INP-WealthPk

Shams ul Nisa

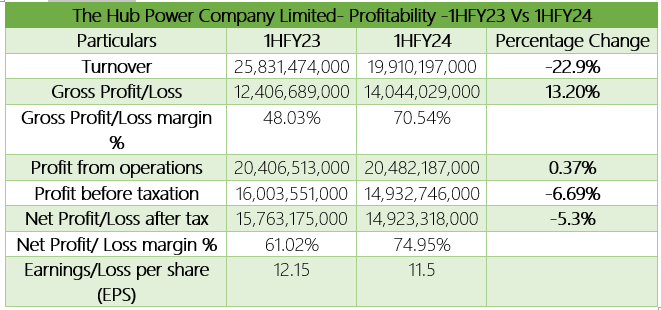

The Hub Power Company Limited (Hubco) released its first-half financial results for the Fiscal Year 2024, posting an unconsolidated turnover of Rs19.9 billion, 22.9% lower than Rs25.83 billion in the 1HFY23. However, the gross profit climbed to Rs14.04 billion during the period from Rs12.4 billion in 1HFY23, up by 13.20%. Thus, the gross margin improved from 48.03% in 1HFY23 to 70.54% in 1HFY24. Similarly, profit from operations expanded marginally by 0.37% to Rs20.48 billion in 1HFY24, reports WealthPK.

During 1HFY24, the company observed a decline of 6.69% in profit before tax to stand at Rs14.9 billion. At the end of 1HFY24, net profit stood at Rs14.92 billion, 5.3% lower than Rs15.76 billion in 1HFY23. According to the director's report, the main factor of decreased profit is high finance expenses because of the surge in interest rates. Thus, earnings per share decreased to Rs11.5 in 1HFY24 from Rs12.15 in 1HFY23.

Quarterly Analysis

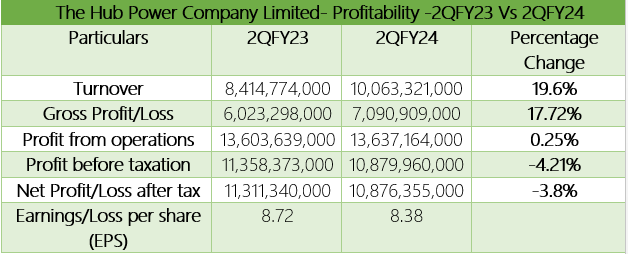

The quarterly analysis of the company reflects a similar pattern, with an increase in turnover of 19.6%, and a decline in net profit by 3.8%.

The company registered a gross profit of Rs7.09 billion in 2QFY24, 17.72% higher than Rs6.023 billion in 2QFY23. At the end of 2QFY24, operating profit grew by 0.25% to Rs13.63 billion. However, profit before tax fell to Rs10.89 billion in 2QFY24 from Rs11.35 billion in 2QFY23, representing a 4.21% decline. At the end of the quarter, the Earnings Per Share slipped to Rs8.38 from Rs8.72 in 2QFY23.

Profitability Ratios analysis

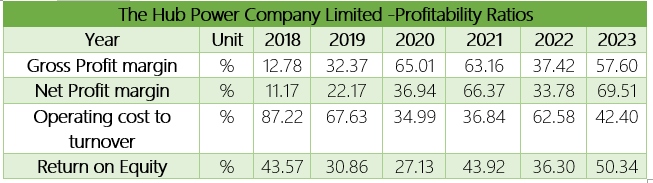

The gross profit margin increased over time, rising from 12.78% in 2018 to 57.60% in 2023, demonstrating the company's increased ability to generate profitability per unit sales. The company recorded the highest gross margin of 65.01% in 2020. In 2023, the company recorded a net profit margin of 69.51%, the highest in the past six years. An operating cost-to-turnover ratio of a company is measured by the total operating costs divided by its net sales. Overall, it dropped from 87.22% in 2018 to 42.40% in 2023, suggesting that the company has improved its expense control.

The return on equity of a company measures net income to the equity held by its shareholders. From 43.56% in 2018 to 50.34% in 2023, the return on equity had an increasing trend, indicating a larger return on equity that the company invests.

