INP-WealthPk

Moaaz Manzoor

The Ministry of Finance’s outlook for November reveals a historic inflation drop driven by global factors, but also highlights the need for lasting policy reforms to ensure sustained stability in prices, reports WealthPK.

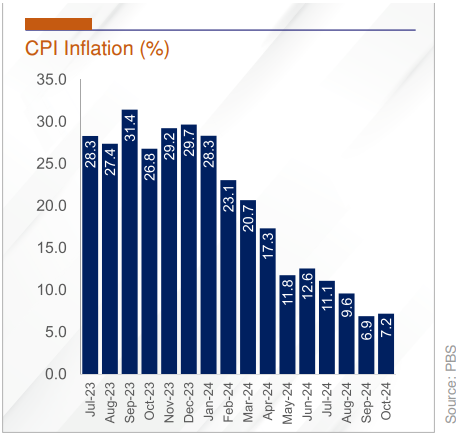

The outlook report highlights that key economic indicators for the first four months of FY25 maintained sustained recovery, marked by receding inflation, increased remittances and IT exports, and improved fiscal and external sector performance. Inflation during Jul-Oct FY25 stood at 8.7%, a stark improvement compared to 28.5% in the same period last year. Year-on-year (YoY) inflation was recorded at 7.2% in October 2024, a slight increase from 6.9% in September but significantly lower than the 26.8% recorded in October 2023.

Source: https://www.finance.gov.pk/economic/economic_update_November_2024.pdf

Similarly, inflation projections suggest further easing, with rates expected to fall within the range of 5.8%-6.8% in November and 5.6%-6.5% by December 2024. Likewise, globally, inflationary pressures also eased in October, providing additional scope for further interest rate cuts worldwide, adding to domestic economic optimism. Speaking to WealthPK, Dr Nasir Iqbal, Acting Dean and Head of the Macro Policy Lab at the Pakistan Institute of Development Economics (PIDE), stated, “Global oil prices have come down, which has helped ease inflationary pressures significantly. The stable exchange rate over the past year has also played a role.”

Acknowledging the positive trend in inflationary relief, Dr Iqbal , however, highlighted that prices remain high despite the slower pace of increase. "Inflation essentially measures the rate at which prices grow. If inflation is at 20%, it means prices are 20% higher than they were a month or year ago. We’re seeing a slowdown in the rate of price growth, not an actual drop in prices," he clarified. He further cautioned that the improved inflation figures do not reflect major government-led reforms addressing price mechanisms or stabilising supply-demand dynamics. “What we see in inflation reduction is largely a natural correction rather than policy-driven improvement.

The government’s current priorities are more investment-oriented and lack initiatives to curb inflation sustainably,” he explained. According to him, the absence of a stable price mechanism and inadequate government-driven demand-supply adjustments underscore the need for comprehensive economic reforms to achieve long-term price stability. The November report underscores a positive trajectory for the economy, with declining inflation boosting market confidence. However, the sustainability of this recovery depends heavily on structural reforms and effective policymaking.

While falling inflation marks a welcome respite from past economic turbulence, it cannot mask the lack of robust governance to regulate price mechanisms and stabilise markets. Long-term stability will require the government to complement investment-focused initiatives with measures that address persistent structural issues, including inflationary pressures and supply-demand mismatches. Without these adjustments, the economy risks reverting to cycles of growth and crisis, hindering efforts to achieve sustainable economic progress. The current inflation relief offers an opportunity to build a foundation for future stability, but it must be supported by decisive and well-planned policy interventions.

Credit: INP-WealthPk