INP-WealthPk

Ayesha Mudassar

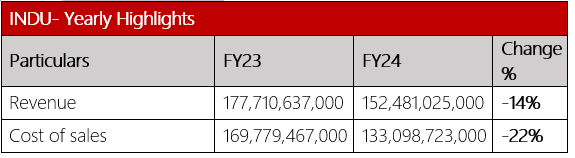

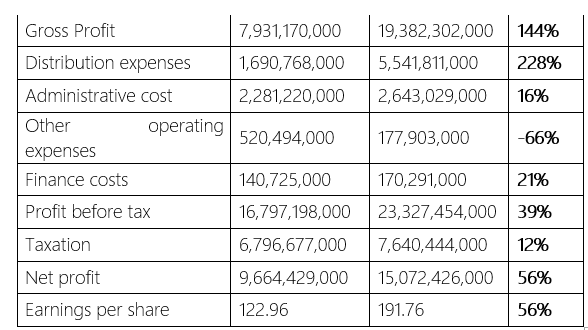

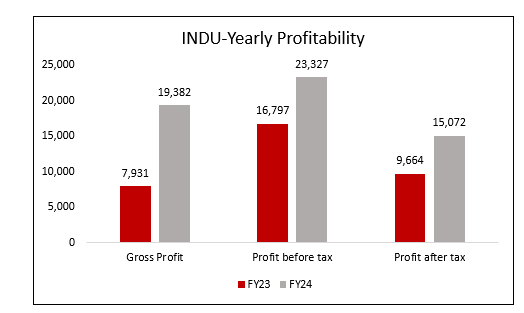

Indus Motor Company Limited (INDU) reported a significant

financial growth in the fiscal year 2024, with the gross profit increasing by 144%, profit-before-tax by 39% and net profit by 56% compared to the previous fiscal, reports WealthPK. The company earned a gross profit of Rs 19.3 billion, profit-before-tax of Rs 23.3 billion, and a net profit of Rs15.07 billion in FY24. Additionally, the company posted the earnings per share of Rs191.76 during the year under review. The factors contributing to the enhanced profitability include increased localization, currency stability, cost control measures, and improved sales mix.

Furthermore, INDU’s topline shrank by 14% to reach Rs152.4 billion compared to Rs177.7 billion in FY23. This decline was primarily attributed to a surge in the import of used cars. On the expense front, the distribution expenses skyrocketed by 228% due to a paramount hike in warranty claims, elevated development expenditures, increased salary expenses, and a higher advertising and promotion budget associated with the launch of Corolla Cross. The administrative expenses rose by 16% in 2024, driven by higher payroll costs resulting from inflationary pressures. The financial costs rose 21% from Rs140.7 million to Rs170.2 million. Implementing stringent fiscal discipline is essential to manage these rising finance costs and enhance operational efficiency. On the tax front, the company paid Rs7.6 billion, up from Rs6.7 billion in FY23. During the year, the company contributed Rs68.5 billion to the national exchequer, representing approximately 0.8% of the total tax revenue collected by the Government of Pakistan. Since its incorporation in 1989, the company's cumulative contribution has exceeded Rs780 billion.

Pattern of Shareholding

As of June 30, 2024, INDU had a total of 78.6 million shares outstanding held by 4,109 shareholders. Foreign investors/companies hold 77.5% of the shares followed by associated companies, undertakings, and related parties holding 6.2% shares. Insurance companies account for 5.6% of the company's shares, while the general public holds 5.4%. Around 2.2% of the company’s shares are held by banks, development financial institutions, and non-banking financial institutions. The remaining shares are held by other categories of shareholders, each possessing less than 1%.

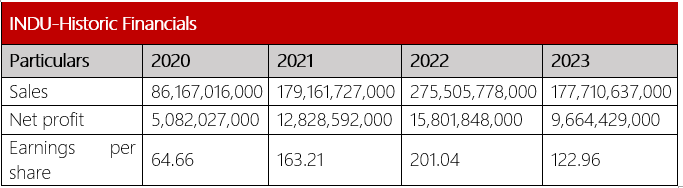

Historical Operational Performance (2020-23)

The company observed a significant financial growth until 2022, followed by a decline in both sales and profitability in 2023. In 2021, the company achieved an impressive 108% year-on-year (YoY) sales growth, driven by the introduction of facelift models for the Corolla, Hilux, and Fortuner, as well as the wider acceptability of Toyota Yaris. This led to a 152% YoY increase in net profit, which reached Rs12.8 billion with an EPS of Rs163.21. In 2022, INDU posted a topline growth of 54% on account of higher sales volume of both Semi-knocked Down (SKD) kits and Completely Knocked Down (CKD) units. Furthermore, the company experienced a 23% rise in net profit, which stood at Rs15.8 billion with an EPS of Rs201.04.

After two consecutive years of sales growth, INDU recorded a 35% decline in 2023. This was due to higher duties and taxes, import restrictions, inflationary pressures, and shrunken purchasing power of the consumers. As a result, the net profit weakened by 39% to Rs 9.6 billion with an EPS of Rs122.96.

About the company

Indus Motor Company Limited was incorporated in Pakistan as a public limited company in December 1989 and started commercial production in May 1993. Registered on the Pakistan Stock Exchange (PSX) with the symbol 'INDU', the company is the largest entity in the automobile assembler sector with a market capitalization of 138.4 billion. The company's primary activities include assembling, progressive manufacturing, and marketing Toyota vehicles in Pakistan.

Credit: INP-WealthPk