INP-WealthPk

Hifsa Raja

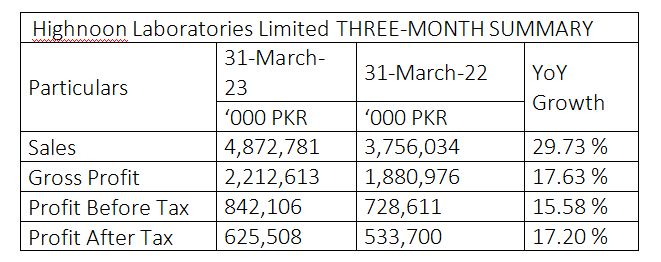

The sales of pharmaceutical firm Highnoon Laboratories Limited increased 29.73% to Rs4.8 billion in the first quarter of the ongoing calendar year 2023 (1QCY23) from Rs3.7 billion over the corresponding period of the previous year.

The gross profit during the three-month period of CY23 increased 17.63%to Rs2.2billion from Rs1.8billion over the corresponding period of CY22.

The profit-before-taxation increased by 15.58% in 1QCY23 to Rs842 million from Rs728million over the corresponding period of CY22.

The profit-after-tax also increased by 17.20% to Rs625 million in 1QCY23 from Rs533 million in 1QCY22.

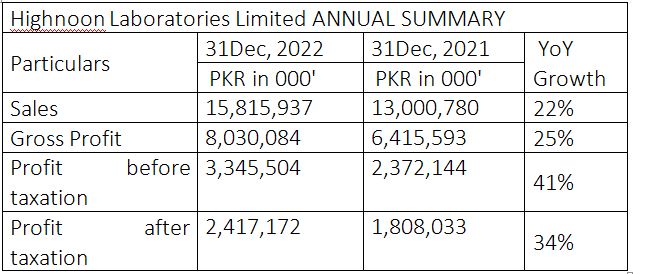

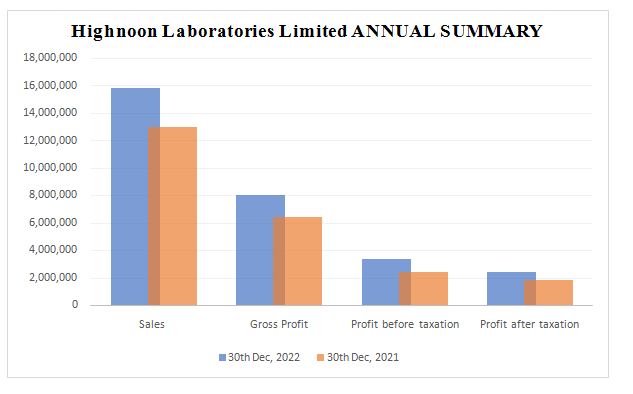

Highnoon Laboratories’sales increased 22% to Rs15billion in the calendar year 2022from Rs13billionin 2021.

The gross profit also increased 25% to Rs8 billion from Rs6.4 billion previously.

The profit-before-taxation increased 41% to Rs3.3billionin CY22 from Rs2.3billion in CY21.

The profit-after-taxation jumped 34% to Rs2.4billionin CY22 from Rs1.8 billionin CY21.

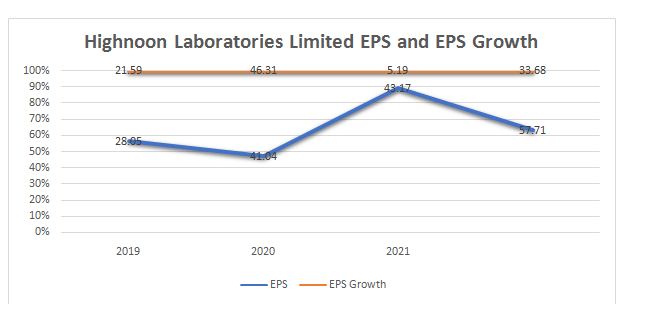

Earnings growth analysis

Over the last four years, the company's earnings have grown ata good pace, reflecting strong profitability. In 2019, the company's growth rate was relatively strong at 21.59%. The growth rate further jumped to 46.31%in 2020. However, EPS growth dwindled to a low of 5.19% in 2021. But the company achieved another strong profit growth rate of 33% in 2022.

