INP-WealthPk

Ayesha Mudassar

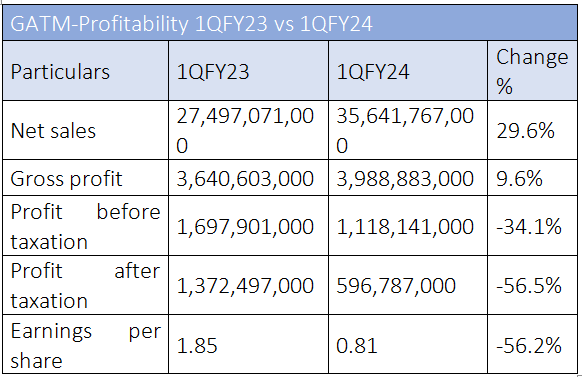

Gul Ahmed Textile Mills Limited (GATM) experienced a decline of 34.1% and 56.5% in before and after-tax profits, respectively, during the first quarter of the fiscal year 2023-24 as compared to the corresponding period of the earlier fiscal, WealthPK reports. GATM posted a pre-tax profit of Rs1.1 billion and a post-tax profit of Rs596.7 million in the first quarter of FY24. The lower profit was mainly due to challenging and adverse economic conditions that included higher raw material costs, depreciation of local currency, a rapid increase in the interest rate and high inflation. GATM posted earnings per share of Rs0.81 during the period under review.

The company's sales stood at Rs35.6 billion in 1QFY24 as compared to Rs27.4 billion in 1QFY23, representing a 29.6% growth. Furthermore, the cost of sales also surged by 32.7% during 1QFY24. On the expense side, the company observed a rise in selling and administrative costs.

GATM-Historical Performance

A historical analysis of GATM demonstrates that its sales have kept increasing in the last four years. The company posted its highest four-year sales in FY23 at Rs111.9 billion. GATM posted Rs78.7 billion sales in FY21 and Rs100.2 billion in FY22. Concerning the net profit, the company's historical performance fluctuated over the years. In the last four years (2019-2023), the firm posted the highest profit of Rs8.8 billion in FY22. The company posted a net profit of Rs4.4 billion in 2021, and Rs986 million in FY23. GATM posted the highest four-year earnings per share in FY22. However, the company witnessed a dip in EPS in FY23.

Company profile

Gul Ahmed Textile Mills Limited was incorporated in Pakistan on April 01, 1953 as a private limited company. It subsequently was converted into a public limited company on January 07, 1955. The company is a composite textile mills and is engaged in the manufacture and sale of textile products.

Pakistan's textile sector

Global economic uncertainty and rising production costs have eroded the global competitiveness of Pakistan's textile industry. Additionally, frequent energy shortages and power outages in the country have hindered the textile industry's ability to maintain consistent production schedules, affecting delivery timelines and eroding customer trust. Total textile exports during the quarter under review were $4.12 billion as compared to $4.59 billion during the same period last year, which demonstrates that the textile sector continued to maintain a downward trajectory.

Credit: INP-WealthPk