INP-WealthPk

Shams ul Nisa

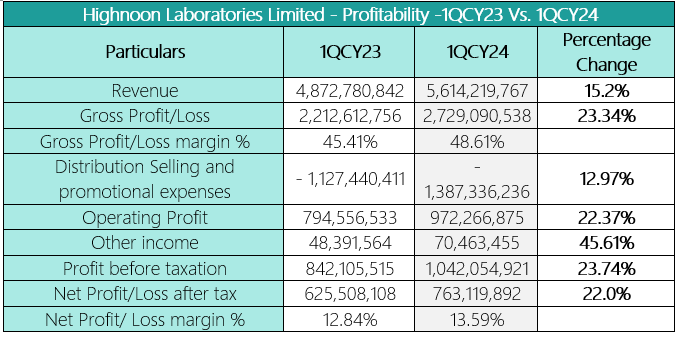

Highnoon Laboratories' revenue increased by 15.2%, gross profit by 23.34%, and net profit by 22.0% in the first quarter of the ongoing Calendar Year 2024, reports WealthPK. The company attributed the rise in revenue to organic growth, which includes optimization of processes, reallocation of resources, and new product offerings. During the review period, the company adopted effective cost management strategies, which helped the gross profit margin to stand at 48.61% compared to 45.41% in 1QCY23, mainly driven by the focus on key brands and a leading product portfolio.

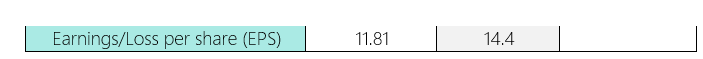

Owing to the targeted marketing initiatives during the period, the company experienced a spike of 12.97% in distribution, selling, and promotional expenses. Whereas, the efficient financial investment planning of working capital increased "other income" to Rs70.4 million in 1QCY24. Thus, at the end of 1QCY24, the profit before tax grew by 23.74% to Rs1.04 billion compared to Rs842.1 million in the same period last year. The net profit margin and earnings per share of the company expanded to 13.59% and Rs14.4 in 1QCY24, respectively. Regarding the pharmaceutical sector, the state deregulated non-essential drug prices to guarantee product availability. This allowed the companies to set their prices based on input costs.

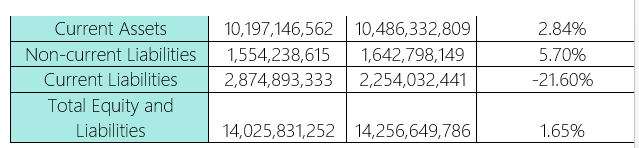

Assets and liabilities analysis

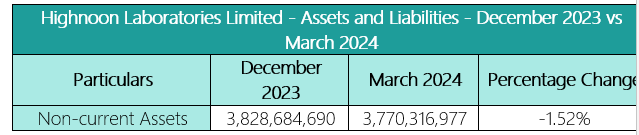

The quarter witnessed a decline in non-current assets, including property, plant and equipment, intangible assets, and long-term deposits. Thus, non-current assets contracted by 1.52% to Rs3.77 billion in March 2024. Trade receivables, advances, trade deposits, prepayments, and other receivables expanded, resulting in a rise in the current assets to Rs10.48 billion, which is 2.84% higher than Rs10.19 billion in December 2023.

As of March 2024, the company's non-current liabilities were Rs1.6 billion compared to Rs1.55 billion in December 2023, reflecting a growth of 5.70%. This is due to an increase in lease liabilities and deferred liabilities. The company's current liabilities fell 21.60% to Rs2.25 billion in March 2024 from Rs2.87 billion in December 2023. The total equity and liabilities rose marginally to Rs14.25 billion, 1.65% higher than Rs14.02 billion in December 2023.

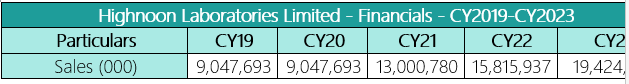

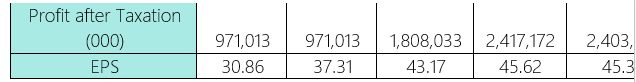

Financials

The pharmaceutical company's sales remained the same at Rs9.047 billion during CY19 and CY20 and later increased to Rs13.0 billion in CY21 reaching the highest of Rs19.4 billion in CY23. Similarly, profitability remained the same at Rs971.01 billion in CY19 and CY20. In CY21, net profit rose to Rs1.8 billion and recorded the highest profitability of Rs2.4 billion in CY22 before declining to Rs2.4 billion in CY23. The earnings per share increased to Rs45.62 in CY22 but witnessed a decimal contraction to Rs45.35 in CY23.

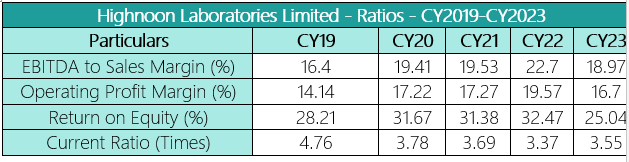

Ratios analysis

The company's EBITDA to sales remained above 10% over the past five years, reflecting a healthy cash flow. The EBITDA to sales ratio measures how much cash a company generates from its operations relative to its sales. The operating profit margin continues to grow from 14.14% in CY19 to a peak of 19.57% in CY22, before dipping to 16.7% in CY23.

The return on equity measures how profitably the owner's funds have been utilized to generate the company's revenues. The company registered the highest 32.47% return on equity in CY22. The ample assets compared to liabilities as the current ratio remained above 1.2 during the review period.

Company's profile

Highnoon Laboratories Limited was incorporated in March 1984. The company always looks for continuous progress in the quality and variety of products and services by investing in research and development. The company's core activities include manufacturing, import, sale, and marketing of pharmaceutical and allied consumer products.

Credit: INP-WealthPk