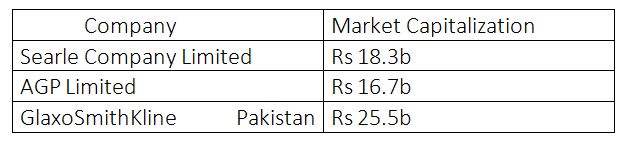

Industrycomparison

Searle Company Limited, AGP Limited,GlaxoSmithKline Pakistan Limited,and Abbott Laboratories (Pakistan) Limitedare regarded as rivals of Highnoon Laboratories Limited, which has a market capitalisation of Rs19.6 billion.

Abbott Laboratories (Pakistan) Limited has the highest market value of ₨40 billion followed by GlaxoSmithKline Pakistan’s ₨25.5 billion.AGP Limited has the lowest market value of ₨16.7billion.

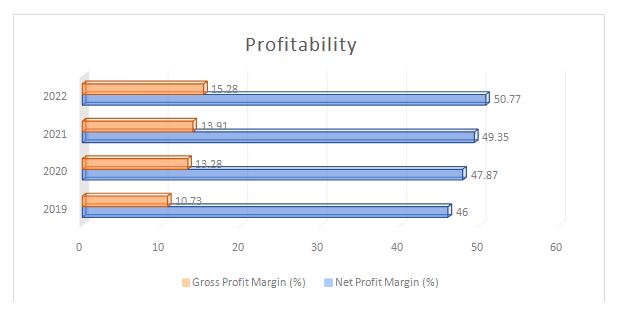

Profitability

The pharmaceutical industry in Pakistan is subject to regulatory changes, such as changes in the drug pricing policies, that can impact the profitability of companies. The probability of Highnoon Laboratories depends on its ability to compete effectively with other players in the industry, such as by introducing innovative products, maintaining high-quality standards and managing costs. The company’s financial health also impacts the probability of its future success. The company's ability to generate profits, manage debt, and maintain liquidity are key factors in determining its ability to invest in research and development, expand its product portfolio, and compete in the market.

Ratio analysis

Highnoon Laboratories has demonstrated consistent improvement in both net profit and gross profit margins over the past four years. The net profit margin has steadily increased from 46% in 2019 to 50.77% in 2022. This indicates the company's ability to generate higher profits for every rupee of revenue generated. The upward trend suggests that the company's cost management and efficiency measures have been effective in boosting profitability.

The gross profit margin has also shown steady growth, rising from 10.73% in 2019 to 15.28% in 2022. This signifies that the company has been able to effectively manage its production costs and maintain a healthy markup on its products. The improvement in this metric indicates that the company is effectively controlling its production and manufacturing expenses. Overall, the ratio analysis demonstrates Highnoon Laboratories’ strong financial performance and consistent profitability over the years. The increasing profit margins reflect the company's ability to sustain growth while managing costs efficiently, which bodes well for its future prospects.

International recognition

As a testimony to the company’s focused approach towards all-round professional excellence, market competitiveness and most importantly, patient welfare, Highnoon has made it to the Forbes Asia Best Under a Billion 2022 list yet again. The firm has been included in this esteemed list three times in the last four years between 2019 and 2022.

Company profile

Highnoon Laboratories Limited isengaged in the manufacture, import, sale and marketing of pharmaceutical and allied consumer products in Pakistan. The company's portfolio contains products for all major therapeutic areas, with a focus on alimentary tract and metabolism, antihistamines, anti-infectives, cardiovascular, endocrine, hematology, musculoskeletal, nervous system, parasitology, respiratory and urinary tracts.

Credit: INP-WealthPk