INP-WealthPk

Hifsa Raja

Globally, the interest rates and inflation were rising but now the cycle is gradually reversing to normal, making it an ideal time for investors to invest, said Muhammad Imran, Manager Gulrez Securities (Pvt) Limited, in an interview with WealthPK. The market's outlook is shifting globally, which is encouraging. This suggests that foreign investors are relocating more money to stocks, he continued.

WealthPK: How can we persuade foreign investors to invest additional money when the market is currently low?

Muhammad Imran: Owing to Covid-19, commodity prices greatly increased when more money was printed globally. Thus, inflation increased. All commercial banks raised their interest rates uniformly. Europe and America had the highest rates of interest and inflation in the post-Covid time. The interest rates and inflation reached their peaks, but now the interest rate cycle is going in reverse. Due to the cycle's reversal, this is the ideal time for foreign investors to make investments.

WealthPK: Does the local market experience any effects of inflation and interest rate reverse cycle?

Muhammad Imran: Yes, our local market is a part of this cycle on a worldwide scale. Political unrest is another element affecting local investors as well as global factors as a whole.

WealthPK: What tips would you provide to a foreign investor?

Muhammad Imran: Holding their investments is prudent. The protracted period of stress is going to come to an end. The contraction period of the market is about to come to an end, so foreign investors should buy stocks. Therefore, they ought to invest more money in stocks.

WealthPK: What is the most crucial factor an investor should consider when making a decision?

Muhammad Imran: Whether an investor chooses to invest for the long run or the short term relies on his investment plan. Investors may benefit twice by purchasing stocks with high dividend yields and potential for capital gains.

WealthPK: How to stabilize the local market?

Muhammad Imran: The market's view is shifting globally, which is a good indication. Local market stability may be achieved through early elections or a political party deal.

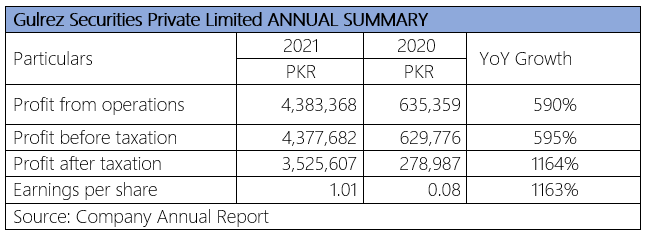

Performance of Gulrez Securities (Pvt) Limited:

Annual Performance:

During the Fiscal Year 2020-21, the company generated a profit from operations of Rs4.38 million. The company also generated a profit of Rs635,359 in the previous Fiscal Year 2019-20. In FY21, the company’s profit before tax was Rs4.3 million. In FY20, the profit was Rs629,776, showing an increase of 595%. The profit after tax was Rs3.5 million in FY21 against Rs278,987 in FY20.

Profile of company:

According to Muhammad Imran, Gulrez Securities (Pvt) Limited provides reliable sales and purchases of stocks in Lahore, Pakistan. It has been operating since 1998 under the name of Gulrez Rashid (member LSE) and was later incorporated as a private limited company in 2007. “We are committed to providing our customers with the best brokerage services through smart investments in equity shares in order to achieve the best possible returns,’’ he added.

Credit : Independent News Pakistan-WealthPk