INP-WealthPk

Ayesha Mudassar

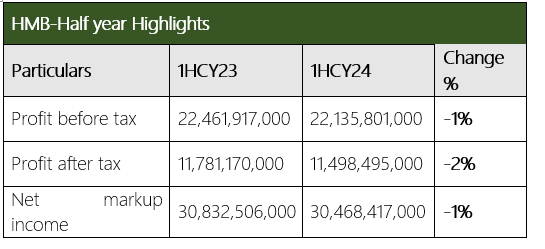

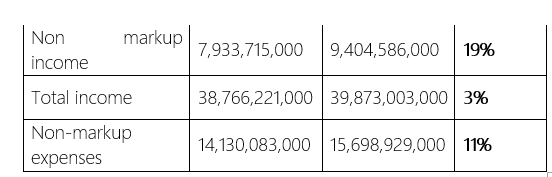

Habib Metropolitan Bank Limited’s (HMB) net profit declined 2% year-on-year (YoY) to Rs11.4 billion for the half year ended June 30, 2024 compared to Rs11.7 billion in the corresponding period of last year, reports WealthPK.

The bank also experienced a 1% decline in pre-tax profit, reaching Rs22.1 billion against Rs22.4 billion in the first half of CY23.

For the first half of CY24, the bank’s total income reached Rs39.8 billion, representing a 3% year-on-year (YoY) increase. This income growth was primarily driven by a 19% rise in the non-markup income. On the expense side, the bank’s non-markup expenses grew by 11% YoY to Rs15.6 billion compared to Rs14.1 billion in 1HCY23. The increase was largely due to a 126% rise in other charges, which surged from Rs32.1 million to Rs72.7 million during the review period. Additionally, the bank’s operating expenses increased to Rs15.1 billion from Rs13.5 billion in the first half of CY23.

Financial Position as of June 30, 2024

As of June 30, 2024, the bank's asset base surpassed Rs1.5 trillion, boosted by its prudent investment strategies and robust transactional banking. This asset growth was mainly fuelled by a notable 29% increase in net investments, which reached Rs873.5 billion during the review period.

Supported by marketing campaigns and strategic customer acquisition efforts, the bank’s deposit base expanded by 16%, totalling Rs1.09 trillion as of June 30, 2024.

Pattern of Shareholding

As of December 31, 2023, the bank had 1.04 billion outstanding shares held by 2,869 shareholders. Habib Bank AG Zurich holds a majority stake of 51% of its shares, while the local general public owns 18.8% of the shares. Foreign companies possess 9.6% of the shares and National Investment Trust (NIT) accounts for 3.38%. Directors, CEOs, their spouses, and minor children hold 2.47% of the bank’s shares. Modarabas and Mutual Funds collectively own approximately 1.33% of the shares. The remaining shares are held by various other categories of shareholders.

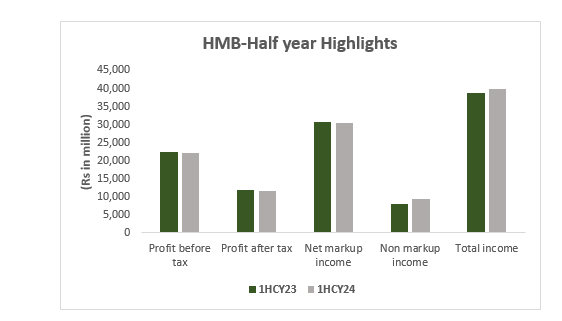

Historical Performance (2018-23)

The bank's asset base has demonstrated a steady growth over the years, driven by increases in both advances and investments. Moreover, the deposits also witnessed a reasonable growth since 2018, rising from Rs543.5 billion to Rs1,012.3 billion by 2023.

The non-markup income has shown a considerable growth despite losses on securities in several years. The primary sources of non-markup income have been fees and commission income and foreign exchange income. Owing to the expansion of the branch network, the operating expenses have risen significantly from Rs11.6 billion in 2018 to Rs28.7 billion in 2023. The net profit has exhibited a consistent upward trend over the years. In 2023, the bank's net profit reached Rs24.3 billion compared to Rs6.1 billion in 2018.

About the bank

Habib Metropolitan Bank was incorporated in Pakistan as a public limited company in 1992. It operates as a subsidiary of Habib Bank AG Zurich, Switzerland, which serves as its holding company. With an extensive network of over 500 branches, HMB provides a broad range of conventional banking services. Besides, the bank offers a comprehensive spectrum of financial products and services, including specialized trade finance solutions and advanced digital banking options.

Future Outlook

Habib Metropolitan is committed to expanding its deposit base, enhancing its local presence, and providing exceptional services to its esteemed customers. The bank’s strategic priorities include a focused approach to the consumer sector, broadened cash management capabilities, and effective use of technology to meet the customers’ banking needs.

Credit: INP-WealthPk