INP-WealthPk

Shams ul Nisa

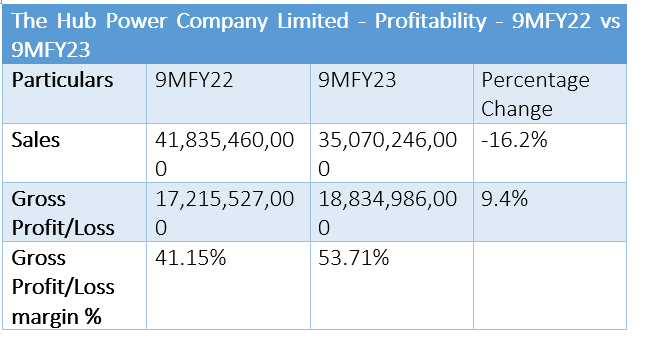

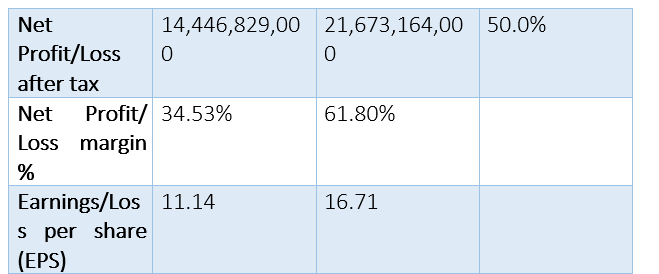

The Hub Power Company Limited (HUBCO) witnessed a 50% surge in net profit in the first nine months of the previous fiscal year 2022-23 compared to the corresponding period of FY22. The company posted a net profit of Rs21.6 billion in 9MFY23 compared to Rs14.4 billion over the same period in FY22. Likewise, HUBCO’s gross profit spiked by 9.4% to Rs18.8 billion in 9MFY23 from Rs17.2 billion in 9MFY22. However, the company’s revenue plunged by 16.2% to Rs35 billion in 9MFY23 from Rs41.8 billion in 9MFY22, WealthPK reports.

The company’s gross profit margin in relation to total sales increased from 41.15% in 9MFY22 to 53.71% in 9MFY23. The net profit ratio also showed a rise in 9MFY23 by 61.80% as compared to 34.53% over the corresponding period of FY22. The increase in profit came from the divided income from Narowal Energy Limited. HUBCO’s earnings per share (EPS) stood at Rs16.71 in 9MFY23 as compared to Rs11.14 in 9MFY22.

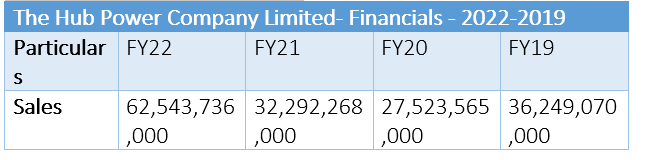

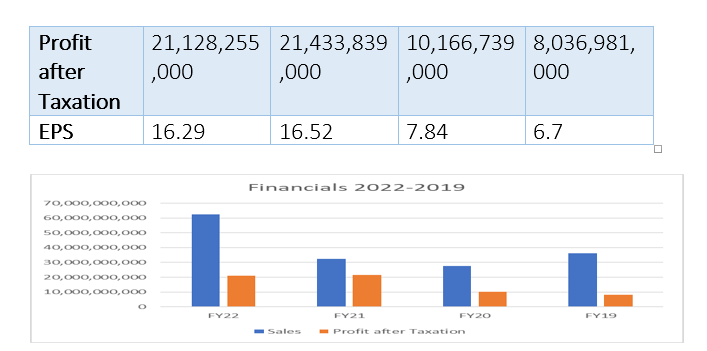

Analysis of last four years' financials

The company had the highest sales in FY22 at Rs62 billion and the lowest in FY20 at Rs27 billion.

Similarly, the highest profit-after-tax was also recorded at Rs21.4 billion in FY21, followed by Rs21.1 billion in FY22 and the lowest at Rs8 billion in FY19. The highest EPS was recorded at Rs16.52 in FY1 and the lowest at Rs6.7 in FY19.

