INP-WealthPk

Hifsa Raja

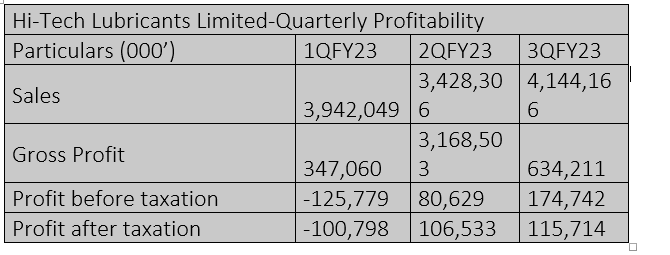

Hi-Tech Lubricants Limited has unveiled its quarterly financial results for the previous fiscal year 2022-23, strongly recovering from the first quarter losses in net profit, and posting robust results in the latter two quarters. The figures present a compelling narrative of recovery and resilience, showcasing the company's remarkable ability to rebound from a challenging start to the year. In the first quarter (July-Sept) of FY23, Hi-Tech Lubricants posted sales of Rs3.9 billion and gross profit of Rs347 million. However, the company posted a net loss of Rs100 million.

In the second quarter (Oct-Dec), the company posted sales of Rs3.4 billion and gross profit of Rs3.1 billion. The company posted a net profit of Rs106 million. In the third quarter (Jan-March), the company posted sales of Rs4.1 billion and gross profit of Rs634 million. The company posted a net profit of Rs115 million. Hi-tech Lubricants demonstrated resilience by recovering from a net loss in the first quarter of FY23 and posting profit in the next two quarters.

The company’s resilience and strategic adaptations underscore its ability to navigate complex market dynamics. As it forges ahead, the company's impressive performance in 2023 stands as a testament to its commitment to innovation and growth, providing investors and stakeholders with renewed confidence in its trajectory.

Performance in FY22

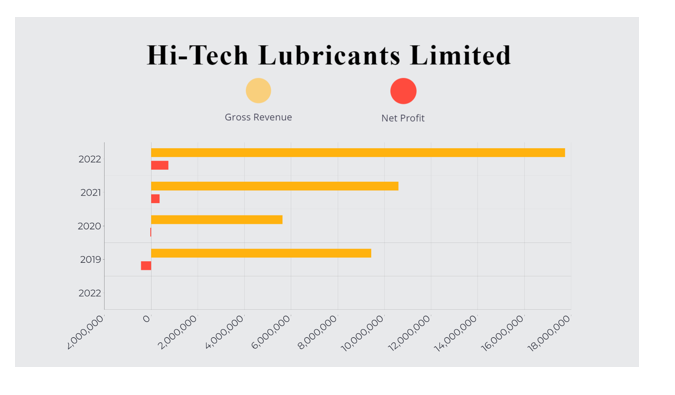

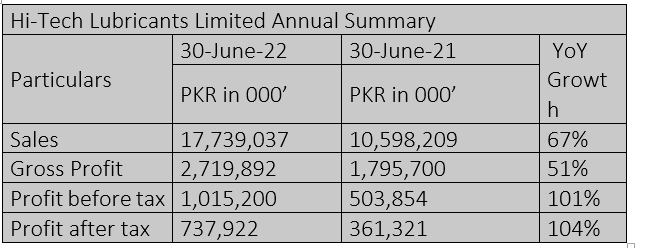

In the fiscal year 2021-22, the company’s all financial metrics posted robust growth year-on-year. It reported a growth of 67% in net sales, which jumped to Rs17 billion from Rs10 billion in the previous year. Similarly, the gross profit soared to Rs2.7 billion, up 51% from the previous year's Rs1.7 billion.

The company’s profit-before-tax jumped to Rs1 billion in FY22, surpassing the previous year's profit of Rs503 million by 101%. Moreover, the company’s profit-after-tax jumped to Rs737 million in FY22, increasing from previous year's Rs361 million at 104% growth rate.

