INP-WealthPk

Azeem A Khan

IT exports is increasingly becoming one of the leading foreign exchange earning segments of Pakistan’s economy. IT exports rose to $2.1 billion during the fiscal year 2021-22 from $0.89 billion during FY19 and $0.29 billion during FY13, according to the State Bank of Pakistan (SBP). Likewise, the size of funding and the number of deals in technology startups have risen from around $37.5 million and 29 deals in 2019 to $347.4 million and 70 deals, respectively, during 2022, led largely by international investors, the SBP said in its report “Pakistan’s Growing IT Exports and Tech Startups: Opportunities and Challenges.”

However, this growth stems from a negligible base. While software usage in domestic economy is uncommon, implying a low level of basic form of digitalisation, the country’s IT exports are dominated by small-sized software exporters, most of whom export less than $0.1 million a year. Moreover, IT exports are not diversified, where the share of the US alone is more than a half. The domestic tech startups, on the other hand, are concentrated in fintech and e-commerce, which cumulatively accounted for 71% of total funding of all publicly reported deals between 2015-22.

As indicated by funding and deal count, startup activity is not widespread across various sectors of the economy, such as education, health and other sectors where digital transformation can have large positive externalities. In Pakistan, the recent growth in IT exports and startups appears as emerging signs of digitalisation. Driven by both enabling policies of the government and the central bank, the availability of low-cost human capital, and the onset of the Covid-19 pandemic, IT exports and tech startups have witnessed sharp growth in recent years.

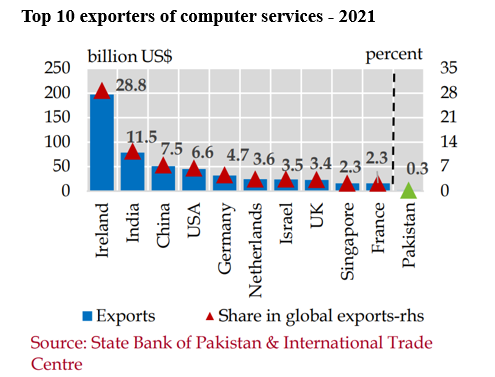

During the Covid-19 pandemic, which led to increased demand for digital services, the growth in Pakistan’s IT service exports averaged 24% between FY20-FY22, whereas startup funding between CY21-CY22 reached around $709 million compared to approximately $100.8 million during CY19-CY20, the SBP report said. Nevertheless, both IT exports and domestic tech startups have substantially large room to grow. Even after such fast-paced growth during recent years, Pakistan’s share in global exports of computer services is only 0.3%. Similarly, the startup space still lags far behind regional and global players.

Human capital constraints have also begun to emerge in the form of demand-supply gaps, skill-mismatch and inadequate quality of technical and soft skills. On the other end, low levels of basic literacy and weaker levels of digital literacy among population impairs absorptive capacity of technology. Similarly, despite recent gains, digital connectivity remains a challenge both in terms of access and usage as the cost of mobile phone devices and internet is higher in Pakistan compared to both advanced and peer economies, and thus a constraint to potential digital transformation.

The country needs to improve significantly on e-government indicators to fast track digitalisation of the economy which can increase the size of domestic market for software firms and startups, as well as digital transformation ought to be made a top priority agenda alongside streamlining the sectoral policies and regulations. Discussing trends in Pakistan’s IT exports and technology startups, the SBP said, they have gained prominence in recent years. The former, led by software and software-related services, grew at a compound annual growth rate of 24.4% between FY17 and FY22, whereas the latter rose significantly during the same period, both in terms of deal count and funding.

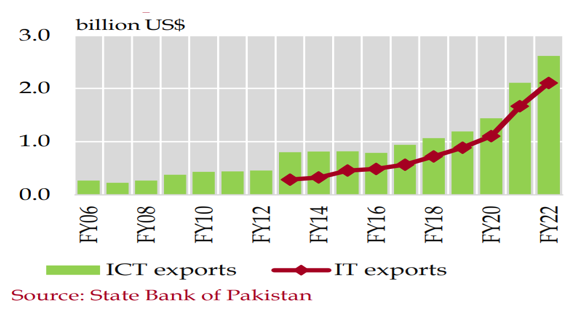

The report noted that software and software-related services are leading the way in terms of export classification. IT is part of the larger information and communications technology (ICT) sector in Pakistan, which stood at only $269 million during FY06. It took more than 10 years before the country’s ICT exports were able to cross the $1 billion mark during FY18.

Growth trajectory of ICT and IT services exports

However, the pace of growth accelerated sharply since then, with ICT exports crossing $2 billion by FY21 and $2.5 billion by FY22. The share of ICT exports in total services exports increased from 7.2% during FY06 to 37.7% during FY22, which makes it the largest contributor to service exports. The growth in exports of Pakistan’s ICT sector is mainly led by IT exports, which contributed 80.5% (or $2.1 billion) to Pakistan’s ICT services exports during FY22, with the rest of the inflows coming from telecommunication services category (including call centres), and a negligible share of information services.

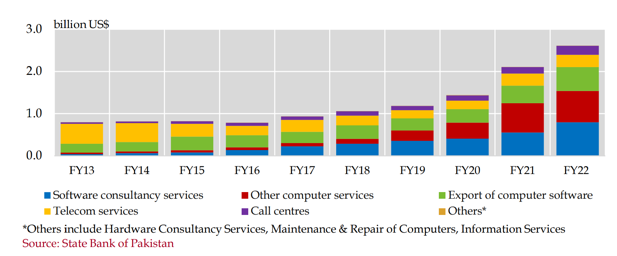

IT exports, as classified under the category computer services, consist of five sub-sectors: (a) export of computer software; (b) software consultancy services; (c) other computer services; (d) hardware consultancy services; and (e) maintenance and repair of computers. Of these, software and software-related exports, i.e., exports of computer software and software consultancy services - have the largest share in Pakistan’s IT exports, rising to 52% during FY22 from 32% during FY13, as a result of an increase from $255 million to $1.4 billion during this period.

Breakdown of ICT exports

Pakistan mostly exports software and software-related exports since the country’s hardware industry is not as developed as software industry. From the perspective of global trade, while Pakistan’s share in global exports of computer services remained small, it has increased from 0.17% in 2017 to 0.3% in 2021, as shown below:

Talking about export diversification, the report said, total IT exports are concentrated in a few markets where the share of the USA has averaged more than 55% between FY13-FY22. Moreover, Pakistan’s exports to its top five destinations have increased slightly as shown below:

According to the SBP, the recent growth in Pakistan's IT exports and startups deals may be seen as emerging signs of digitalisation. However, domestic market size of IT and software is insufficient to help the industry scale up; the firms in the sector are very small; and their exports lack market diversification. For continued growth in these areas and to be amongst early adopters of digital transformation, it is essential that individuals, federal, provincial and local governments, and businesses across sectors embrace the latest technologies, it said.

Credit: Independent News Pakistan-WealthPk