit took a massive leap to Rs6.3 billion from Rs1.8 billion the previous year. As a result, the EPS rose to Rs7 from the previous year’s Rs2.

A worldwide recessionary outlook and domestic structural reforms have created uncertainty in Pakistan's business environment. The recent floods caused by climate change have made things even worse.

The government abolished large energy-related subsidies and implemented a super tax in order to meet income targets under the IMF programme, which significantly raised the cost of doing business in the country.

Furthermore, the recent fluctuations in the exchange rate and the tight monetary policy are likely to weaken the company's fundamentals.

According to the company's financial statement, despite all these difficulties, the company is still dedicated to serving its clients and other significant stakeholders. The business will keep providing sustainable and top-notch products.

Credit : Independent News Pakistan-WealthPk