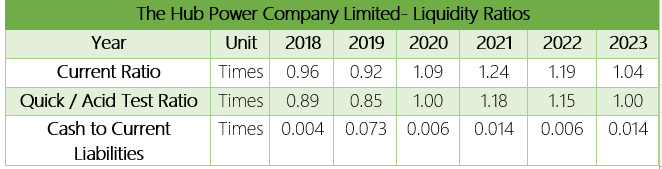

Liquidity Ratios analysis

The liquidity ratio provides detailed insights into a company’s financial position to settle its obligations. The company's capacity to settle its immediate debts is gauged by the current ratio. The company's risk of not being able to pay its obligations rises when the current ratio falls below 1.2. In 2018 and 2019, the company current ratio was less than 1. However, it became better in subsequent years and stayed above 1, demonstrating the company's increasing capacity to settle its short-term debt. In 2021, the company recorded the highest current ratio of 1.24 from 2018 to 2023.

The quick ratio showed a similar trend, staying over 1 from 2020 to 2023, but remained below 1, at 0.89 in 2018 and 0.85 in 2019. The company's cash to current liabilities indicates how well it can use its cash to pay down its current obligations. Though it has increased somewhat from 0.004 in 2018 to 0.014 in 2023, the Cash to Current Liabilities ratio remains relatively low year over year.

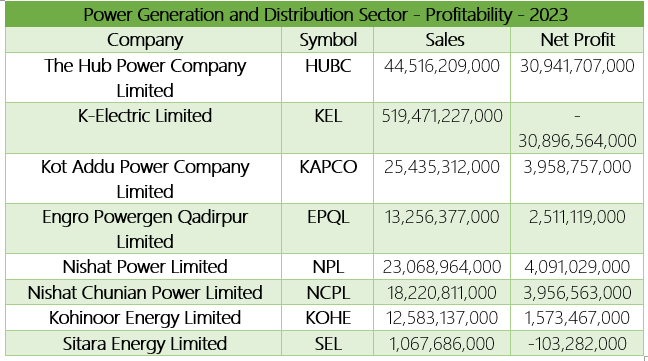

Power Generation and Distribution Sector Analysis

To analyze the power generation and distribution sector’s profitability for 2023, we have taken the gross sales and net profit of the companies. All the company's fiscal year ends in June each year, except Engro Powergen Qadirpur Limited, whose fiscal year ends in December.

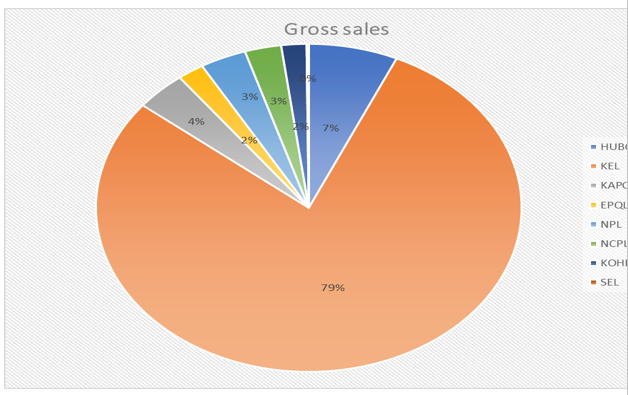

According to the sales for the year 2023, K-Electric Limited covers 79% of total sales among the given power generation and distribution companies followed by 7% of total sales by the Hub Power Company Limited. For 2023, Sitara Energy Limited posts the lowest sales among the other companies, with a sale of a total 1.067 billion.

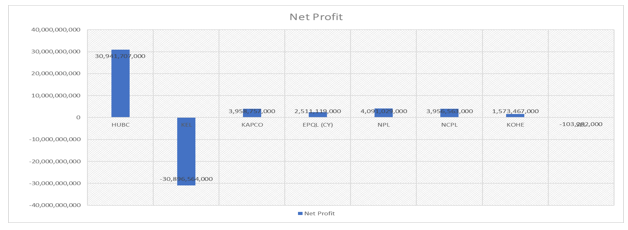

In terms of net profit, Hub Power Company Limited leads the power generation and distribution sector with a net profit of 30.9 billion in 2023 followed by Nishat Power Limited with a net profit of 4.09 billion. Whereas, KEL bore a net loss of 30.89 billion during the period under review.

Company’s profile

The Hub Power Company Limited was founded as a public company in 1991. The company's core activity is development, ownership, management, and upkeep of power plants. The company owns an oil-fired power station of 1,200MW (net) in Balochistan (Hub plant).

Credit: INP-WealthPk