INP-WealthPk

Qudsia Bano

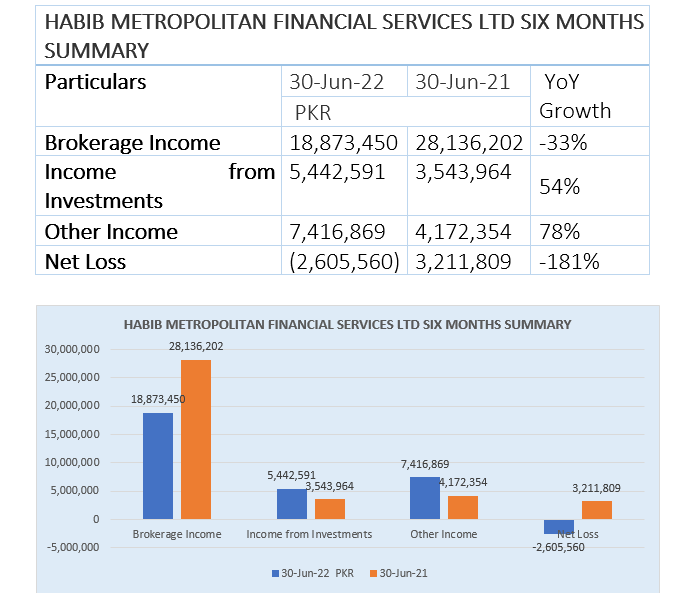

Brokerage income of Habib Metropolitan Financial Services Limited (HMFS) decreased 33% to Rs18.9 million in the first six months of the ongoing calendar year 2022 (6MCY22) compared with Rs28.13 million over the corresponding period last year. The income from investments, however, registered a 54% growth during the 6MCY22 and stood at Rs5.4 million compared with Rs3.5 million in the corresponding period of the previous year.

The company posted ‘other income’ of Rs7.4 million during the six months of CY22 compared to Rs4.2 million in the same period last year, showing a positive growth of 78% year-on-year, reports WealthPK. The company, nonetheless, suffered a net loss of Rs2.6 million in 6MCY22 compared with a net profit of Rs3.2 million in the corresponding period of the previous year.

Performance in 2021

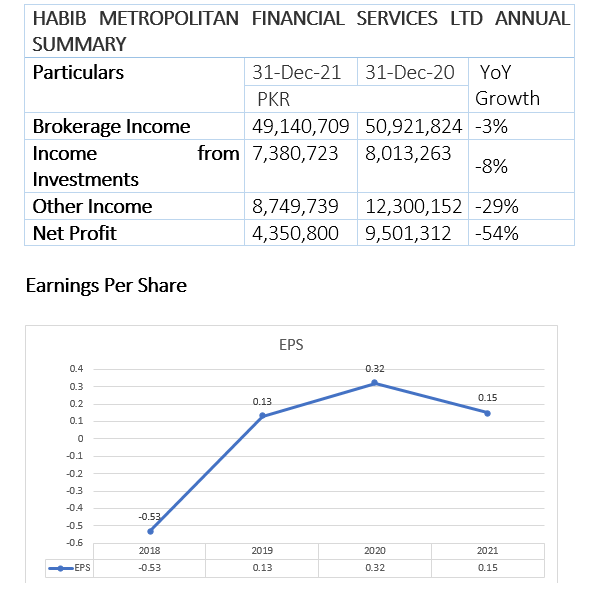

During CY2021, the company’s brokerage income decreased by 3% to Rs49 million from Rs50.9 million in CY20. Similarly, the company’s income from investments for CY21 stood at Rs7.38 million, down 8% from Rs8 million in CY20. The profit-after-tax for the year stood at Rs4.3 million, down 54% from Rs9.5 million in CY20.

The earnings per share (EPS) of the company stood negative during 2018. However, it pushed up to positive territory at Rs0.13 in 2019 and Rs0.32 in 2020. But the EPS again dragged down to Rs0.15 in 2021.

Company profile

HMFS was incorporated in Pakistan on September 28, 2007 as a public limited company under the Companies Ordinance, 1984 (now Companies Act, 2017). The company commenced its operations on March 06, 2008. It is a wholly-owned subsidiary of Habib Metropolitan Bank Limited (HMB). The company holds a Trading Rights Entitlement (TRE) certificate from Pakistan Stock Exchange Limited.

HMFS offers a comprehensive array of equity brokerage services. As a fully owned subsidiary of HMB, the firm maintains the same high standards of repute, trust and service as set by its parent institution. Its team is highly experienced and well-equipped to provide superior equity brokerage services to its valued clients.

Credit : Independent News Pakistan-WealthPk