INP-WealthPk

Amir Khan

The Finance Division has expressed its readiness to allocate Rs450 billion for the power sector subsidies in the FY23-2024, which is an increase from Rs350 billion allocated in the Fiscal Year 22-23, a senior official in the power sector told WealthPK. According to the Economic Survey for the FY2023, the government disbursed Rs180 billion as subsidies for independent power plants (IPPs) in the previous year. Additionally, an amount of Rs48 billion was provided under the Kisan Package, which was initially not included in the budget estimates. “For the Fiscal Year 2024, the subsidy for K-Electric (K-E) has been substantially raised to Rs315 billion.

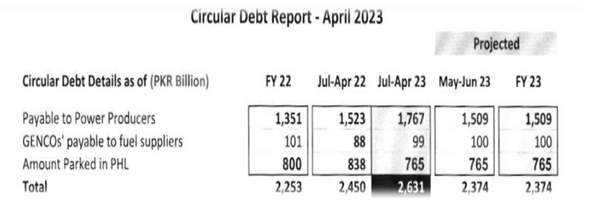

In the ongoing year, the initial allocation for K-E consumers was Rs80 billion; however, the actual subsidy amounted to Rs193 billion, surpassing the initial estimate,’’ he explained. The Central Power Purchasing Agency has revealed that the subsidies have been incurred due to the escalating circular debt in Pakistan. The accumulated payables for the July-April period of the Fiscal Year 2023 have reached Rs2,631 billion, representing a 7.38 percent increase compared to the same period in the previous year, when the circular debt amounted to Rs 2,450 billion, he added. Sources from the Ministry of Finance and Ministry of Energy have revealed that the average monthly.

increase in circular debt during the July-February period of the Fiscal Year 2022-23 was an enormous Rs52.4 billion. Showing his concern, the official said payment of trillions of rupees towards Tariff Differential Subsidy (TDS) had contributed to the ongoing increase in circular debt. The TDS, as an untargeted subsidy, primarily benefits the urban affluent section of the society and accounts for over 90% of the total subsidies. Removing this subsidy not only reduces the fiscal deficit but also alleviates the financial difficulties faced by the government, he said. The official emphasized that reducing the TDS would have a substantial impact on reducing the fiscal deficit and relieving financial burdens.

The updated circular debt management plan revealed that despite a substantial price hike and an additional subsidy of Rs335 billion, the circular debt continued to rise, raising alarming concerns for the power sector and having broader implications for the overall economy. Concluding, he emphasized that a decrease in subsidies to the power sector will only be possible if the required shift in policy focuses on subsidizing the underprivileged rural population instead of the affluent urban segment. The government should develop targeted policies that determine who should receive subsidies and who should bear the tax burden, aiming to enhance societal welfare. Additionally, to effectively reduce the circular debt, a strong administrative government is necessary, which will ensure penalties for non-payment of bills and address illegal activities such as electricity theft.

Credit: INP-WealthPk