INP-WealthPk

Muhammad Saleem

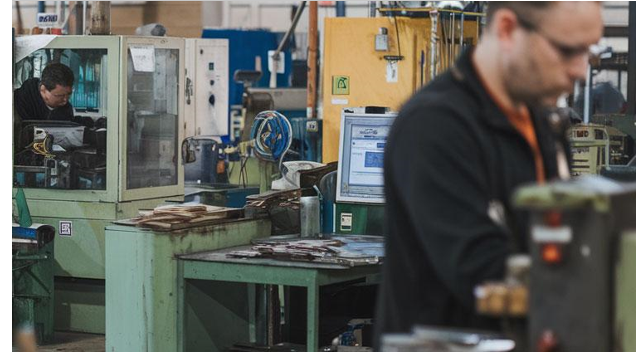

Lowering interest rates is essential for encouraging investment in the industrial sector, boosting exports, creating jobs, and ensuring sustained economic growth. Zeeshan Khan, a university lecturer, emphasized that entrepreneurs are desperately seeking relief from high utility costs, as electricity and gas are the backbone of the textile sector. "The sector is underperforming due to the soaring cost of energy," he said. Speaking to WealthPK, Khan stressed that a substantial cut in the policy rate is crucial to reducing borrowing costs, which would, in turn, drive industrial expansion and job creation. He warned that the International Monetary Fund’s bailout programme could further exacerbate the situation. “Our youth are looking for opportunities abroad, while local industrialists and investors face growing uncertainty,” he remarked. He added that a sharp reduction in interest rates would give businesses the much-needed boost to thrive.

Khan noted that businesses are more inclined to scale up operations when borrowing costs are lower. He underscored the importance of investing in modern operational methods to meet market demands, which can only be achieved through affordable bank credit. Boosting investment in the industrial sector, he said, would increase productivity, create employment for the youth, and secure long-term economic growth. Sheikh Saeed, an industrialist, also shared concerns over rising energy costs, which he said were squeezing their ability to cover essential expenses, including labour. He noted that many industrialists were being forced to lay off workers due to the challenging economic environment. Saeed emphasized that affordable bank credit is crucial for the growth of industries and businesses. "Small and medium-sized enterprises, which contribute significantly to the national economy, need easier access to financing at lower interest rates," he said.

He urged for a substantial reduction in the policy rate to stimulate investment and economic expansion. Farhan Raza, a textile exporter, pointed out that industrialists and exporters are facing a severe financial crunch as billions in government refunds remain pending. He called on authorities to expedite the release of these funds. "The high cost of energy and lack of liquidity are creating immense challenges for us. Millers are struggling to keep their operations running," Raza said, adding that economic conditions are nearing a breaking point. He stressed that government intervention, especially in providing affordable energy, is critical to reviving the industry.Raza concluded that lower interest rates would reduce production costs, making Pakistani products more competitive globally. "We need job creation, export growth, and foreign exchange to stabilize our economy," he urged.

Credit: INP-WealthPk