INP-WealthPk

Jawad Ahmed

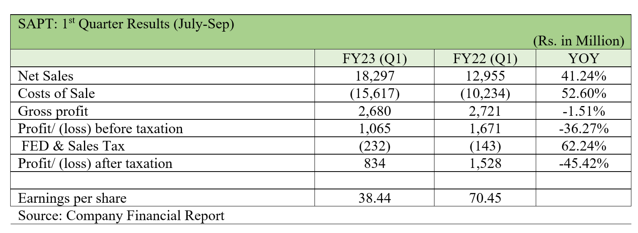

The Sapphire Textile Mills Limited’s net sales increased 41.2% to Rs18.29 billion in the first quarter (July-Sep) of Financial Year 2022-23 compared with Rs12.95 billion in the Fiscal Year 2021-22. However, the quarter proved to be challenging, as the company suffered a sharp fall in profitability due to an increase in the cost of sales and rising tax, reports WealthPK quoting the company’s financial stats.

The gross profit slightly decreased to Rs2.68 billion in the first quarter of FY23 from Rs2.72 billion in the corresponding period of FY22 due to an increase of over 5% in the cost of sales. The company made a before tax profit of Rs1.06 billion in the first quarter of FY23, compared to Rs1.67 billion in the first quarter of FY22.

Owing to an increase in taxes, after-tax earnings decreased by 45.4%, from Rs1.52 billion in 1QFY22 to Rs834 million in the same time the previous year. As a result of a drop in profits, the earnings per share (EPS) plummeted from Rs70.45 in 1QFY22 to Rs38.44 in 1QFY23.

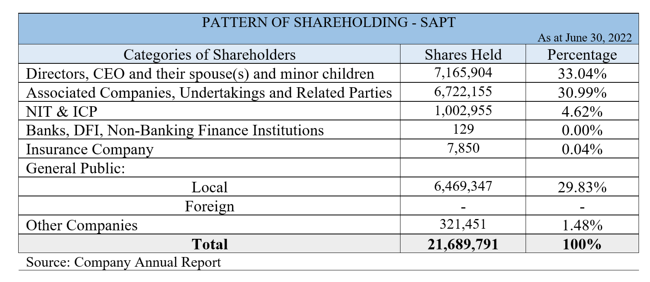

Shareholding pattern

As of June 30, 2022, the company’s directors, CEO, their spouses and minor children owned 33.04% of shares, associated companies, undertakings and related parties 30.99%, NIT & ICP 4.62%, banks, DFI, non-banking finance institutions and insurance companies a negligible number of shares, local investors 29.83% and ‘others’ 1.48%.

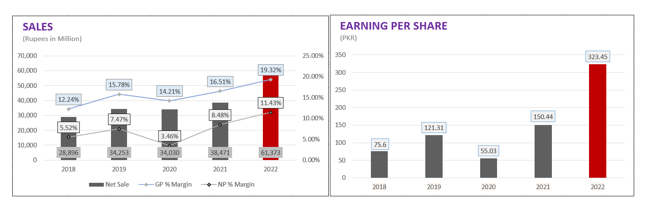

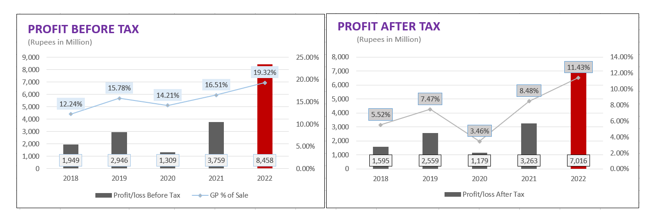

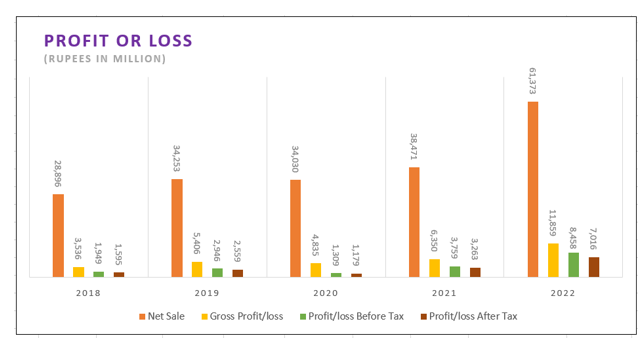

Company’s performance over the years

In 2019, the company’s sales revenue increased to Rs34.25 billion from Rs28.89 billion in 2018. The company’s gross profit surged to Rs5.40 billion from Rs3.53 billion in the previous year, registering a 53% increase year-over-year.

The profit-after-tax for the year jumped to Rs2.55 billion, 60.4% higher than the previous year’s Rs1.59 billion. Resultantly, the EPS increased to Rs121.31 in 2019 from Rs75.60 the year before.

In 2020, despite the Covid-19 pandemic and the resultant challenging economic environment the company managed to achieve a sales volume of Rs34 billion, a negligible decline compared to 2019.

The company’s gross profit dropped from Rs5.40 billion in 2019 to Rs4.83 billion in 2020.

The net profit also decreased from Rs2.55 billion in 2019 to Rs1.17 billion in 2019. The EPS nosedived to Rs55.03 from Rs121.31 in comparison with 2019.

In 2021, the company’s top line climbed to Rs38.47 billion from Rs34 billion in 2020 as a result of an increase in the product demand.

Owing to the increased demand and economic recovery following the lifting of restrictions brought on by Covid-19, the gross profit increased to Rs6.35 billion from Rs4.83 billion the previous year.

The net profit also jumped from Rs1.17 billion the previous year to Rs3.26 billion in 2021. As a result, the EPS increased from Rs150.44 to Rs55.03.

In 2022, the company witnessed a massive increase in its top line to Rs61.37 billion compared to Rs38.47 billion in the previous year due to an increase in the product demand. The company reported an 87% increase in gross profit during the year, which stood at Rs11.85 billion, up from Rs6.35 billion in the previous year.

The net profit also jumped from Rs3.26 billion in the previous year to Rs7 billion in 2022. As a result, the EPS jumped to Rs323.45 from Rs150.44. Sapphire Textile Mills was incorporated on March 11, 1969 as a public limited company. The principal activities of the company are manufacturing of yarn, fabrics, home textile products, finishing, stitching and printing of fabrics.

Credit : Independent News Pakistan-WealthPk