INP-WealthPk

Arsalan Ali

The recent hike in interest rate by the State Bank of Pakistan (SBP) will heighten the borrowing cost that will in turn raise the cost of doing business resulting in closure of industries and rendering hundreds of thousands of workers jobless, reports WealthPK.

Ayaz Ahmed, former senior research economist at the Pakistan Institute of Development Economics, (PIDE), told WealthPK that interest rates play an imperative role in the economic development of a country and that increased interest rates adversely affect business and investment besides increasing the borrowing costs. He said the central bank has tightened the monetary policy in an attempt to control inflation but this initiative will increase inflation.

‘’When manufacturers take loans at high interest rates, the cost of doing business increases. The manufacturers pass the burden on to the consumers by increasing the prices of their finished products, which further increases inflation. Owing to the shortage of energy and political unrest in the country, the business community is suffering badly,’’ he added.

Ayaz said high interest rates affecte the purchase of new machinery, capital goods, and capital expenditures, while reductions in capital spending damage the economy, as factories and capital equipment increase the productivity of firms.

He opined that the interest rates should be in the single digit to increase the ease of doing business in the country because the current inflation is a supply side problem. Businesses and consumers are likely to purchase more when the financing costs are low that provide employment to thousands of workers.

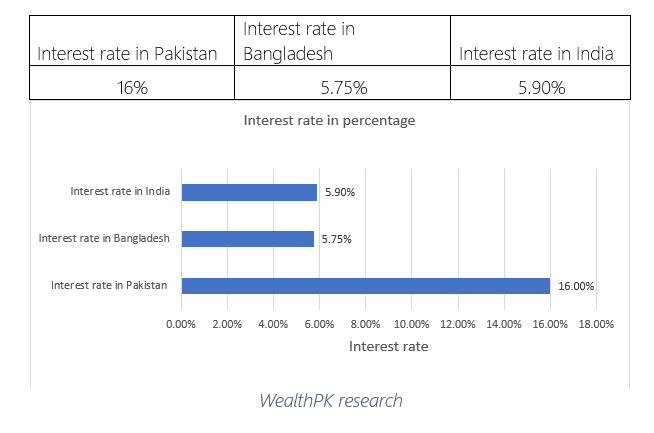

According to him, the interest rate in Pakistan is much higher than in the neighbouring countries. It is 5.75 percent in Bangladesh and 5.9 percent in India but in Pakistan it has reached 16 percent. In addition, he said the recent increase of 100 basis points had brought the policy rate to a 24-year high level, as it was only in 1998.

‘’The interest rate has a major impact on the performance of small and medium enterprises (SMEs). It plays a predominant role in employment creation and economic growth of the country,’’ he said.

Further, the SMEs are facing difficulties in getting loans from banks. The recent hike in interest rates has further increased the cost of doing business, and more financing restrictions may contribute towards impeding the implementation of growth opportunities.

President of Islamabad Chamber of Commerce and Industry (ICCI) Ahsan Zafar Bakhtawari said businesses are already struggling due to a number of challenges, including rising utility tariffs and energy shortages, as well as massive rupee-dollar fluctuations.

He said during these tough times, the government has made an unprecedented hike in the policy rate instead of taking measures to ease the ease of doing business. This would be very damaging to the business and economic activities.

Credit : Independent News Pakistan-WealthPk