INP-WealthPk

Fakiha Tariq

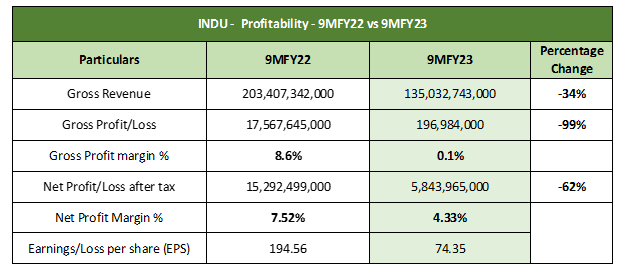

Indus Motor Company Limited’s (INDU) revenue, gross and net profits massively decreased by 34%, 99% and 62%, respectively, in the first nine months (July-March) of the ongoing fiscal 2022-23 as compared to the corresponding period of the previous year, reports WealthPK, quoting the automaker’s financial results. In 9MFY23, INDU made gross sales of Rs135 billion, gross profit of Rs196 million and gross profit ratio of 0.1% only. The company posted net profit of Rs5.8 billion and net profit ratio of 4.33%. INDU posted earnings per share of Rs74.35 in 9MFY23.

In comparison to the same period of FY22, the revenue of the leading automobile assembler in Pakistan dropped by 34% from Rs203 billion to Rs135 billion in 9MFY23. Likewise, the gross profit of Rs17 billion in 9MFY22 plunged 99% in 9MFY23. INDU’s net profit of Rs15 billion declared in 9MFY22 also crashed to Rs5.8 billion in 9MFY23. Registered on Pakistan Stock Exchange (PSX) with the symbol ‘INDU’, the company is the largest entity in the automobile assembler sector with a market capitalisation of Rs73.9 billion.

INDU – Quarterly Review – 9MFY23

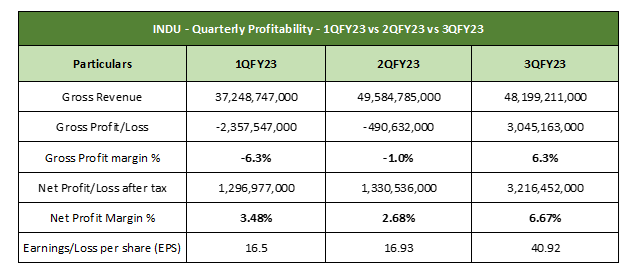

Review of the quarter-based profitability reveals that INDU remained in profits only in the recently-ended third quarter (January-March) of FY23. However, the company bore losses in the first quarter (July-September) and second quarter (October-December), consecutively. In the first quarter, INDU posted gross revenues of Rs37 billion and a gross loss of Rs2.3 billion. The company posted net loss of Rs1.2 billion. Therefore, the gross and net loss ratios came out to be 6.3% and 3.48%, respectively. In 1QFY23, the company reported the earnings per share of Rs16.5.

In the second quarter, the auto firm posted gross revenue of Rs49 billion – the highest during the ongoing fiscal. The firm also suffered gross loss of Rs490 million in this quarter. The company posted net profit of Rs1.33 billion. Therefore, the gross loss and net profit ratios were reported to be 1.0% and 2.68%, respectively. During this quarter, the company reported the earnings per share of Rs16.93. In the most recent quarter of FY23, the company posted gross revenues of Rs48 billion and gross profit of Rs3 billion. The company posted net profit of Rs3.2 billion. Therefore, the gross and net profit margins were calculated as 6.3% and 6.67%, respectively. In 3QFY23, the company posted the earnings per share of Rs40.92.

Credit: Independent News Pakistan-WealthPk