INP-WealthPk

Ayesha Mudassar

Habib Bank Limited (HBL), the country's largest commercial bank, recorded a profit of Rs 15.04 billion during the first quarter of ongoing calendar year 2024, compared to Rs 13.2 billion over the same period last year, reports WealthPk. Positive volumetric growth in average earning assets, improved spreads, and effective investment duration management are the primary factors behind the bank’s substantial profits.

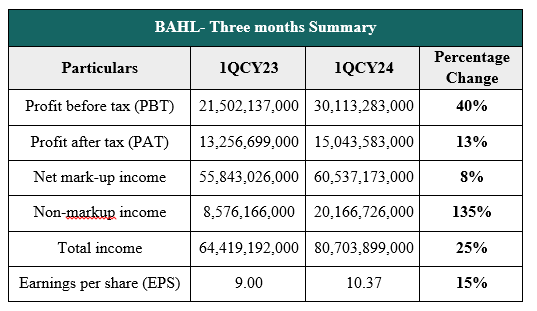

Going by the income statement, the HBL registered a profit-before-tax (PAT) of Rs 30.1 billion for 1QCY24 versus a PBT of Rs 21.5 billion in 1QCY23. Moreover, the HBL announced an earnings per share (EPS) of Rs 10.37 for the quarter under review. The bank’s net markup income posted 8% growth, reaching Rs 60.5 billion for 1QCY24, compared to Rs 55.8 billion in 1QCY23. During the period under review, the bank's total non-markup income also increased by 135% YoY to Rs 20.1 billion, owing to a massive jump in foreign exchange income and a colossal reduction in loss on securities. The sound financial performance is reflective of the bank’s customer-centric approach coupled with prudent risk management practices.

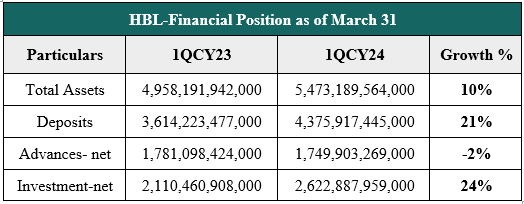

HBL Financial position as of March 31, 2024

The prudent investing and transactional banking have helped the asset base of Habib Bank to cross Rs 5.4 trillion as of March 31, 2024. The growth in assets was primarily driven by increases in investments. The net investment rose by 24% to Rs 2.6 trillion during the period under review.

Driven by marketing campaigns and customer acquisition drives, the deposit base of the bank increased by 21% and was recorded at Rs 4.3 trillion as of March 31, 2023. Amidst challenging operating conditions, the HBL has demonstrated resilience and achieved significant growth in both its balance sheet and net profits.

Banking Sector Performance

Pakistan’s banking sector maintained its resilience against multiple headwinds including pandemic aftershocks, high inflation, economic slowdown, and political unrest. As of March 31, 2024, the total assets of the industry increased by 1% and was recorded at Rs 45,263 billion, compared to Rs 45,183 billion as of March 31, 2023. This growth was mainly driven by a 4% appreciation in investment. On the liability side, the total deposits grew by 2% to Rs 28,322 billion as of March 2024, compared to Rs 27,841 billion as of March 31, 2023.

Future Outlook

Despite the country's challenges, the bank continues to achieve its vision through growth, efficiency, and diversity and create sustainable value for all stakeholders. The HBL now focuses on promoting the advancement of the digital ecosystem in the financial sector.

Credit: INP-WealthPk