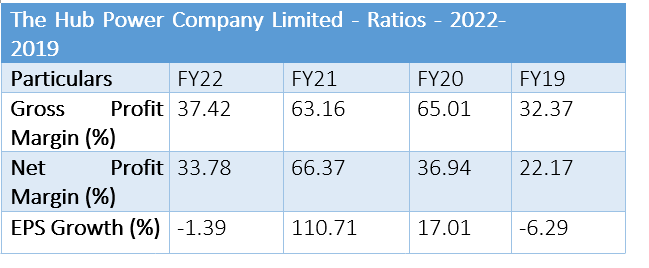

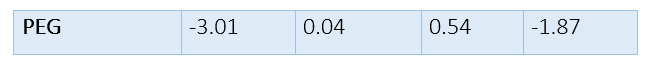

Analysis of last four years' ratios

The highest gross profit margin was recorded at 65.01% in FY20 and the lowest at 32.37% in FY19. Similarly, the highest net profit margin was recorded at 66.37% in FY21 and the lowest at 22.17% in FY19.

The highest EPS growth was observed in FY21 at 110.71%, and the lowest at -6.29% in FY19. The price/earnings to growth ratio (PEG) was negative (-3.01) in FY22 and -1.87 in FY19, while it was positive (0.04) and (0.54) in FY21 and FY20.

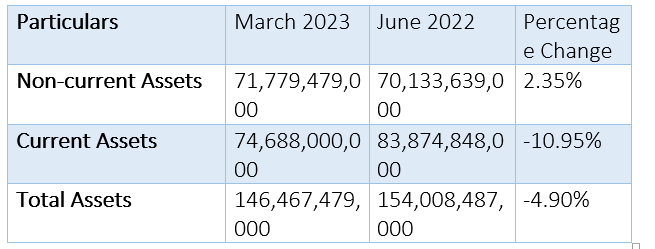

Assets analysis

The company faced a downfall in total assets in March 2023 as compared to June 2022. The non-current assets showed a slight increase of 2.35%, from Rs70.1 billion in June 2022 to Rs71.7 billion in March 2023.

In contrast. the current assets dwindled to Rs74.6 billion in March 2023 from Rs83.8 billion in June 2022, constituting a decrease of 10.95%. Hence the total assets were recorded at Rs146.4 billion in March 2023, which were Rs154 billion in June 2022. That marked a 4.90% decline in total assets in March 2023 as compared to June 2022.

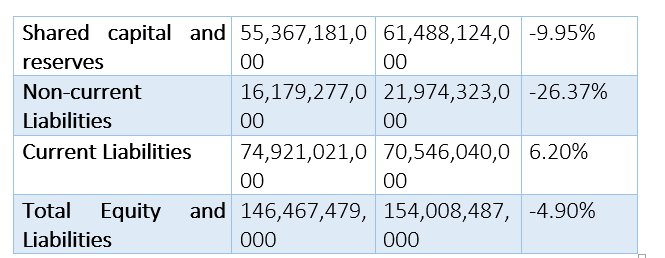

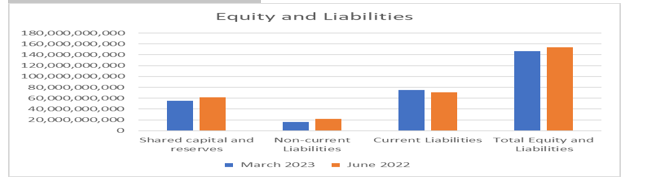

The company’s total equity and liabilities faced a downfall of 4.90% in March 2023 as compared to June 2022. Current liabilities showed a positive change of 6.20%, while non-current liabilities and shared capital and reserves exhibited a negative growth of 26.37% and 9.95%, respectively, in March 2023 as compared to June 2022.

The current liabilities were recorded at Rs74.9 billion in March 2023 compared to Rs70.5 billion in June 2022. Non-current liabilities fell to Rs16.1 billion from Rs21.9 billion in June 2022. Similarly, shared capital and reserves stood at Rs55.3 billion in March 2023 against Rs61.4 billion in June 2022.

Company profile

HUBCO was founded on August 1, 1991, as a public limited company. The objective of the company is to develop, own, operate and maintain power stations. It has capacity of generating 3,581MW power. The company operates multiple plants, such as the Hub plant in Balochistan, the Narowal plant in Punjab and Thar Energy Limited plants. HUBCO has two wholly owned subsidiaries, the Hub Power Services Limited (HPSL) and Hub Power Holdings Limited (HPHL). HPHL's objective is to invest in the future growth projects and explore other domestic and foreign business opportunities. HPSL, on the other hand, manages the existing power assets, including the indigenous coal-based growth projects.

Credit: INP-WealthPk