INP-WealthPk

Ayesha Mudassar

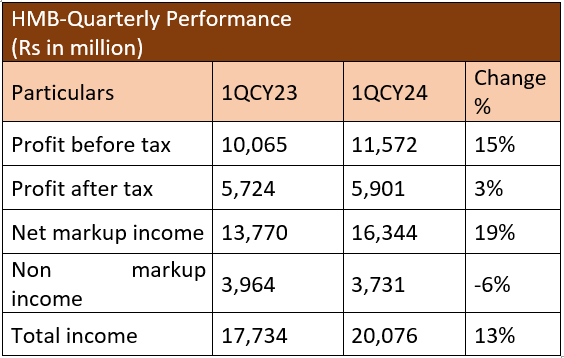

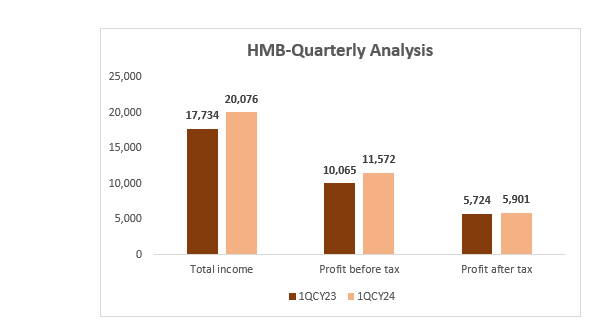

Habib Metropolitan Bank Limited (HMB) recorded a 3% year-on-year (YoY) rise in its net profit for the quarter ended March 31, 2024 (1QCY24) to clock in at Rs5.9 billion compared to Rs5.7 billion in the same period last year, reports WealthPK. The analysis of the income statement shows that the bank’s profit-before-tax increased 15% to Rs11.5 billion compared to Rs10 billion in 1QCY23.

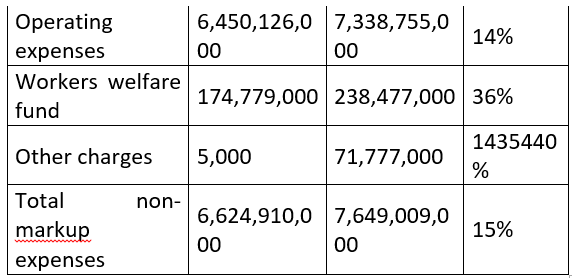

With interest rates at their peak, the bank reported a boost in interest income, which was reflected in its net markup income of Rs16.3 billion during the quarter. Meanwhile, the bank's total non-markup income dropped by around 6% YoY to Rs3.7 billion owing to a significant decline in foreign exchange income. On the expense side, the bank’s non-markup expenses increased by 15% YoY to Rs7.6 billion in 1QCY24 compared to Rs6.6 billion in 1QCY23. The rise was attributed to a jump of 14% in operating expenses during the quarter under review.

Likewise, the bank’s expenses towards the workers welfare fund and other charges also increased during the period.

Pattern of shareholding

As of December 31, 2023, HMB had a total of 1.04 billion outstanding shares held by 2,869 shareholders. Habib Bank AG Zurich held 51% of its shares followed by the local general public holding 18.8%. Foreign companies had a stake of 9.6% and NIT accounted for 3.38% of HMB’s shares. Directors, CEOs, their spouses, and minor children held 2.47% of the bank’s shares. Around 1.33% of HMB’s shares were held by Modarabas and Mutual Funds. The remaining shares were held by other categories of shareholders.

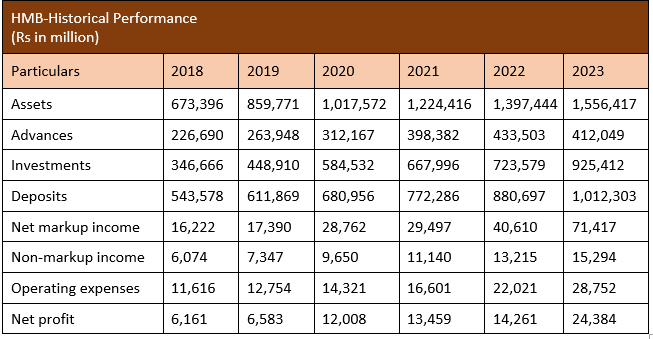

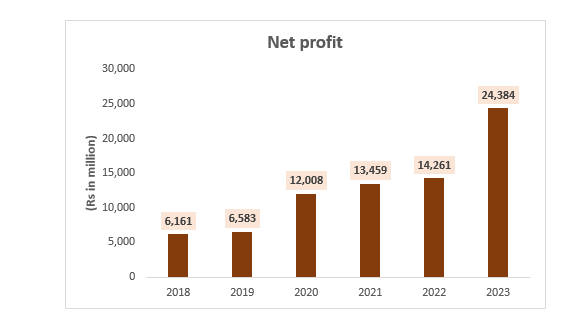

Performance (2018-23)

The bank's asset base has been showing steady growth over the years on account of both advances and investments. In addition, the deposits have been posting reasonable growth since 2018, rising from Rs543.5 billion to Rs1,012.3 billion in 2023. The non-markup income of HMB has shown considerable growth, even though the bank incurred losses on securities in most of the years. The main contributors of non-markup income have been fee, commission and foreign exchange income.

Due to consistent growth in the branch network, operating expenses also grew significantly from Rs11.6 billion in 2018 to Rs28.7 billion in 2023. The net profit also posted an ascending trajectory in all the years under consideration. The bank’s net profit clocked in at Rs24.3 billion in 2023 compared to Rs6.1 billion in 2018.

About the bank

Habib Metropolitan Bank was incorporated in Pakistan as a public limited company in 1992. The bank is the subsidiary of Habib Bank AG Zurich – Switzerland – which is the holding company of the bank. HMB operates a network of 525 branches in 207 cities across Pakistan, including 208 Islamic banking branches and 187 Islamic banking windows, offering a comprehensive spectrum of banking services and products, including specialized trade finance products and digital banking solutions.

Future outlook

Habib Metropolitan is determined to advance its deposit base, enhance its local presence and deliver unparalleled services to esteemed customers. The bank’s strategic pillars include a heightened focus on the consumer sector, broadened cash management capabilities and the adept use of technology to cater to customers’ banking needs.

Credit: INP-WealthPk