INP-WealthPk

Shams ul Nisa

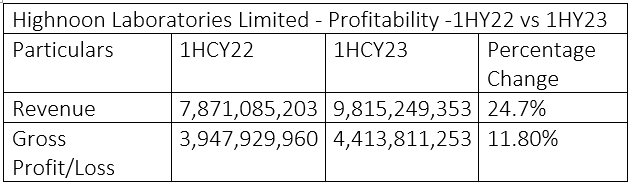

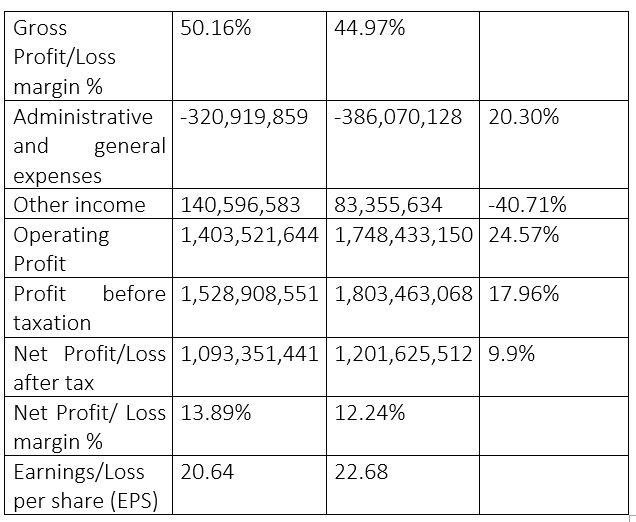

Highnoon Laboratories Limited’s net sales revenue increased 24.7% to Rs9.8 billion in the first half of 2023 (1HCY23) from Rs7.87 billion over the same period in 2022. Regardless of the rise in inflation and currency depreciation, the company increased gross profit by 11.80% to Rs4.4 billion in 1HCY23 from Rs3.9 billion in the same period last year. The company attributed the growth in gross profit to the innovation in supply chain methods, well-managed operations, and continuous enhancement in the internal control environment. However, gross profit margin slumped to 44.97% in 1HCY23 from 50.16% in 1HCY22.

Administrative and general expenses grew by 20.30% due to a rise in inflation as well as the need for human capital because of increased sales and the introduction of new products, resulting in high payroll costs. Consequently, the pharmaceutical company posted a decline in other income by 40.71% to Rs83.3 million in 1HCY23 from Rs140.59 million in 1HCY22.

On the other hand, operating profit increased to Rs1.7 billion in 1HCY23, compared to Rs1.4 billion in the same period last year, posting a jump of over 24.57%. As a result, Highnoon Laboratories posted a profit-before-tax of Rs1.8 billion in 1HCY23 compared to Rs1.5 billion in 1HCY22. During 1HCY23, the company saw a growth of 9.9% in net profit, which increased to Rs1.2 billion from Rs1.09 billion over the same period last year. As such, the net profit margin stood at 12.24% in 1HCY23, which was slightly lower than 13.89% in 1HCY22. The earnings per share rose to Rs22.68 in 1HCY23 from Rs20.64 in 1HCY22.

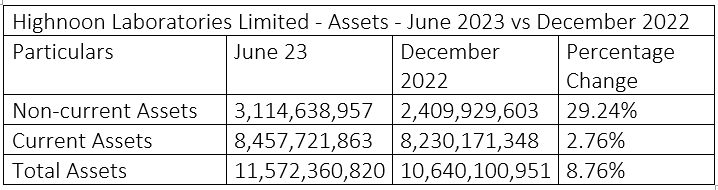

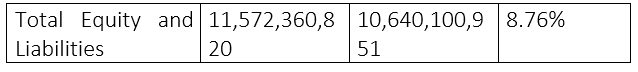

Total assets analysis

The company’s better financial performance during the period under review resulted in investment in both short and long-term assets such as property, plant, equipment, stocks and trade receivables. As a result, the non-current assets rose by 29.24% to Rs3.1 billion in June 2023. The current assets stood at Rs8.45 billion, up 2.76% from Rs8.23 billion in December 2022. As a result, the total assets increased by 8.76% to Rs11.57 billion in June 2023.

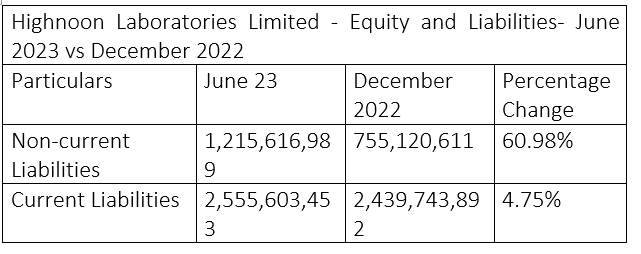

Total equity and liabilities analysis

The company’s non-current liabilities include lease liabilities, long-term advances and loans, and deferred liabilities. As of June 2023, the company’s non-current liabilities were Rs1.2 billion compared to Rs755.12 million in December 2022, reflecting a tremendous growth of 60.98%. This increase shows that the company has taken more long-term obligations to cover investments and other expenses. The company’s current liabilities grew marginally by 4.75% to Rs2.55 billion in June 2023 from Rs2.43 billion in December 2022. The company’s total equity and liabilities rose to Rs11.57 billion, which was 8.76% higher than Rs10.64 billion in December 2022.

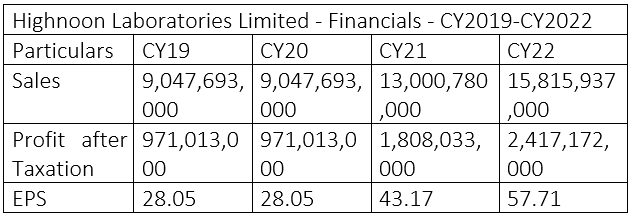

Financials analysis

The pharmaceutical company’s sales remained the same at Rs9.047 billion in CY19 and CY20. The sales increased to Rs13 billion in CY21 and reached the highest figure of Rs15.8 billion in CY22. Similarly, profitability remained the same at Rs971.01 million in CY19 and CY20. In CY21, the net profit rose to Rs1.8 billion and reached the highest profitability of Rs2.4 billion in CY22. Earnings per share of the company increased to the highest level of Rs57.71 in CY22 from Rs28.05 in CY19.

Company’s profile

Highnoon Laboratories was incorporated in March 1984 as a private limited company and in 1995, it became a public limited company. The company always looks for continuous progress in both the quality and variety of products and services by investing in research and development. The company’s core activities include manufacturing, import, sale, and marketing of pharmaceutical and related consumer products.

Credit: INP-WealthPk