INP-WealthPk

Muneeb ur Rehman

Skewness in the taxation system toward indirect taxes is the leading reason, among a host of underlying factors, for the increasing poverty rate in Pakistan, Qaiser Bengali, a member of the Board of Directors of Benazir Income Support Program (BISP), told WealthPK. As reported by the 'Pakistan Development Update' by the World Bank, poverty rate is projected to reach 37.2% in the current fiscal year, based on the World Bank standard of $2.15 per day. The rural poverty has been recorded at 30.7%, while the urban poverty stands at 12.5%.

He said indirect taxes like the Goods and Services Tax (GST), as well as charges for gas, electricity, and other consumption-related levies, constitute a higher percentage of income for individuals with lower incomes when compared to those with higher earnings. Consequently, individuals with lower incomes shoulder a disproportionately greater share of their earnings through these taxes.

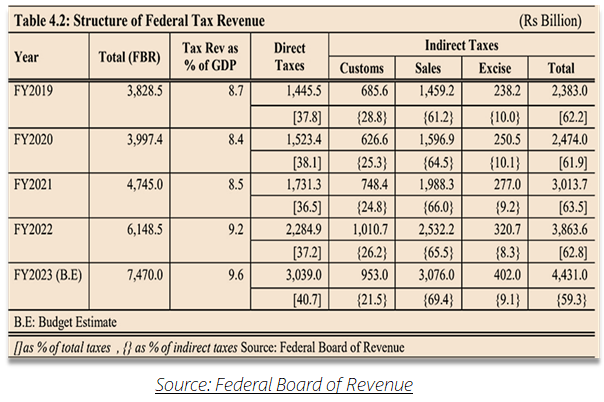

Consumption-oriented indirect taxes have a more prominent impact on individuals, as their entire income is dedicated to essential needs. Consequently, people living in poverty lack the financial cushion to absorb the consequences of rising prices, thereby experiencing increased financial strain, he asserted. The Ministry of Finance reports that direct taxes constitute 37.2% of the overall tax collection by the Federal Board of Revenue (FBR), while indirect taxes maintain a contribution of 62.8%.

Among the total FBR collection, sales tax emerged as the primary source of revenue, accounting for 41.2%, followed by the customs duty at 16.4% and Federal Excise Duty (FED) at 5.2%. Qaiser Bengali criticized the government’s regular practice of increasing indirect taxes in order to reach the fiscal targets.

“The recent hike in electricity taxes has caused the cost of living to rise, as electricity is crucial for lighting, cooking, and heating. This increase in utility costs through indirect tax has a substantial burden on families with limited income, pushing them further into poverty,” he said. He suggested the Federal Board of Revenue (FBR) integrate the untaxed sectors with the tax framework, instead of further burdening the already economically disadvantaged segments with indirect taxation.

Credit: INP-WealthPk