INP-WealthPk

Shams ul Nisa

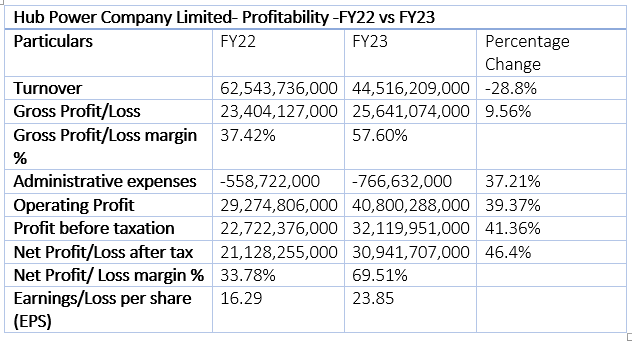

Hub Power Company Limited’s turnover decreased by 28.8% to Rs44.5 billion in the financial year 2022-23 from Rs62.5 billion in FY22. The company attributed this reduction to the lowest net electrical output on account of the lower load demanded by the Central Power Purchasing Agency.

According to the annual report for FY23, the company posted a gross profit of Rs25.6 billion in FY23, which was 9.56% higher than Rs23.4 billion in FY22. As a result, the gross profit margin increased to 57.60% in FY23 from 37.42% in FY22. Administrative expenses saw a surge of 37.21%. However, the operating profit rose to Rs40.8 billion in FY23, up 39.37% from Rs29.27 billion in FY22. The profit-before-tax grew by 41.3% and the net profit by 46.4% year-on-year in FY23. This caused the earnings per share to increase to Rs23.85 in FY23 from Rs16.29 in FY22. The company attributed this rise to the higher dividend income from its subsidiaries and associates.

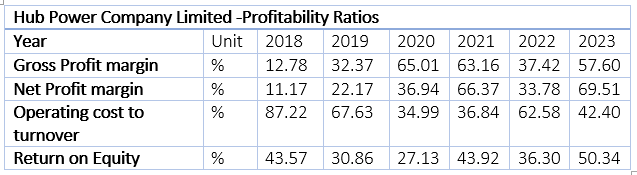

Profitability ratios analysis

The gross profit margin improved significantly over the years from 12.78% in 2018 to 57.60% in 2023, indicating that the company successfully generated more profit on each unit of sale. Similarly, the net profit margin followed the same pattern and reached 69.51% in 2023. The company’s operating cost as a percentage of turnover decreased from 87.22% in 2018 to 42.40% in 2023, indicating improved cost management. Return on equity, which measures a company's net income divided by its shareholders' equity, showed an upward trend moving from 43.56% in 2018 to 50.34% in 2023, reflecting higher return on equity that is invested by the company.

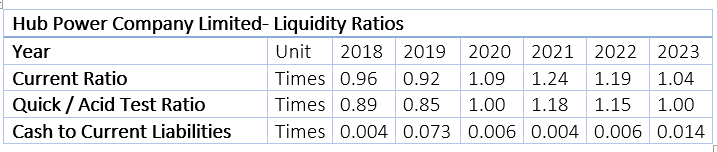

Liquidity ratios analysis

If the current ratio, which measures the company’s ability to pay off its short-term obligations, lies below 1.2, the company’s risk of covering obligations increases. Hub Power Company’s current ratio remained below 1 in 2018 and 2019. But improved in later years and remained above 1, showcasing its ability to pay off its short-term obligations. The company observed the highest current ratio of 1.24 in 2021. A similar pattern was followed by the quick ratio, indicating the stability of the company to cover its obligations as it remained at or above 1 from 2020 to 2023. Cash to current liabilities measures the company’s ability to cover its current liabilities using its cash. The company’s cash to current liabilities was comparably low over the years, but slightly improved from 0.004 in 2018 to 0.014 in 2023.

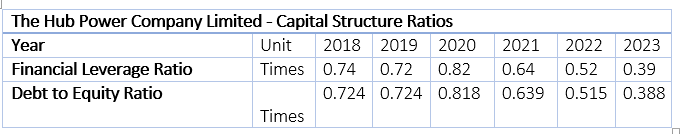

Capital structure ratios analysis

The financial leverage ratio measures the amount of debt a company owns to finance its assets. A ratio less than 1 is considered good as it reflects that the company borrows less to finance its assets. Hub Power Company’s financial leverage ratio remained below 1 over the years, reflecting less dependency on debt to finance assets. The company’s debt equity ratio remained below 1 over the years from 2018 to 2023, indicating lower financial risk.

Company’s profile

Hub Power Company was established in 1991 as a public limited company. Its core activities are to develop, own, operate and maintain power stations. Its Hub plant in Balochistan is one of the most efficient residual fuel oil-fired thermal power plants in Pakistan.

Credit: INP-WealthPk