INP-WealthPk

Shams ul Nisa

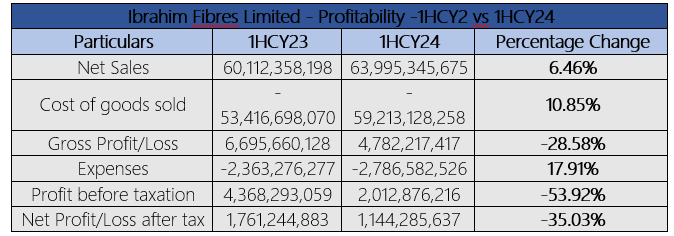

Ibrahim Fibres Limited’s net sales increased 6.46% to Rs63.99 billion in

1HCY24, reports WealthPK.

During the period, the company's plant produced 132,481 tons of polyester staple fiber (PSF), up from 134,470 tons in the previous year. Furthermore, the

textile plants consumed 17,654 tons of PSF for blended yarn production, compared to 16,447 tons in the previous year. Additionally, the textile plants produced 29,068 tons of blended yarns. However, the cost of goods sold increased by 10.85%, indicating that the production costs are growing faster than revenue. As a result, the gross profit fell by 28.58% to Rs4.78 billion. The company's expenses rose by 17.91%, further impacting the overall profitability. The profit before tax dropped sharply by 53.92%, and net profit decreased by 35.03%, causing the net profit margin to fall from 2.93% to 1.79% in the first half of CY24. The earnings per share also declined, from Rs5.67 in 1HCY23 to Rs3.69 in 1HCY24, reflecting lower returns for shareholders.

Profitability Ratios

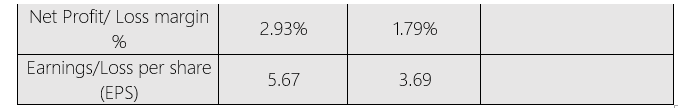

Ibrahim Fibres' gross profit ratio decreased from 4.1% in 2020 to 7.5% in 2023, indicating difficulties in sustaining healthy sales margins. This decline could be due to the rising production costs or increased pricing competition. The net profit to sales ratio followed a concerning pattern, starting with a negative -1.8% in 2020, and then improving to 3.2% in 2023. The company reached a peak net margin of 8.6% in 2022, but it fell to 3.2% the following year. Despite improvement, the low net profit margin shows that the company is still struggling to turn the sales into significant profits.

The return on capital employed has experienced considerable fluctuations, starting at 1.6% in 2020, reaching a high of 20.1% in 2021, and then dropping to 9% in 2023. This volatility indicates that the company is not utilizing its capital efficiently. Similarly, the return on equity has been unstable, shifting from -3.4% in 2020 to a positive 14.8% in 2021, before decreasing to 0.6% in 2023. This trend underscores the company's challenges in consistently providing returns to the shareholders. The earnings per share followed a similar trajectory, with a loss of 4.2 per share in 2020 and a peak of 21.2 in 2021.

Synthetic & Rayon Sector

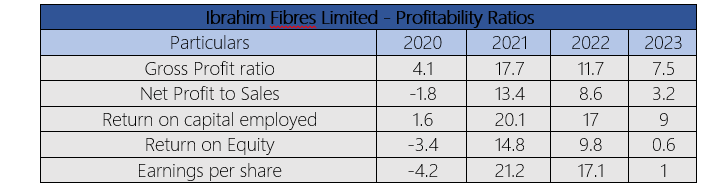

The sector's total revenue declined 0.96% from Rs59.05 billion in March-June 2023 to Rs58.48 billion in the same period in 2024, reflecting difficulties in sustaining sales amid competitive pressures and potentially unfavorable market conditions.

Image Pakistan Limited led the sector with 47.33% increase in revenue, 48.52% rise in gross profit, and 38.20% increase in net profit. However, Pakistan Synthetics Limited experienced 4.34% revenue decline, with gross profit down by 19.55% and net profit plunging by 56.40%. Ibrahim Fibres Limited reported a slight dip in revenue but saw a significant improvement from a net loss of 125.4 million to a net profit of 781.8 million. However, Rupali Polyester Limited struggled significantly, with revenue decreasing by 9.04%, gross profit dropping by 88.05%, and net losses escalating sharply to 822.5 million during the review period.

Future Outlook

Despite signs of macroeconomic stability, the domestic economy continues to face challenges like inflation, high energy costs, unsustainable fiscal pressures, and the need for significant foreign exchange to meet obligations. The government incentives for importers are leading to a decline in PSF quality. The crude oil market has been highly volatile due to the economic uncertainties and regional conflicts. The domestic economic activity is likely to remain constrained, and the local textile industry may be impacted by the reduced capacity utilization and shrinking margins. The company’s management is focusing on increasing the market share through strategic marketing efforts and careful financial management.

Company Profile

Ibrahim Fibres Limited was incorporated in Pakistan as a public limited company. The principal business of the company is to manufacture and sell polyester staple fibre and yarn.

Credit: INP-WealthPk