INP-WealthPk

Muhammad Asad Tahir Bhawana

The IMF’s Stand-By Arrangement (SBA) has brought a momentary respite to Pakistan from an imminent default. However, the enduring stability of the country's economy depends upon the long-term implementation of prudent policies and decisive measures, Dr Muhammad Jaleel, Memorial Chairperson at the State Bank of Pakistan, told WealthPK. “Pakistan faces significant financing requirements, with approximately $25 billion needed to meet the external debt obligations this fiscal year. Consequently, the country must seek additional funds, making it necessary to negotiate a longer-term funding agreement with the IMF in future.

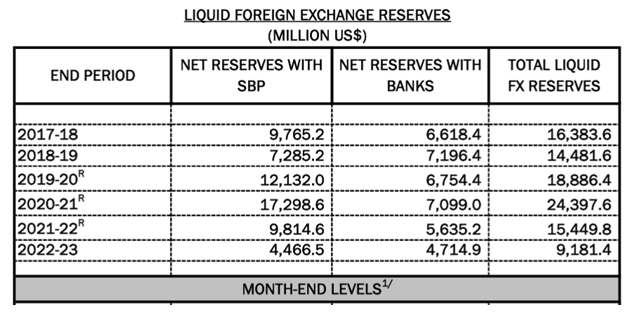

“While an IMF program is a crucial step, it alone cannot guarantee complete economic recovery. Pakistan must implement comprehensive and domestically-driven structural reforms to break free from the cycle of deficits, slow growth, low savings, excessive borrowing, rising indebtedness, and soaring inflation,” he said. Dr Jaleel disclosed concerning details about the country's limited foreign currency reserves. With a total of $9 billion reserves (Including net reserves with the SBP and banks), Pakistan can barely cover eight weeks of imports.

Notably, even after the successful deal, the IMF has predicted a mere 0.5 percent growth rate for the current year – a drastic decline from 6.5 percent achieved in 2022. Dr. Jaleel asserted that provision of a $3 billion short-term loan by the IMF would not significantly impact Pakistan's economy unless the underlying structural issues within the country's economic framework were adequately addressed.

The IMF has emphasized the critical importance of steadfast policy implementation for Pakistan to overcome its ongoing challenges. This includes efforts to improve economic conditions, enhance fiscal discipline, establish a market-determined or free-floating exchange rate, and implement reforms, particularly in the energy sector, to promote climate resilience. Despite the relief brought by the IMF deal after a year of uncertainty and political and economic instability, Dr. Jaleel warned that full and sincere implementation of the new deal was of utmost importance.

“Doing so will enable the government to negotiate a better long-term plan after the elections, considering the estimated cost of $77 billion for debt repayment and investment,” he said. In conclusion, while the IMF loan has provided crucial support, Pakistan must remain committed to robust policy implementation and undertake necessary reforms to navigate its economic challenges successful

Credit: INP-WealthPk