INP-WealthPk

Muneeb ur Rehman

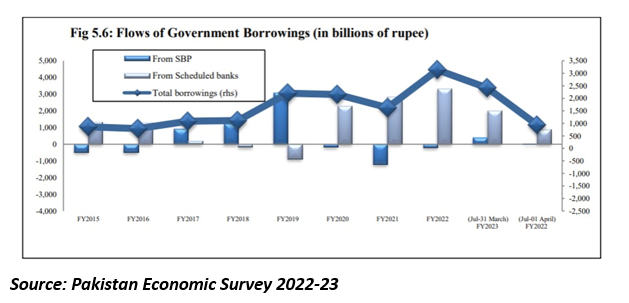

Increasing government borrowing from the money market to address the budget deficit has led to contraction in private sector growth. Dr Sajid Amin Javed, Deputy Executive Director at the Sustainable Development Policy Institute (SDPI), said while talking to WealthPK that the government’s inability to manage the gap between revenue and expenditure has a negative impact on the private sector since it leads to crowding out of private investment. According to Pakistan Economic Survey 2022-23, from July to March FY 2022-23, the government borrowing for budgetary support surged to Rs2.414 trillion, a significant increase compared to Rs938.5 billion during the corresponding period of FY 2021-22.

He added that as the government borrows more, it competes with the private sector for credit resources. This leads to a shortage of credit for private businesses, making it difficult for them to access the funds necessary for growth, innovation, and job creation. The enhanced borrowing, he said, eventually sets the ground for the forthcoming governments to rely on the increased taxes. To finance its borrowing, the government resorts to higher taxes or additional debts, which can burden businesses. Higher corporate taxes reduce profits and hamper the ability of businesses to reinvest in and expand their operations. This, in turn, can hinder private sector growth. Pakistan Bureau of Statistics (PBS) reports that domestic sources financed the budget deficit with Rs3.761 trillion, a notable rise from Rs1.584 trillion during FY23. Dr Sajid said building business confidence has always been a challenge for the successive governments of the country.

“Excessive government borrowing can create economic uncertainty and reduce business confidence. High levels of public debt raise concerns about the government's ability to repay its obligations, increasing risk perceptions among investors and businesses. This dampens private sector investment and hinders overall economic growth,” he said. Dr Sajid mentioned that a key challenge faced by the country is the mismanagement of resources by successive governments. “To address this issue, Pakistan should prioritise the creation of ample opportunities for private businesses to access financial resources by ensuring the availability of credit,” he said. If the government focuses on generating revenue rather than relying heavily on borrowing, it can lead to more favorable economic outcomes, particularly in terms of increasing credit availability for the private sector.

Credit: INP-WealthPk