INP-WealthPk

Qudsia Bano

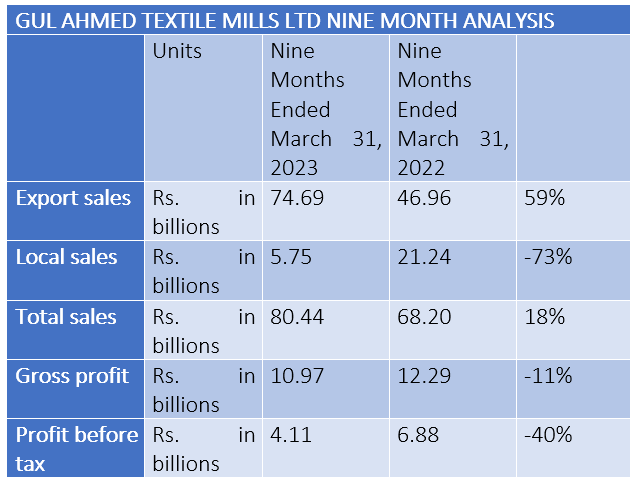

Gul Ahmed Textile Mills Limited recently released its nine-month financial analysis for the period ending March 31, 2023, highlighting an uptick in foreign sales but a downturn in profits. The report highlights various key performance indicators, including sales, profitability, margins and financial ratios. Unfortunately, the company faced significant challenges during this period, as evidenced by negative growth in several crucial areas.

Talking to WealthPK, Muhammad Khursheed, Deputy General Manager of Gul Ahmed Textile Mills, said despite all the difficulties at both domestic and international levels, where the businesses are scaling back or ceasing operations and the country's textile exports are declining, the company was able to operate at its full potential and achieved export sales in dollar terms that were comparable to the corresponding domestic sales of the previous year. He said the demand for yarn, which accounts for the majority of local sales, decreased while local sales remained level.

The company's nine-month total net sales increased to Rs80.44 billion from Rs68.20 billion during the same period last year. Sales for the three months ending March 31, 2023, were also Rs5.9 billion higher than those for the three months ending December 31, 2022. Higher cost of cotton and other raw materials, pressure on yarn prices due to decreased demand, unstable dollar parity with the rupee, an increase in markup rates, and general inflation were the reasons that had a significant influence on gross and net profit margins.

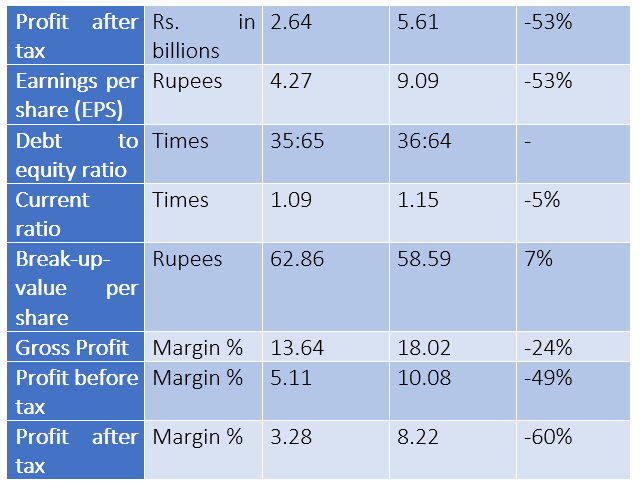

Gul Ahmed witnessed a substantial increase in export sales during the nine-month period, with revenues reaching Rs74.69 billion. This represented a 59% growth compared to the same period the previous year, which demonstrates the company's success in expanding its international market presence. However, the local sales figure declined sharply by 73% to Rs5.75 billion, indicating a weak domestic market performance. Overall, the total sales increased by 18% to reach Rs80.44 billion.

The company's profitability faced a downturn during the nine-month period. Gross profit declined by 11% to Rs10.97 billion, suggesting challenges in managing production costs and maintaining efficient operations. The decline in gross profit was accompanied by decreases in profit-before-tax (40%) and profit-after-tax (53%), which dropped to Rs4.11 billion and Rs2.64 billion, respectively. These figures reflect the overall decrease in profitability and highlight the need for strategic adjustments in the company's operations.