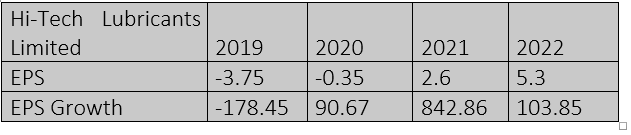

Earnings per share since 2019

In 2019, the EPS was minus Rs3.75, which posted some improvement and remained at minus Rs0.35 in 2020. However, the company posted EPS of Rs2.6 and Rs5.3 in 2021 and 2022, respectively.

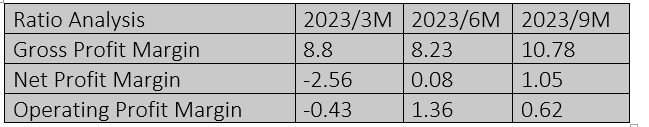

Ratio analysis

The company's profitability, including gross, net and operating profit margins, demonstrated its ability to generate healthy returns on its operations.

In the first quarter of FY23, the margin stood at 8.8%, indicating that the company retained 8.8% of its revenue as gross profit after accounting for the cost of goods sold. This percentage dipped slightly to 8.23% by the second quarter, reflecting potential challenges in cost management. However, the third quarter saw a notable upswing, with the margin expanding to 10.78%, suggesting improved profitability in producing and selling its goods.

Analysing the net profit margin, a critical metric indicating the proportion of revenue that translates into net profit, the company faced a tough start to the year. The first quarter reported a worrying -2.56%, implying the company incurred losses exceeding its revenue. However, there was a slight improvement by the second quarter, with the margin climbing to 0.08%, indicating a marginal net profit. The positive trend continued into the third quarter, reaching 1.05%, indicating the company's success in controlling costs and enhancing its bottom line.

The operating profit margin, which assesses the efficiency of a company's operations, also exhibited fluctuations. The initial quarter displayed a challenging figure of -0.43%, suggesting operational inefficiencies led to losses. A significant turnaround occurred in the second quarter, with the margin soaring to 1.36%, signifying a stronger grip on operational costs. However, the margin regressed to 0.62% in the third quarter, indicating room for further optimisation in the company's operations.

In sum, Hi-Tech Lubricants’ financial journey through the first three quarters of FY23 has showcased a dynamic narrative. While challenges persist, the company has demonstrated resilience and adaptability, translating into improved profit margins as the year progresses. These ratios not only provide insights for stakeholders and investors but also underscore the company's commitment to continuous improvement in its financial performance and operational efficiency.

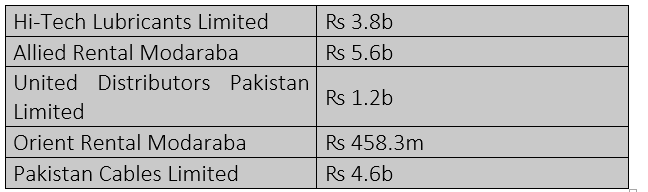

Industry comparison

Hi-Tech Lubricants’ competitors include Allied Rental Modaraba, United Distributors Pakistan Limited, Orient Rental Modaraba, and Pakistan Cables Limited.

Hi-Tech Lubricants Limited has a market capitalisation of ₨3.8 billion. The highest market value is of Allied Rental Modaraba at ₨5.6 billion, while the lowest market cap is of Orient Rental Modaraba at ₨458.3 million.

Company profile

Hi-Tech Lubricants Limited was incorporated under the Companies Ordinance, 1984 (now Companies Act, 2017). The principal activity of the company is to procure and distribute lubricants and petroleum products. During the year ended June 30, 2017, Oil and Gas Regulatory Authority (OGRA) granted licence to the company to establish an oil marketing company. On May 31, 2019, OGRA granted permission to the company to operate new storage facility in Sahiwal and market petroleum products in the Punjab province.

Credit: INP-WealthPk