INP-WealthPk

Qudsia Bano

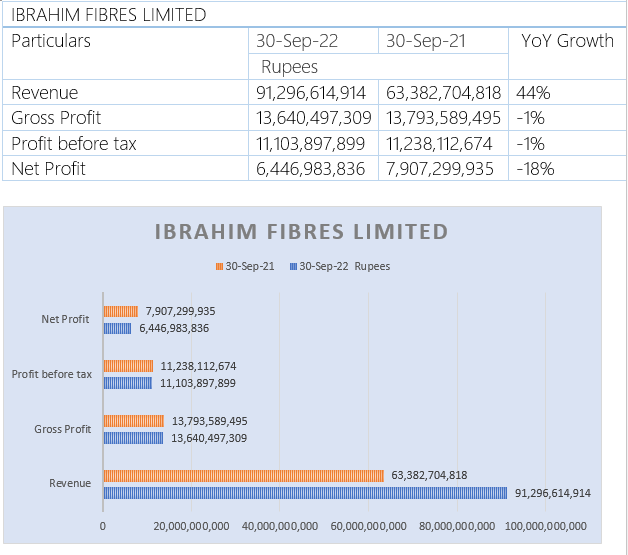

Ibrahim Fibers Limited’s net sales for the nine months of CY22 were Rs91,297 million compared to Rs63,383 million for the same period the year before, reports WealthPK. For the nine months, the company's gross profit was Rs13,640 million as opposed to Rs13,794 million for the same period the year before.

The profit before tax for the nine months under review was Rs11,104 million, down from Rs11,238 million for the same period the year before. For the nine months under examination, the profit after tax came to Rs6,447 million, down from Rs7,907 million for the same time the year before, posting a decrease of 18%.

Reports show that the global commodity prices have been in a great deal of turmoil as a result of contractionary economic policies implemented by all significant economic policymakers to counteract demand-driven inflationary pressures – the OPEC+, intervention in the market for crude oil, and the evolving geopolitical situation in Europe. This has increased the likelihood of a worldwide economic recession and, as a result dimmed the economic picture, particularly for the emerging countries.

In addition to all of these problems, the domestic economy is also dealing with enormous difficulties brought on by a lack of liquidity, a foreign exchange crisis, environmental catastrophes, and political unrest. After considering all these variables, a significant slowdown in domestic economic activity is anticipated, which will cause a sluggish turnover and narrow margins in the near future.

Industry comparison:

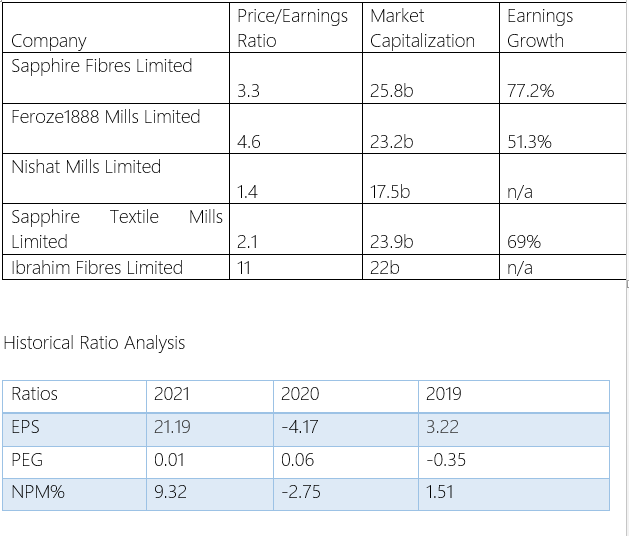

Ibrahim Fibres Limited competitors are Sapphire Fibers Limited, Feroze1888 Mills Limited, Nishat Mills Limited, and Sapphire Textile Mills Limited. Ibrahim Fibres Limited’s PE ratio is 11 along with a market capitalization of Rs22 billion. In comparison to its rivals, Ibrahim Fibres Limited appears to be overvalued. For investors wishing to short a position, overvalued equities are attractive. To achieve this, the shares must be sold in order to profit from impending price drops.

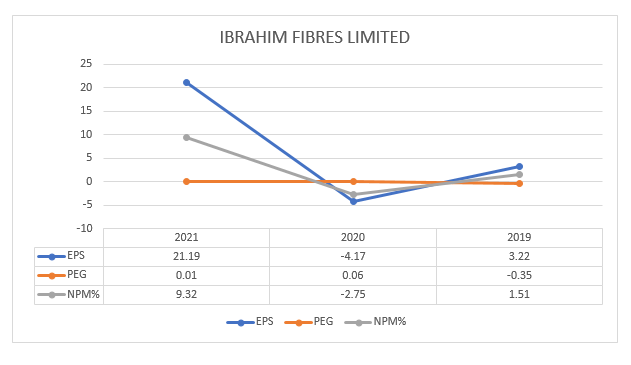

The earnings per share of the company demonstrated a mix of trends during the recent years. During CY19, the EPS was Rs3.22 which decreased to Rs-4.17 in CY20 and then jumped to Rs21.19 in CY21. The Price Earning Growth (PEG) remained under 1 during the recent years, but it decreased to -0.35 in CY19. However, it improved to 0.01 in CY21.

The net profit margin also showed a steady growth in recent years. During FY19, the NPM was 1.51%, which decreased to -2.75% in CY20. However, the NPM again increased in CY21 and stood at 9.32%.

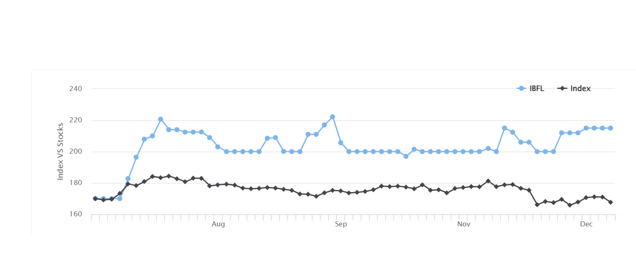

KSE Index Vs IBFL Stock

The performance of IBFL's stock is streamlined to that of the market average except for December when the IBFL stock was performing better than the overall market average and reached Rs215, a higher price than the index.

About the company

Ibrahim Fibers Limited was incorporated in Pakistan as a public limited company and its principal business is to manufacture and sell polyester staple fiber and yarn.

Credit : Independent News Pakistan-WealthPk