INP-WealthPk

Qudsia Bano

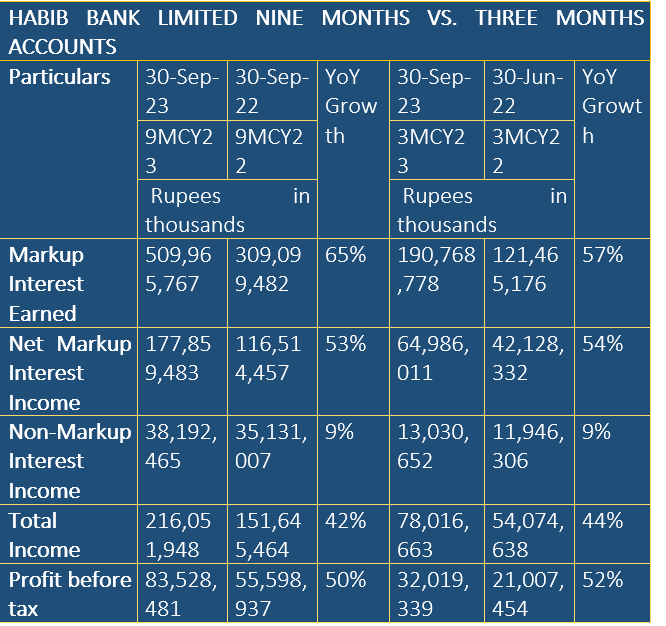

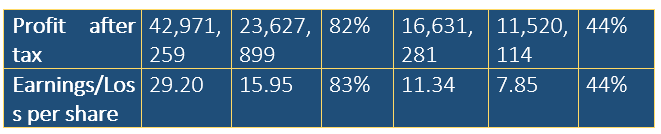

Habib Bank Limited (HBL) has reported robust financial performance in the nine months ending on September 30, 2023. The bank's markup interest earned surged to an impressive Rs509.97 billion, representing a substantial 65% year-on-year (YoY) growth. This remarkable increase is attributed to higher interest rates and an expanded loan portfolio, showcasing HBL's ability to capitalise on market opportunities. Net markup interest income, a key indicator of a bank's core operational strength, reached Rs177.86 billion, marking a notable 53% YoY growth. This reflects effective management of interest-bearing assets and liabilities, contributing significantly to the bank's overall profitability. Non-markup interest income also demonstrated steady growth, increasing by 9% to Rs38.19 billion. HBL's diversified income streams and successful non-interest income strategies played a crucial role in achieving this positive result.

Total income for the nine-month period stood at an impressive Rs216.05 billion, marking a substantial 42% YoY growth. This comprehensive metric underscores the bank's resilience and adaptability, successfully generating income from various sources amidst a dynamic financial landscape. In terms of profitability, HBL reported a profit-before-tax of Rs83.53 billion, reflecting a robust 50% YoY growth. The profit-after-tax saw an even more significant increase, surging by 82% to Rs42.97 billion. This highlights the bank's efficiency in managing costs and risks, contributing to its overall financial strength. Earnings per share (EPS) for the nine months of 2023 stood at Rs29.20, showcasing a substantial 83% YoY growth. This metric is a clear indication of HBL's commitment to delivering value to its shareholders.

Turning to the three-month analysis, markup interest earned during this period amounted to Rs190.77 billion, reflecting a robust 57% YoY growth. The sustained momentum in interest rates and the continued growth of the loan portfolio contributed to this positive result. Net markup interest income for the three-month period reached Rs64.99 billion, indicating a commendable 54% YoY growth. This suggests effective interest rate management by the bank, contributing to its core operational strength. Non-markup interest income for the quarter witnessed a steady growth of 9%, reaching Rs13.03 billion. This reflects HBL's consistent success in leveraging diverse income streams to support its overall financial performance.

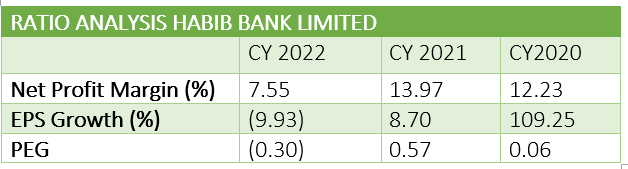

Net profit margin

The net profit margin, a critical indicator of a company's profitability, reflects the percentage of revenue retained as net income. In CY22, HBL reported a net profit margin of 7.55%, showing a decline from 13.97% in CY21 and 12.23% in CY20.

EPS growth

EPS growth, a key metric for assessing a company's profitability on a per-share basis, experienced a notable dip in CY22, registering a negative growth of (9.93%). This contrasts with the positive growth observed in CY21 (8.70%) and the substantial surge in CY20 (109.25%). The negative EPS growth in CY22 suggests challenges or adverse conditions impacting HBL's per-share earnings.

PEG ratio

The price/earnings to growth (PEG) ratio provides insight into a company's valuation relative to its earnings growth. A PEG ratio below 1 is generally considered favourable. In CY22, HBL reported a negative PEG of (0.30), contrasting with the positive ratios of 0.57 in CY21 and 0.06 in CY20. The negative PEG in CY22 suggests that the market may have undervalued the bank relative to its earnings growth rate.

About the bank

Habib Bank Limited is engaged in commercial banking-related services in Pakistan and overseas. The Aga Khan Fund for Economic Development (AKFED), S.A. is the parent company of the bank and its registered office is in Geneva, Switzerland.

Credit: INP-WealthPk