INP-WealthPk

Qudsia Bano

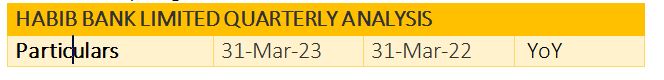

Habib Bank Limited (HBL), one of Pakistan's leading financial institutions, has reported a strong performance for the quarter ending March 31, 2023, showcasing robust growth in various financial metrics, demonstrating its resilience and adaptability in a challenging economic environment. Net markup, which represents the bank's interest income, witnessed substantial growth, reaching a staggering Rs55.84 billion. This figure reflects a remarkable 54% year-on-year increase compared to the corresponding quarter of the previous fiscal year. The surge in net markup can be attributed to the bank's effective management of its interest-earning assets and a favourable lending environment. However, HBL experienced a decline in its non-markup or non-interest income, which comprises various fee-based services and commissions. The total non-markup income for the quarter amounted to Rs8.58 billion, reflecting a decline of 17% compared to the same period last year.

This decrease could be attributed to market conditions, lower business activity, or changes in the bank's fee structure. Despite the decline in non-markup income, HBL's total income for the quarter stood at an impressive Rs64.42 billion, showcasing a notable 38% increase compared to the previous year. This growth can be attributed to the bank's strong net interest income and prudent financial management practices. On the expense side, HBL reported total non-markup expenses of Rs39.74 billion for the quarter, reflecting a 29% increase over the same period last year. These expenses include administrative costs, employee salaries, and other operating expenses. The rise in non-markup expenses can be attributed to inflationary pressures and the bank's efforts to enhance its infrastructure and technology platforms to cater to evolving customer needs.

Despite higher expenses, HBL's profit-before-tax witnessed substantial growth, reaching Rs21.50 billion, representing a significant 47% increase year-on-year. This noteworthy growth demonstrates the bank's ability to generate strong operating profits while effectively managing costs. HBL's profit-after-tax for the quarter stood at Rs13.26 billion, reflecting a 54% increase compared to the corresponding quarter of the previous fiscal year. This growth can be attributed to the bank's robust operational performance, effective risk management strategies, and favourable economic conditions. The bank's earnings per share (EPS), a key indicator of profitability, also showed an impressive increase. HBL reported an EPS of Rs9.00 for the quarter, reflecting a substantial 56% growth compared to the same period last year. This indicates enhanced profitability on a per-share basis and underscores the bank's ability to generate returns for its shareholders.

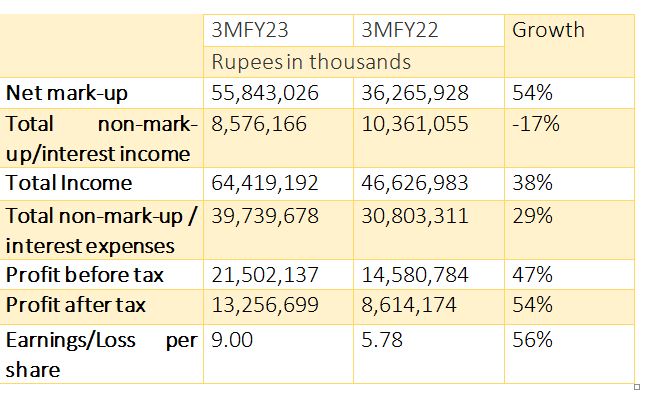

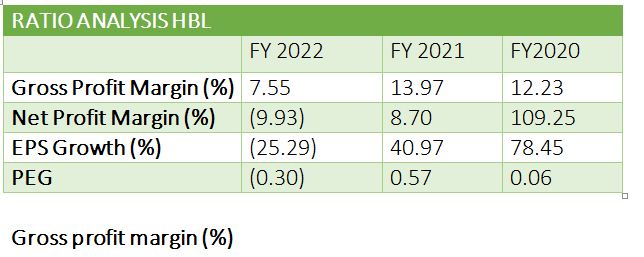

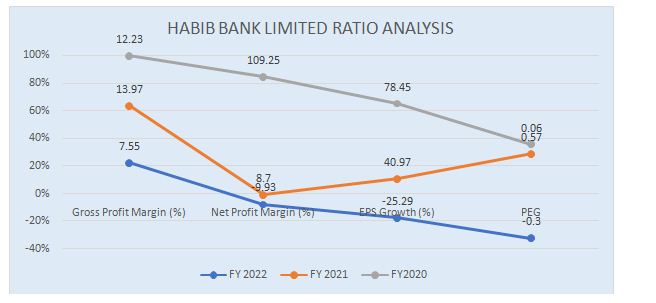

The gross profit margin measures the profitability of a company's core operations. HBL's gross profit margin decreased to 7.55% in FY22 from 13.97% in FY21, indicating a decline in the bank's ability to generate profits from its core activities. This decline may be attributed to factors such as increased operating costs, competitive pressures, or changes in the bank's business strategy.

Net profit margin (%)

The net profit margin represents the percentage of revenue that translates into net profit after accounting for all expenses. HBL's net profit margin was negative (-9.93%) in FY22, a significant decrease from the positive net profit margin of 8.70% in FY21. The negative net profit margin suggests that HBL incurred more expenses than the revenue it generated during the year. This could be due to higher provisioning for bad loans or other exceptional expenses impacting the bank's profitability.

EPS growth (%)

EPS growth is a key metric that reflects the growth in earnings per share over a specific period. HBL experienced a decline in EPS growth, with a negative growth rate of -25.29% in FY22, compared to a positive growth rate of 40.97% in FY21. This decline indicates a decrease in the bank's ability to generate earnings on a per-share basis, potentially caused by factors such as reduced profitability or an increase in the number of outstanding shares.

PEG (price/earnings to growth) ratio

The PEG ratio is a valuation metric that considers both the company's P/E ratio and its EPS growth rate. A PEG ratio below 1 is generally considered favourable, indicating that the stock may be undervalued relative to its earnings growth. HBL's PEG ratio was negative (-0.30) in FY22, indicating a potential undervaluation of the stock based on its EPS growth rate. In contrast, the positive PEG ratios of 0.57 in FY21 and 0.06 in FY20 suggest that the stock may have been relatively overvalued during those periods.

About the company

Habib Bank Limited is engaged in commercial banking-related services in Pakistan and overseas. The Geneva-based Aga Khan Fund for Economic Development is the parent company of the bank.

Credit: INP-WealthPk