The analysis reveals that Gul Ahmed's debt-to-equity ratio remained relatively stable, with a slight improvement of 36:64 compared to the previous year's ratio of 35:65. This indicates a reasonable level of financial leverage and the company's ability to manage its debt obligations. However, the current ratio decreased by 5% to 1.09, indicating potential challenges in meeting short-term financial obligations. Additionally, the break-up value per share increased by 7% to Rs62.86, indicating a positive growth in shareholder equity.

The company's profitability margins witnessed significant declines across all levels. The gross profit margin fell by 24% to 13.64%, highlighting the increased cost of production or potentially lower selling prices. Similarly, the profit-before-tax and post-tax margins experienced declines of 49% and 60%, respectively. These margin reductions reflect the challenges faced by Gul Ahmed in maintaining profitability and efficiency in its operations.

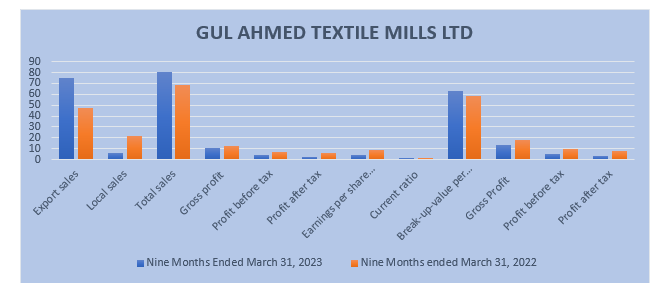

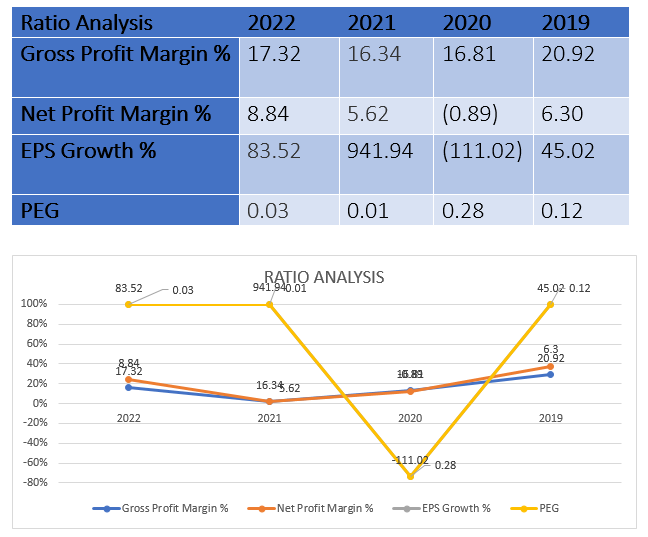

Gul Ahmed Textile Mills Ltd's ratio analysis provides insights into the company's financial performance over the past four years. Starting with the gross profit margin, which represents the percentage of revenue remaining after deducting the cost of goods sold, the company experienced a slight increase in 2022 with a margin of 17.32%. However, this was lower than the 16.34% recorded in 2021 and 16.81% in 2020, suggesting challenges in managing production costs and maintaining profitability.

Moving on to the net profit margin, which reflects the percentage of revenue that translates into profit after deducting all expenses, Gul Ahmed showed improvement in 2022 with a margin of 8.84% compared to 5.62% in the previous year. However, the company had a negative net profit margin of (0.89%) in 2020, indicating losses during that period. This highlights the need for Gul Ahmed to focus on enhancing profitability and cost management.

Examining the earnings per share (EPS) growth, which measures the percentage change in earnings per share, Gul Ahmed had a remarkable improvement in 2022 with a growth rate of 83.52%. However, the company faced a significant decline of 941.94% in 2021, reflecting a setback in profitability. The volatile EPS growth pattern over the years underscores the importance of consistent performance and stability for the company.

Lastly, the PEG ratio, which compares a company's valuation to its earnings growth, indicates Gul Ahmed's potential attractiveness as an investment. With a PEG ratio of 0.03 in 2022 and 0.01 in 2021, the company appears undervalued relative to its earnings growth potential. These low PEG ratios suggest that Gul Ahmed may present an appealing investment opportunity.

Credit: Independent News Pakistan-WealthPk